Content

Reference: Content 1

Growth and Innovation

At Haussmann Limited, we operate with a pioneering spirit, partnering with social and human development. We work to responsibly source essential raw materials and intermingled raw materials and processes for the industrial production of precision engineered affordable dwellings for Australia and neighbouring countries as well as emergency housing to solve social and humanitarian problems and enrich the lives of all Australians and humanity globally.

The crisis caused by the unavailability of shelter, if not resolved, will lead to an unstable and dangerous situation and is already affecting individual groups of the global community in underdeveloped regions. Natural disasters, crises and emergency events are affecting the availability of shelter with negative impacts on the security, economic, political, societal, or environmental affairs of many nations.

Haussmann Teams, in initial Research and Development undertakings, have been working to develop and build the industrial production basis for mass production of future sustainable housing. It is our intention to create economically resilient communities in Australia and our neighbouring countries in the Pacific.

For us, progress is more than what comes from establishing a manufacturing plant. It is our inquisitive minds which have inspired new composite products and new industrial processes to make it possible to industrially mass produce such advanced shelter systems. We believe in connected communities – people and industry making a difference.

Progress is more than just an idