Investment

An Exceptional long term Investment Offer

We made key Choices to enable us to generate success.

We have the Tools, Knowledge, and Expertise to make our Vision a Reality.

Why we are planning to going public on the NSX and then by reverse merger on to the ASX and other Exchanges.

The long-term benefits of being publicly traded are numerous and can include improved liquidity, higher company valuation, the ability to make acquisitions, attract and retain employees with the company’s stock and greater access to capital at a lower cost. Also, being a publicly traded enterprise allows a company to make acquisitions with its stock since public company stock can be viewed as currency for mergers and acquisitions.

Moreover, public trading status often leads to a higher price at a later offering of a company’s securities. In our case, there is an additional major benefit, we will become a “local” company and may qualify for all relevant government grants available by state and federal governments. For example, Haussmann’s proposed Sassnitz plant, in addition, to local and federal grants available, will also quality for grants offered from the European Union.

A global blueprint for ethical wealth creation & a sustainable future

An investment in Haussmann Residential Industrial Building Systems Production Plants, are an ethical investment.

Governments around the world are encouraging investment into industry, R&D and affordable housing, sustainability, carbon reducing, environmental investments, shelter and new job creations.

The Haussmann Plant investments “ticks all the boxes”.

Haussmann outlines the company’s contribution/ donations, as a form of profit share, to its workforce including annual donations, doubling superannuation, free health insurance including all hospital care, contributions to workforce members’ children to provide university education. All such contributions are tax-deductible and will impact on the true net achieved for all shareholders and the community and the workforce of Haussmann Limited. Total wages bill for each Haussmann Plant based on – plant infrastructure operations 280 days per annum, a 4-day working week, plant infrastructure operations 20 hours per day -– see cost and benefit study.

To make the world a better place, and, in preparation for the implementation of a massive social difference, to date, 1648 dedicated contributors, stakeholders made a combined investment to the value of $ 25 million plus to the building technology trust, (BTT) contributions either in cash, knowledge, goods or services, which created and made it possible to develop intellectual property, which makes it possible, for HML now to proceed to global implementation, to plan, build and bring into production, the first number of Haussmann housing systems manufacturing plants, changing the world of housing, revolutionizing the way we purchase and build our homes and shelter. BTT is the major shareholder in Haussmann Limited.

Our project will be changing the world for a better place, protecting the environment through your contributions, creating jobs for your children and affordable housing, sustainability and hope for the next generation, creating national wealth and personal wealth and dignity, and the satisfaction of having created a huge social difference and a fairer society.

Key Success Factors

Conditions of funding and construction of the first manufacturing plant and its success will be measured in profit from sales and the size of the possible philanthropic intentions of Haussmann Ltd. It is proposed to donate 2,000 homes a year for 20 years per plant with the proviso that 1, 000 of all such homes be rented for an amount of $50 per week. A typical catchment area for the donation of homes could be for example Australia, New Guinea, New Zealand, and the Pacific Islands. Winners will be determined by the annual lottery. Lottery ticket holders will be nominated councils located within the catchment area of a particular plant. Councils are expected to provide building sites and make such arrangements for Haussmann teams to build gifted houses. Rental management arrangements will also need to be managed by councils through previously agreed city management units.

Capital we seek:

The 6 Kinds of Capital For Our Business

- Internal economic capital. This includes financial capital (funds available, including debt and equity finance), and non-financial capital (for example the value of our brand).

- External economic capital. …

- Natural capital. …

- Human capital. …

- Social and relationship capital. …

- Constructed capital.

Sources of Capital

- Long term – usually above 7 years. Share Capital. Mortgage loan. Retained Profit. Venture capital. Debenture. Bonds

- Medium term – usually between 2 and 7 years. Term Loans. Revenue-based financing. Leasing. Hire Purchase.

Short term – usually under 2 years. Bank Overdraft. Trade credit. Deferred Expenses. Factoring. - Grants

Sources of Capital

Each with its own requirements and investment goals.

They fall into three main categories:

- debt financing, which essentially means you borrow money and repay it with interest.

- equity financing, where money is invested in our business in exchange for part ownership.

- grants

Use of Capital

View Application of Funds chart

Click image to enlarge

Reference: Content 1

All Haussmann Advantages are Unlocking Huge Market Demand For Haussmann Homes

The current demand for affordable dwellings globally is approx. 30-50 million households and growing globally at a rate of a further 5-10 million dwelling units per year. In Australia, the nation has been experiencing a significant appreciation in dwelling prices over the last 15 years, driven by a range of factors including high population growth, increased access to finance, sustained economic growth, increased investor activity, and relatively unresponsive housing supply. The most noticeable impacts have been the reduction in home ownership experienced by younger Australians, an increase in the percentage of Australians renting, and greater competition in the rental market especially for properties at the lower end of the market. Currently, the Australian housing shortfall is estimated at 1.2 to 1.5 million homes. Additionally, the Australian Bureau of Statistics reveals that around 318,000 low-income households are currently in mortgage stress while around 187,500 households remain on waiting lists for public and community housing across Australia. Many Australian studies suggest that more effective/supportive housing policies could improve the mental health of Australia’s economically vulnerable populations – a growing topic across the nation. Such systematic changes are likely to be more cost-effective, and produce more substantial additional welfare gains, than acute medical interventions or socialisation programs for which there is little evidence of effectiveness. The above quoted housing shortages do not include 10’s of millions of displaced people ( 92 million) requiring emergency housing globally. Recent Radio announcements on ABC Radio, Feb. ’18, that 9.9 million Australians have given up the dream of Home Ownership.

Asia and the Pacific are the most disaster-prone region in the world, particularly vulnerable to earthquakes, droughts, tropical cyclones and floods. During the past decade, the region was struck by 1,625 disasters—over 40% of the global total – and half a million people lost their lives. More than 1.4 billion people were affected by these natural disasters, constituting 80% of those affected globally. Disaster risk reduction policies including emergency shelters are currently at the heart of sustainable development in the Asia-Pacific region and play an important role in the Australian Government’s development policy coordinated by the Department of Foreign Affairs and Trade.6 The Global Shelter Cluster is co-led by UNHCR with the International Federation of the Red Cross and Red Crescent Societies (IFRC). While the IFRC leads in natural disaster situations, UNHCR leads the team in conflict-generated displacement and estimates there are now 2.6 million refugees who have lived in camps for over five years.

Haussmann plants, designated for emergency shelter production, will provide emergency shelters, available, ready for delivery in large quantities from HML warehouse supplies to any global disaster area at short notice. HML plants will be able to export several quality emergency shelter modular designs worldwide to over 1 million sites within 10 years, every year. According to the HML Business Proposal document, Emergency Shelter Production, based on worldwide demand and our highly competitive per-unit pricing and quality, estimated plant annual emergency shelter production of 100,000 Units, will be pre-leased, under a global leasing program, even prior to start of production. Based on market demand worldwide, no one plant’s annual production will be able to full fill supply orders from government agencies and private market demands for emergency housing. The company’s policy for emergency housing produced for government agencies worldwide, is that they will not be sold, but leased on a long-term basis. Each emergency housing unit/shelter will have a 15-year product warranty, guaranteed to withstand any climate and weather conditions.

All single units can be site assembled and disassembled for relocation by any group of able people. Of particular interest to emergency settings is a “quick shelter” or “anywhere now shelter” – emergency housing product to be precisely pre-assembled into a flat-pack system for delivery anywhere in the world, meeting the following criteria: easily transportable (light, optimum size), quickly erected and dismantled, efficiently designed, hardy, cost effective and sustainable. Such quality shelters by design, will have shower, toilet, kitchen living and separate sleeping areas. HML is prepared to compete with any shelter presently offered, like Ikea Shelter ‘Better Shelter’8 launched in early 2017. HML’s design priority addresses sanitation, provides better space, is vermin proof and cyclone proof, providing total protection from all weather conditions. And yes, also offers faster supply production, as the industrial manufacturing process allows HML to produce up to 100,000 emergency home shelters per annum per factory. (8×4 meters in size, including, shower, toilet and kitchen facility, battery packs and imprinted solar on shelter/dwelling roof, inbuilt services for water and grey water, electricity and other wiring. HML shelter price per shelter US $24,500.00 (not including container deliver charges.)

Reference: Content 2

To part finance each project, the following project structures must be put in place:

- Fund 2 listings, reverse mergers via NSX on Berlin and New York – Nasdaq exchanges, to become a "local", funded as proposed by global equity crowd funding.

- Fund grant application processes to achieve grant funding as a “local” in the USA, Europe and Asia, by appointment of local specialist grant funding consultants.

- Fund "global roadshows", to achieve, placing issued convertible Bonds.

- (Haussmann the Plant owner) in Australia, the United States, Europe, and Asia starting annual housing production of 70,000 homes per plant.

Reference: Content 3

Cost-Benefit Analysis

HML Plant #1

Bromelton, QLD. Australia

July 2020

Version 1.0.2

- Introduction

This document serves to inform readers of solutions provided to Haussmann Ltd (HML) enabling the manufacture of houses on an industrial scale, by analyzing the project from a cost-benefit perspective. This cost-benefit analysis provides a clear decision-making framework.Australian Bureau of Statistics (ABS) reported that in 2019, in the whole of Australia, 103,481 dwelling units “Houses: Total” were built (ref. Series A18427K). The HML manufacturing plant being proposed here will use 750,000 tonnes of intermingled raw materials that otherwise would have been placed into landfill (via its precision engineering processes) and turn it into building systems, sufficient to build 70,000 single dwellings (average size 288m²) per year/per plant

Purpose

ABS displayed a falling number of houses being built each year in Australia. The decline in output was particularly noticeable over the last four years. This may be due to factors such as cost, availability of tradespeople and changes to lending arrangements post-Banking Royal Commission. HML believes that important business ‘needs’ will be satisfied by building this plant. Firstly, the cost of HML houses is 50% less than a comparable house built using the existing wet build processes. Secondly, a Haussmann home once delivered to the site can be erected (dry build) to lock up stage in weeks. Thirdly, HML homes are Vendor / first mortgage in-house financed at a minimal deposit of 2 dollars and a fixed interest rate of 5% for a 30-year term. From the perspective of Australian demand, we estimate a shortage of up to 9.9 million homes. The shortage of housing both in Australia and overseas will never be fully satisfied. The International Monetary Fund (IMF) estimates the global market backlog for housing to be “…hundreds of millions of units”. HML proposes to build five manufacturing plants in Australia and several in other countries. This will go some way to alleviating the worldwide housing shortages and will certainly boost local economies and exports. The project has a planned 25-years life program.

Background

The Company was registered on 9th March 2017 with the express purpose of bringing to a new range of precision-engineered and applied composite building systems, ‘state of the art’ housing products and associated industrial manufacturing process, dry build on site, to the market. A game-changer, providing another choice of building and funding a home. A world-first, new industrial manufacturing systems for mass production of housing, residential dwellings, which are designed, sold, approval managed, financed and completed, dry build on-site by HML to lock up stage, ready to move in. HML is the exclusive Global Licensee issued by 5starGreen Building Technology Trust (BTT), the License owner of the patents for Haussmann M3 building systems and manufacturing plant design which includes a pilot, one-off production, research, and development laboratory.The founding stakeholders brought two products to the market: affordable, state of the art housing and bespoke emergency shelters. This was achieved by applying new industrial mass production processes using “intermingled raw materials” from ‘mixed solid waste’. BTT developed advanced composites, application precision-engineered products that will, under HML, revolutionise both the manufacturing process and composite materials building systems. The finished product is 50 % cheaper than any comparable product. It provides freedom of design and has in-house financing for every customer. HML homes are vendor financed on a first mortgage with a $A 2-dollar deposit. Each house is completed to lock up stage within weeks depending on size and weather conditions.- Analysis Scope

The analysis of the project uses previous costs experience for the scope of capital costs. Benefits were divided into three areas, namely; known benefits from previous experiences in Europe, tangible benefits which outline measurable community assets and lastly, intangible benefits which are estimates of the worth of the aspects of the project possible because of HML’s employment policies and flow-on effects to other businesses in the area. - Process

Notes are provided corresponding with each item to assist in understanding its determination

- Analysis Scope

- Life Cycle Costs and Benefits

The planned life cycle of the Plant is 25 years. Lifetime maintenance and operational costs are difficult to predict but for this exercise maintenance costs will be calculated on 2.5% of CAPEX. Operational costs include training and staffing costs. Two per cent (2%) is added to expected salary costs for training on-costs. 2500 full-time employees (FTE) at an average of $80,000 pa over 25 years ~$6,000m.

Any one-off costs for upgrades or expansion are included in the maintenance budget.

Tangible benefits such as industry comparative figures for items such as reduced overall labor costs and increased productivity, use of materials that would have been landfill and recognition from community groups for a resolution to what would have been wasted resources is recognised but not calculated. Care of the environment by not having to consider long term costs of maintaining the safety of landfill sites is also not included in the calculation. - Alternatives

Firstly, do nothing. Secondly, the current process for construction of dwellings is, by its very nature, producing large Co2 emissions, is specialist labor centric. Wet and boutique building has not changed for generations. An alternative to this had to come. The impact of doing nothing means little chance of providing large numbers of housing to reduce a worldwide demand backlog. The present system has not been able to do this and in our opinion, never can satisfy the enormous backlog. Providing an alternative to begin to stem the enormous social cost of homelessness is difficult to measure. Doing nothing does not change present losses in productivity. Doing nothing means no change to labor cost opportunities. This unique opportunity resolves many of the existing problems inherent with the current system. HML houses can be built faster, significantly cheaper, dry build with no Co2 emissions produced, with greater customer inputs and fully financed if required. HML houses are vermin, fire and cyclone proof as standard. There is no other precision engineered, industrial process, housing system like this. No other process uses the volumes of composite material mixes in the core product formulations. Material mixes include up to 80% of mixed solid waste (mixed solid waste from industrial, commercial and domestic sources) which includes paper, all plastics, all rubber, all glass, all timber, all textiles, and man-made demolition materials. An acceptance fee, charged by each Haussmann plant of $400 per tonne for receiving this ‘benefit’ means 740,000 x 400 = $ 296 million p.a. It is noted however that 3D printing techniques are making small in roads into the housing/construction market. The complementary issues with this technology are that the materials for panels or ‘printing’ can be similar and both technologies may be used for similar results, separately or intermingled depending on the design. HML has developed and adopts an industrial process engineered product for efficiency, cost, and expediency, suitable for industrial mass production. No monetary value has been made here for a 3D printing alternative to construction as the two systems are not comparable.- Current System

The current system is well recognised with all its inherent ‘idiosyncrasies’ because it is how things have been done for hundreds of years. The preference for bricks and mortar by Australians as a “proper” house is changing. The same ABS figures show marked reductions over the past five years in demand for conventional housing. Rather than speculate on a range of possibilities for this here HML houses will be 50% cheaper than their conventional counterparts, fire proof, will not combust, vermin proof and cyclone proof and these reasons alone is put forward as the game-changer in the global residential market. - Proposed System

Each HML manufacturing plant’s infrastructure is designed to accommodate all the integral components for houses together in one site. The design for the plant includes everything from the receptors for the mixed solid waste and raw virgin material, all the building services such as bathroom, window, doors, kitchens, solar panels, etc. through to the range of necessary professional engineering inputs sufficient to do everything from maintaining the site through to providing civil and structural information for individual house designs. This system will revolutionise the housing industry and most importantly giving more people access to living in a house of their own. Houses will be made in part from what would have been waste material. Extruded panels (all mass-produced), will be set to customer design, then delivered to site and erected within two weeks depending on the weather. There is no other system like this. The proposed system is a ‘revolution’ in mass-produced housing.

- Current System

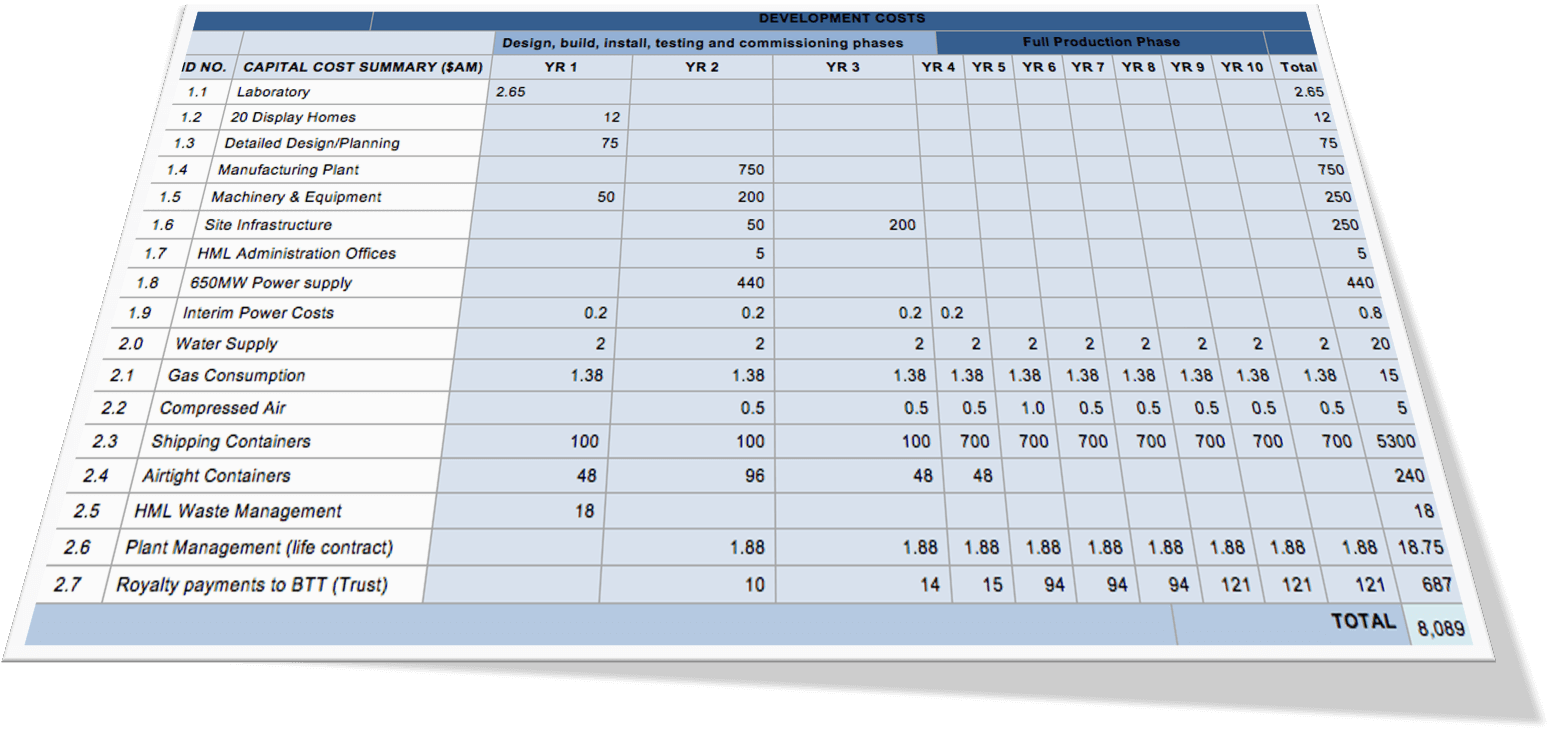

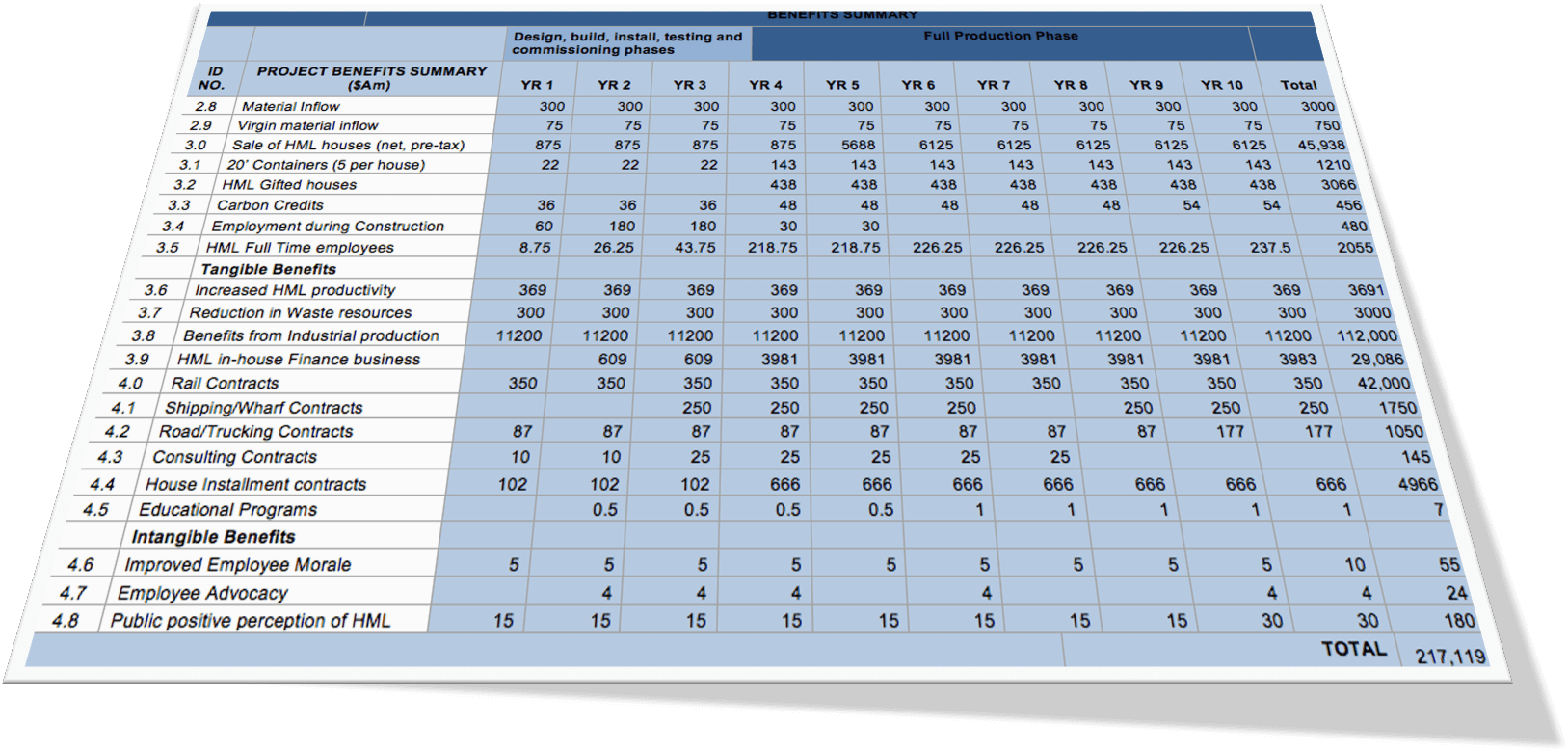

- Cost Analysis

A cost analysis, above, has been provided giving a breakdown of costs for the proposed project. These include design and development, installation, operational costs, maintenance, disposal, and consumables. Analysis of costs for each year for the first 10 years is provided to show growth from the soil breaking ceremony to a maturing operation but may need to be revised over the next 24 months, based on actuals. Notes explaining each Item ID entry are provided below. The Items ‘Laboratory’ and ‘20 Display homes’ are included in the overall project as they form an integral part of the project’s development and make pre-plant production residential sales possible. - Cost and Benefit Comparison

Rounding the resultant totals begins to show the positive aspects of the project. The present value for the capital and benefits cost estimates show $8b capital costs over the first 10 years with the greater proportion spent before the full production phase. Benefits show incomes for the same period as $217b. As a new industry, these figures are, to say the least, encouraging. - Return on Investment

The return on investment ratio (ROI) can also be seen as a return on assets ratio. Here it is to be seen not as an estimated profitability ratio as it would in a business sale, for example, but as a method to highlight the potential return from the business over a period of time. The ROI looks at the project gains compared to the original costs. ROI has been used here to allow potential investors to use this simple calculation (benefits/capital costs) for any comparative decision making regarding different investments. Figures here show an ROI of 27% for the first 10-year phase. - Results

In this report, it has been assumed that all houses will sell each year. The results show a positive return on some conservative figures. It may be the case that a successful manufacturing plant will have little effect on the “bricks and mortar” part of the market. The important factor here is that HML has shown that its revolutionary processes to ‘industrialise’ the industry provides an opportunity for easier entry into the market, thereby providing a wide range of design choices, opening up a large new market for new entries and prospective new home purchasers, previously unable to consider home purchase, due to price and or draconian prohibitive mortgage home loan entry terms and conditions. Alleviating the gaps in the present market – if all houses are not sold in Australia there is an enormous market demand for housing to satisfy overseas, so the assumption of selling all houses is justified. We believe, based on market research, the sale and promotion for the sale of homes, prior to start of plant production, (estimated pre plant sales) period could be up to 18 months, Plant production could be sold out for many years to come. - Annexure 1 Notes

- Laboratory cost, necessary to test panels for certification and produce sufficient material for the 20 display homes.

Set aside amount for 20 display homes - Control your own waste management – intermingled raw materials supply

- Set aside for detailed project design and planning

- Amount set aside for the manufacturing plant land and building as per the blueprint

- Price of extrusion, robotics, coating and associated machinery out of Germany

- An estimate of the HML contribution to road and rail works

- Set aside for HML on-site project administration

- GE combined cycle 1×1 (GE7HA.03) 640MW generation peaking plant

- An estimate of power costs during the development phase

- Laboratory cost, necessary to test panels for certification and produce sufficient material for the 20 display homes.

- Qld bulk water price 2020 – 21given as $3.12/k ltr. 640Km³is $1.998 / year

- East coast Gas price $9.19/GJ. 150,000x 9.192.2 Estimate of the price of compressed gas

- 350,000 containers at $2000 each

- 60,000 airtight containers at $4000 each

- Establishment of the waste management company in Brisbane / Gold Coast Corridor, separate from HML Project site.

- Plant management by lifelong contract

- Royalty payments after-tax to HML – BTT Trust

- Receipts for ‘waste’ inflow. 750K x $400 per year

- Virgin material inflow

- Sale of houses using net pre-tax figure

- Sale of containers, 5 per house at $2200 sale price

- Gifted homes as part of HML contribution to various communities

- Using CSIRO Future Carbon Price matrix for an estimated 1.2 m tonnes of carbon credits pa, full production

- 1200 Professional labour (Plant) on $150,000 for 3-4 years

- 2500 full-time employees on average of $85K over a 6-year period

- Labour productivity difference in houses produced and labour costs of std houses

- Not designated for landfill 750K tonnes at $400/t from landfill per annum

- Cost 50% less than a conventional house. $350K x 70,000 pa

- Estimate of worth of services provided by HML finance mortgages

- Rail trips 70000 x 5x $2000

- Estimated benefit from port/ shipping infrastructure

- Estimated benefits from trucking/road transport contracts

- Estimated benefits from specialist consultant contracts

- Benefits from HML home installation crews, training, and ongoing work

- HML sponsorship of apprenticeship programs and University degree programs

- Estimate of outcomes of positive employment policies

- Estimate of benefits from comprehensive management policies

Estimate of the positive financial effects HML has in the community.

Reference: Content 4

Sharing in future Profits derived from new Manufacturing processes and industrial production of new Materials which simply have no competitors.

The best time to invest in new technology was 20 years ago, the next best time is today.

Our investment offer is an Investment into a new industry, showing over average profits, once a plant is in production. For long term investors, imagine the profits from 2, 6 or 50 plants – an entry into new industry, with unlimited markets, globally, and no known competitors. Projected investor returns on individual investments, based on competitive, industry, customer and market analysis, are expected to be substantial, (conditional on plant establishment).

In the first instance, we invite you and your family’s investment, when offered, via a number of licensed, equity crowd funding platforms, in Europe, the United States, and Asia. You cannot invest directly with HML. The HML Investment offer announcements will be made on our website and public notices issued by haussmann.com.au and the Haussmann contracted, Government licensed Equity Crowd funding investment platforms.

All our plant establishment preparations in Australia, Europe and the United States will be contracted by tender to competent, well known European, Australian and US engineering groups and plant management companies, once funding via convertible Bond issues and Special Government Loans have been obtained.

Click image to enlarge

- Did you know?

Manufacturing plays a global economic role as the greatest economic multiplier of any other sector.

The manufacturing sector is a critical driver to any countries’ prosperity and security.

Haussmann manufacturing technology is next-generation technology.

Haussmann advanced manufacturing produces sophisticated and exclusive products, contributing to economic growth, and, when implemented and sold around the world, will be leading to great wealth and prosperity and increasing job opportunities.

Everyone knows Son, the CEO of Softbank, is the richest man in Japan. He had the “vision” to invest $20 million early on in Alibaba and that stake is now worth $138 B plus, with total returns of 690,000 % (this was the result of his new Technology investment!).

Pre-money valuation and post-money valuation

Upon identifying an investment, the prospective investor starts inquiring about the business. He or she will want to evaluate the company. By this, he or she will want to know, what the company’s pre-money valuation is and what the projected post-money valuation will be. (Pre-Money Valuation).

What is pre-money valuation? Pre-money valuation is what a company is worth before the investor invests in a company.

This needs to be calculated, and many investors will have their experts who will calculate how much a company is worth before the investment.

Pre-money valuation may also determine how much capital a prospective investor might want to invest in our company.

So how is pre-money valuation determined? Well, to tell the truth, there are several factors in determining the pre-money valuation of a company. Several things that determine our company’s pre-money valuation are listed as follows: Intellectual Property – Intellectual property can add quite a bit of value to a company, depending on what kind of intellectual property the entrepreneur brings to the company.

A new technology that can simplify every-day tasks, or changes the way one does things, can be considered intellectual property. Intellectual property can refer to unique formulas or inventions that can improve life or industry.

Depending on methods of valuation, the amount can be more or less. Present Haussmann valuation has been determined, as being the value of the company, as quoted, before receipt of funding from new investors.

Click image to enlarge

Reference: Content 5

Supporting and being responsible to the environment eliminating CO2 emissions when building a home

Residential housing, the way it is presently being built, (the “on-site” building method or “wet build”), is a major contributor to greenhouse gas emissions, with most emissions being generated during the operation of building the residential dwelling on site. The Haussmann manufacturing processes will eliminate such emissions, as each Haussmann home is dry built on site and precision engineered to application in controlled factory conditions. (No Emissions).

Carbon Credits

We are confident we can offset our carbon credits with our nominated provider of cement and other providers of goods and services, positively impacting the environment and achieving an overall advantage of pricing/purchase of goods and services benefits. Before carbon trading, HML will have its carbon credits certified to “standards” https://www.goldstandard.org, https://cdm.unfccc.int.

Haussmann Plant Carbon Credits: we have estimated annual carbon credits exceeding 800,000 tonnes per annum. Benefits received will impact positively on the net profit projections per plant. (750,000 tonnes of mixed solid waste being fully processed (“zero solution),” with 50,000 tonnes being produced by placing solar panels on both buildings, building 1 and building 2. Further carbon credits will be produced by incorporating into the Bromelton Infrastructure a solar farm and using solar power to “enhance” our Hydrogen Plant, producing power for building 1 and building 2 of our plant’s infrastructure. We expect such carbon credits to be substantial. * Please note, we are using 60,000 tonnes of specially formulated cement in our annual production of M3 building systems. Cement production is having a large impact on the environment…we propose to offset such impact, (carbon offset between Industries).

Conventionally constructed buildings account for 36% of global energy use and 39% of energy-related carbon dioxide emissions annually, according to the United Nations Environment Program.

Buildings produce (wet build on site) 25% of Australia’s emissions. Haussmann will, by building buildings in a controlled environment, in Haussmann manufacturing plants, eliminate Co 2 emissions.

Igor M., Lecturer in Construction, Deakin University writes…..

The National Construction Code of Australia sets minimal obligatory requirements for energy efficiency.

Software developed by the National Housing Rating Scheme (NatHERS) assesses compliance. This combination of obligatory and voluntary performance rating measures makes up the practical totality of our strategy for reducing built environment emissions. Still, in its experimentation stage, it is far from adequate.

Effective strategy to cut emissions must encompass the whole lifecycle of planning, designing, constructing, operating and even decommissioning and disposal of buildings. A holistic vision of sustainable building calls for building strategies that are less resource-intensive and pollution-producing. The sustainability of the urban landscape is more than the sum of the sustainability of its component buildings; transport, amenities, social fabric, and culture, among other factors, have to be taken into account.

We believe, introducing Haussmann building and construction methods and industrially produced housing, and the construction code as is, will be superseded by Haussmann manufacturing processes and new building materials/systems used to build residential buildings.

We believe, sustainability transition in Australia is presently failing because relevant law makers lack the commitment to develop effective regulations, audit performance, resolve vested interests (developers), clarify their vision and, above all, sell that vision to the community. Sustainability advocates are stuck in isolated silos of fragmented markets (commercial and residential) and are hampered by multiple jurisdictions with varied sustainability regimes.

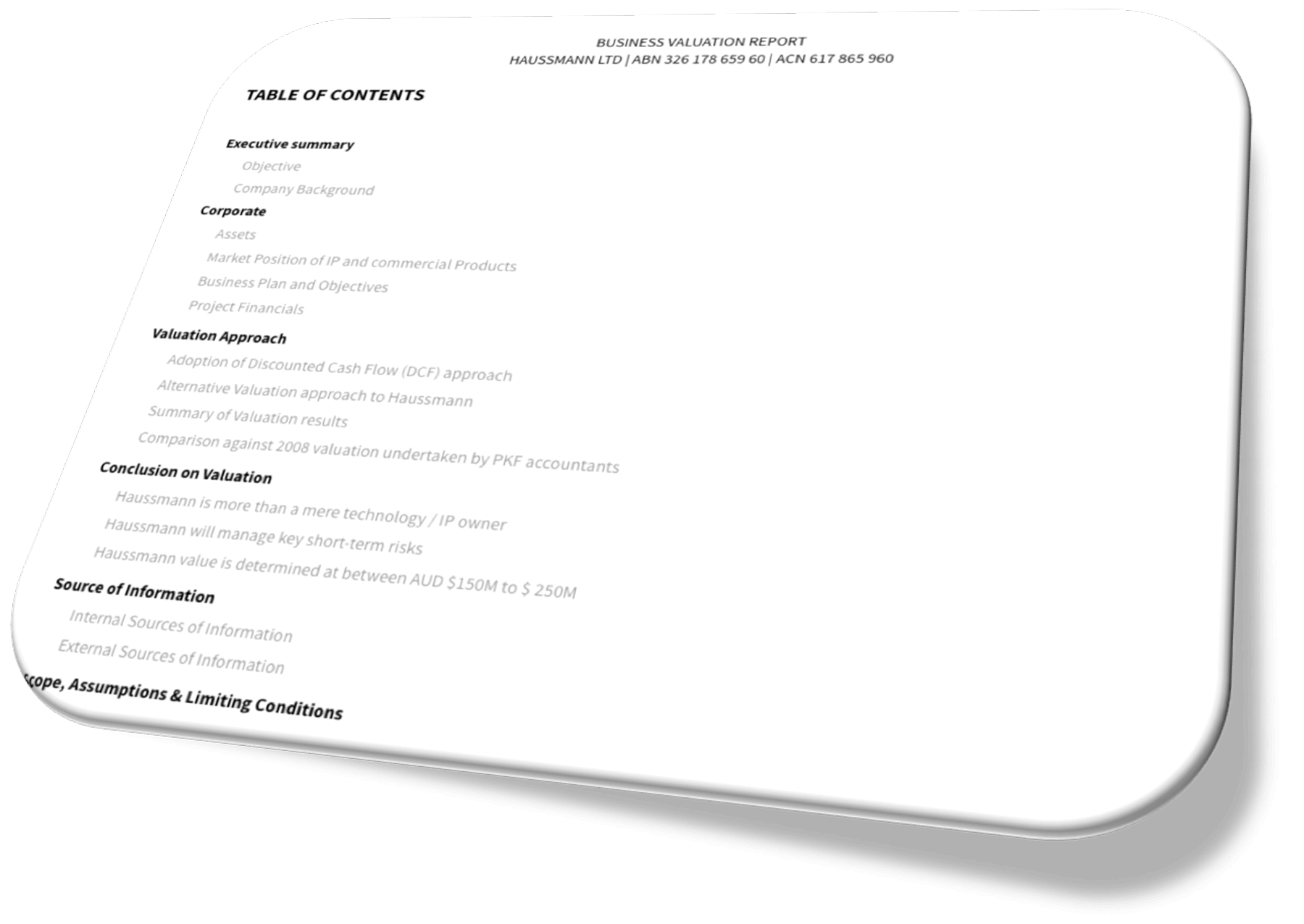

The Haussmann Business Valuation Report

Market Placement

The best place to establish our businesses/plants will be the US, Europe, and Australia. In these markets, the transport logistics are container and sea-based, with acceptance and delivery of goods mainly by container, by boat or barge. A first plant will be ” a learning curve” for our plant engineers and marketing division.

The key management team for implementation will be on the “home ground”.

Specific areas where we can excel are:

- Distribution and completion times of single dwellings

- in-house funding for clients to purchase single dwellings

- Regional developments for land in every country in Europe, and every state in the United States and Australia / New Zealand / New Guinea and the adjoining Pacific Islands.

Company Capability

- The company’s strength and growth: Aim to build 5 manufacturing plants, to take care of affordable housing backlog within the plants’ catchment areas, for example, in Australia. According to government sources, an estimated 1.2 million homes are needed “yesterday”, but not purchased or commissioned to be built as the end recipient cannot afford current standard housing prices in Australia.

- The company’s state of the art technologies, processes, formulations & designs, make it now possible to capitalise on its abilities and ownership of revolutionary generic R&D, leading the building materials technology market, which will propel the company ahead of competitors.

- The company is maximising its capabilities by outsourcing specialist project tasks, plant preparations and implantation. The Australian Project Management Group, together with world-leading specialists in their field of expertise in logistics, coordinating engineers, plant engineering, design, build/operate contracting corporations, machinery and equipment, procurement of goods and services for plant establishment and ongoing production, etc. will ensure success as planned.

Management

- The company will procure and contract specialists and the necessary structures of management for project implementation. Initially, the goal is limited to 5 locations to list and establish plants, but a total global expansion is next.

- During this time, the concept will be successfully established in Australia, Europe, the US. The company in the interim may take a progressive step to license its plant technology and establishments in other parts of the world. The ultimate goal of the company will be to become a global leader in the production of affordable housing, emergency housing, and commercial high-rise panel systems.

Executive Summary

- substantially reducing further production costs to produce application engineered composites, and

- further substantially reducing overall finished single panel costs as a product.

Objective

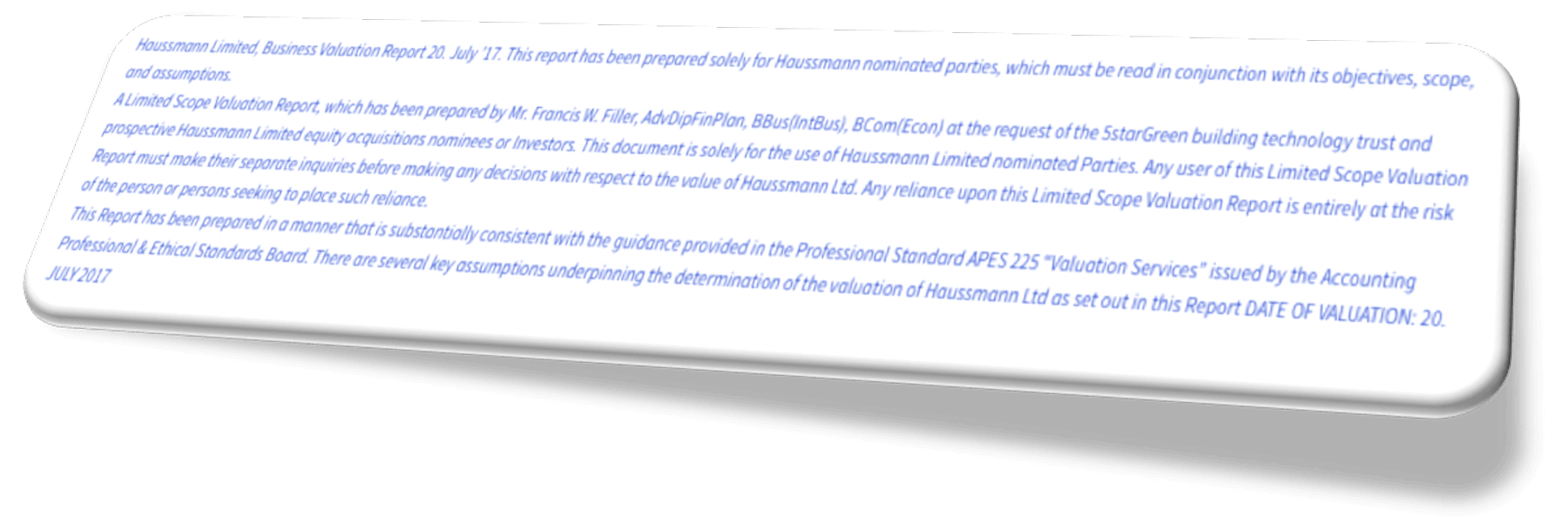

This Valuation Report, is a Limited Scope (Report), prepared at the request of the Board of Haussmann Ltd. The primary objective of this report is to assist the directors and investors in determining the present and future likely enterprise value of the business of Haussmann Ltd, having regard to its current stage of development.

Scope, Assumptions and Limiting Conditions

This Report is solely prepared using the information provided by the 5starGreen Building Technology Trust for the directors and members of Haussmann Ltd in 2017. The 5starGreen Building Technology Trust had access to key specialist advisers and historic R&D and plant production documentation, information and records and provided such key records for the preparation of this Report.

This Report has been prepared in a manner that is consistent with the guidance provided in the Professional Standard APES 225 “Valuation Services” issued by the Accounting Professional & Ethical Standards Board. There are a number of key assumptions underpinning the determination of the valuation of Haussmann Ltd as set out in this Report, including:

- Meeting the time frames for its critical planned business undertakings

- Achieving the financial forecasts set out in its Business Plan, including assessing different scenarios to the forecasts

- Adopting a Discounted Cash Flow (DCF) valuation methodology and retaining the long-term engagement of its nominated specialist advisers

- The development of a Plant

- Appointing a Project Management/Implementation Team to ensure the success of the business

If the scope of this Report were modified, or has been modified, or if information and assumptions used in this Report were different, then it is highly likely that the valuation results and valuation conclusions would be different to that set out herein.

Company Background

Intellectual Property (IP)

The technology and process acquired by Haussmann Ltd has been tested and proven under the supervision and guidance of a number of German engineering firms and independent testing Institutions. The IP (comprising patented engineering processes, formulations, processing, design, trade secrets, and trademarks) is claimed to convert mixed solid waste, from commercial and industrial sources, in high volumes (up to 750,000 tonnes per annum) into application engineered composite materials (pre-finished building systems), produced via a number of specific industrial processes, into a broad range of affordable M3 building/housing systems.

Production trials and generic plant designs are reported to have been completed by specialist engineering firms and the 5starGreen Building Technology Trust in Germany between 2003 and 2009. Production of trial application engineered composite material panels have also been reported to have passed European Union (EU) non-structural panels systems standards tests conducted by independent testing laboratories in Wiesbaden, Mainz, and Stuttgart (Germany) in Nelson BC (Canada) and High Point, North Carolina (United States of America).

Haussmann Ltd has commenced engaging a commercialisation team of technical and commercial specialists, advisers and consultants, who are familiar with the IP to assist in establishing its 3 manufacturing plants: In Selma Alabama, (USA) – North America), Sassnitz, (Germany) – Europe and the first one at Bromelton, Queensland, Australia – (ASIA). Haussmann Ltd is also taking steps, once the second tranche of funding is in place, to engage the key German engineering companies (Head Contractors – Plant engineering Group) associated with the initial development of the IP.

Haussmann Ltd expects to have a significant competitive market advantage, due to having acquired full and exclusive manufacturing and marketing rights, worldwide rights and titles in the entirety of the IP – manufacturing technology with a production capability and capacity to produce new building materials at a price, quantity, and quality, unmatched in the market.

Business Plan and Objectives

The primary business objective of Haussmann Ltd set out in its Business Plan, is to list on the NSX, and by reverse merger on the ASX, US, European and Asian Stock Exchanges. Haussmann will apply and use its exclusive IP to establish global HML manufacturing operations to produce affordable housing building systems, and export nominated emergency housing systems, delivering affordable quality housing in high volumes to the markets worldwide.

Haussmann Stocks, when listed, will be exceptional Growth and Dividend Stocks, prioritising income over long- term growth

and may be offered with a fixed and guaranteed yield.

In the first 5 years of operation, Haussmann Ltd intends to establish 5 manufacturing plants across Asia, North America, and Europe, with the first plant proposed to be established in Australia. The company’s 10-year objective is to have delivered 1 million affordable dwellings globally, with a manufacturing capacity of delivering up to 350,000 homes per annum. The business model to generate earnings is based on “end-to-end” commercial manufacturing solutions that offer natural and unique connectivity in their value chains.

Reference: Content 6

Business Plan and Objectives

The prospective commercial business model adopted by Haussmann, creates an “end-to-end” solution between industries and the affordable housing market, providing affordable housing, and emergency housing to reduce shortages in the low/affordable price brackets and improve availability of supply of housing.

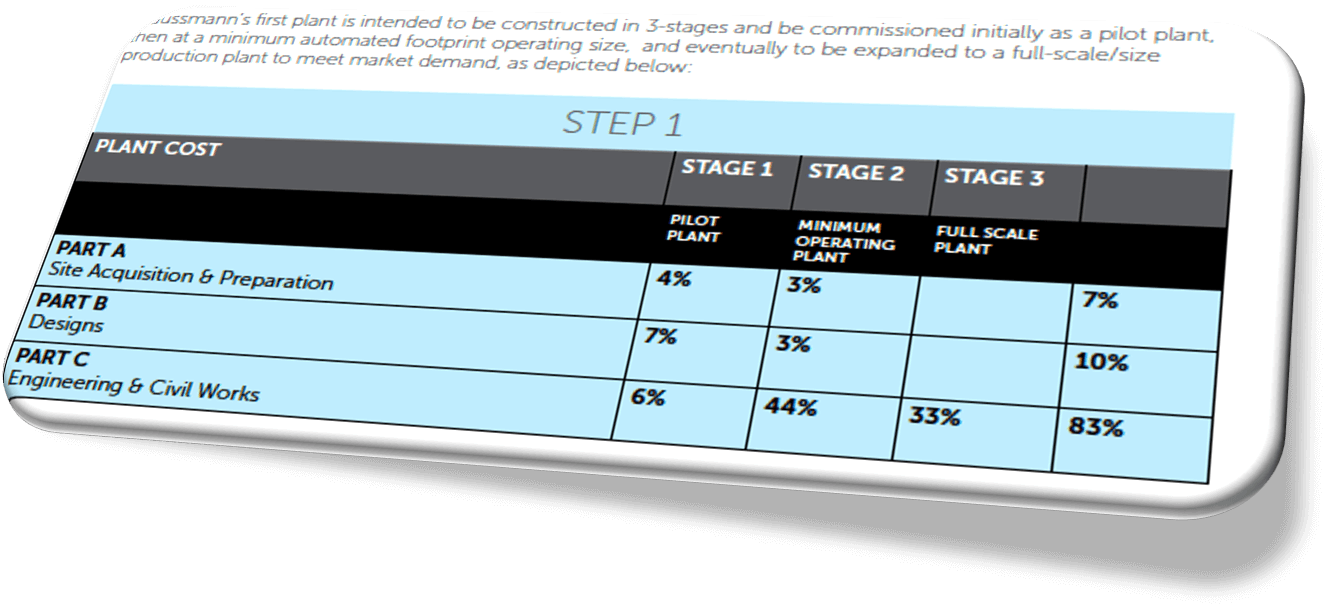

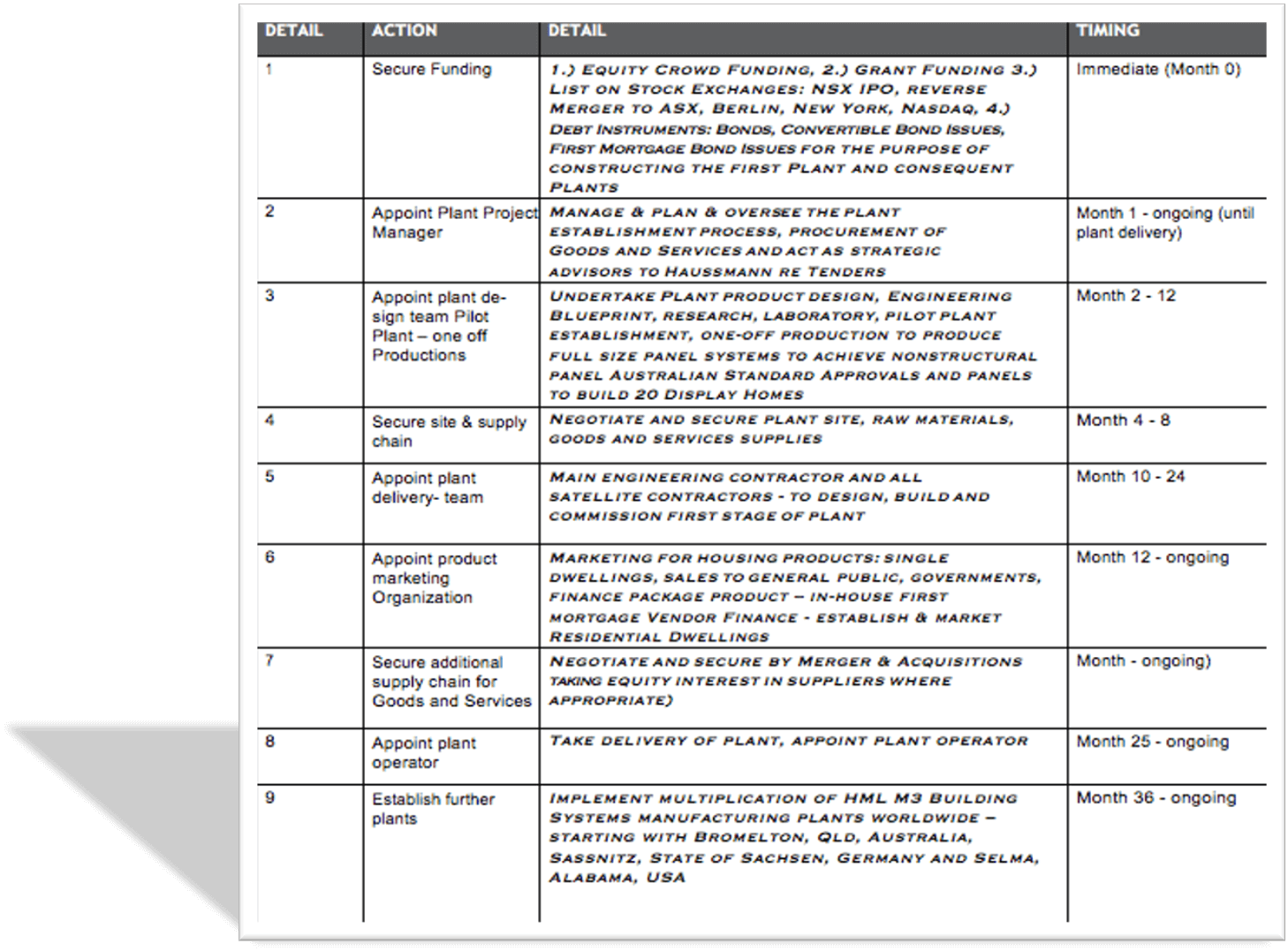

The Business Plan assumes that the distribution/marketing arm of every manufacturing plant will be managed by Plant Management Group Plant operations will be in part 70% plus, wholly owned by Haussmann. Haussmann intends to establish its first plant in Australia, by pursuing a program that has 3 key components:

By Debt Funding, (Bonds) Merger and Acquisition and Strategic Partnerships, creating a guarantee and establishment of plant supply chain for goods and services, plant engineering, (design-build and operate) and the appointment of Head Contractors and Plant Management and production appointments.

The single dwelling establishment organisation steps are reflected in a 9-step action plan that forms part of the Business Plan:

Click image to enlarge

Click image to enlarge

Step 2

Haussmann Full Size Plant

(750 ktpa processing capacity)

Projected Financials

R&D concessions

Haussmann expects to receive significant Research and Development (R&D) concessions and grants from relevant state and federal governments in relation to capital expenditure/establishment costs, that will be incurred during the establishment of the first plant. These R&D concessions and grants will be received as cash inflows, taxation concessions, export grants, etc. to Haussmann, but these have not been included as part of its projected cash flows.

- Please note this financial model report was issued in 2017 and accordingly projections starting dates are 2017 which now to start and move to 2021 with zero plant actions for the first 2 years, during construction of infrastructure being zero.

Valuation Approach

ADOPTION OF DISCOUNTED CASH FLOW (DCF) APPROACH

The objective of this valuation is to estimate the value of 100% of the business of Haussmann Ltd as of 4. July 2017 for the purpose as outlined in this Valuation Report. The standard of value used in our valuation of Haussmann Ltd is the Discounted Cash Flow (DCF) of future net revenues. The Discounted Future Earnings method discounts projected future earnings back to present value at a rate that reflects the risk inherent in the projected earnings. There are a number of alternative valuation approaches also generally used by valuation practitioners, these are briefly outlined further below. However, the 5starGreen Building Technology Trust believes that the DCF method is likely to be the most appropriate approach to determining the valuation, having regard to the business circumstances of Haussmann, which include inter alia:

- Being a newly formed business, without an earnings history

- Judgments can only be made in relation to future events

- Sunk costs to date are likely to be different from those of future investment areas for the business

5starGreen Building Technology Trust also believes that it is appropriate to undertake some sensitivity analysis to the projected future earnings of Haussmann, to reflect the above circumstances. Such sensitivity analysis has been undertaken to reflect a number of scenarios of downside risk potential. The various risk scenarios that have been analysed are:

BASE CASE: being Haussmann’s projected cash flows

LOW CASE: assumes that only 50% of Base Case earnings are achieved

WORST CASE: assumes Low Case as well as a timing delay of 2 years

Alternative Valuation Approaches

Alternative valuation approaches were considered but not adopted, because these were regarded as delivering a less reliable valuation result. The alternative approaches are briefly noted below.

Fair Market Value

Fair Market Value is the price, in terms of cash or equivalent, that a buyer could reasonably be expected to pay, and a seller could reasonably be expected to accept if the business were exposed for sale on the open market for a reasonable period of time, with both buyer and seller having the pertinent facts and neither being under any compulsion to act.

This approach was not considered appropriate because the technology acquired by Haussmann is unique and the commercial, social, environmental, and employment-creating benefits it creates in a number of industries are significant and strategic and of national and international importance. Consequently, the ability to benchmark a Fair Market Value is difficult without embarking on detailed market testing of potential bidders.

Asset Approach

The Asset Approach is generally considered to yield the minimum benchmark of value for a business that has been operating for some time. The most common methods within this approach are Net Asset Value and Liquidation Value. Net Asset Value represents net equity of the business after assets and liabilities have been adjusted to their fair market values.

The Liquidation Value of the business represents the present value of the estimated net proceeds from liquidating the business assets and paying off its liabilities. Ultimately, the worth net assets of a business are a measure of their individual future revenue-generating capabilities if each of these assets were used by other parties in their industry of choice.

This approach was not considered appropriate primarily because Haussmann has only recently been formed and its present net assets do not necessarily reflect the earnings capacity of the business.

Income Approach

The Income Approach serves to estimate value by considering the income (benefits) generated by the asset over a period of time. This approach is based on the fundamental valuation principle that the value of a business is equal to the present worth of the future benefits of ownership. The term income does not necessarily refer to income in the accounting sense but to future benefits accruing to the owner. The most common methods under this approach are Capitalisation of Earnings and Discounted Future Earnings. Under the Capitalisation of Earnings method, normalised historic earnings are capitalised at a rate that reflects the risk inherent in the expected future growth in those earnings.

The Capitalisation of Earnings approach was not considered to be an appropriate approach because Haussmann does not have any historical earnings that can be normalised for capitalisation.

Market Approach

The Market Approach would compare Haussmann to the prices of similar companies operating in the same industry that are either publicly traded or, if privately-owned, have been sold recently. A common problem for privately owned businesses is a lack of publicly available comparable data.

The Market Approach was not considered appropriate to valuing Haussmann.

Other Approaches

Other approaches consist of valuation methods that cannot be classified into one of the previously discussed approaches. The methods utilised in the other approach are Capitalisation of Excess Earnings and Multiple of Discretionary Earnings. Commonly referred to as the “formula method,” the Capitalisation of Excess Earnings method determines the value of tangible and intangible assets separately and combines these component values for an indication of total entity value.

Under the Multiple of Discretionary Earnings method, the entity is valued based on a multiple of “discretionary earnings,” i.e. earnings available to the owner who is also a manager. Both of these methods are normally used to value small businesses and professional practices.

For such reasons, these Other Approaches were not considered appropriate for valuing Haussmann.

Application of DCF Approach to Haussmann

Discount Rate

A discount rate of 14.4% per annum (real, post-tax) has been applied to the projected future net cash flow for each year.

This discount rate has been derived as a surrogate for the Weighted Average Cost of Capital (WACC) for the business of Haussmann, using the following core components:

- The effective rate of tax: 30%

- Gearing: 70% debt

- Cost of debt (pre-tax): 3 %

- Cost of equity: up to 23.5% plus

- Risk-free rate: 3.5%

- Market premium: 20%

While the underlying cost of debt and cost of equity is arguably higher than prevailing market rates, we believe these higher rates are appropriate having regard to the stage of development of Haussmann’s business. The calculation of the discount rate is provided below.

This discount rate of 14.4% pa (real, after-tax) has been applied to each of the project cash flows as well as the sensitivity scenarios. We have not distinguished between the cash flows attributable to earnings from the manufacturing operations and its joint venture in the distribution/marketing of the building system products. The consequence of using a lower discount rate than the 14.4%, would be a higher valuation amount; a higher discount rate would result in a lower valuation amount. A summary of the impacts of using a different discount rate (other than 14.4% pa) upon the derived valuation for Haussmann is shown elsewhere in this Report.

Reference: Contact 7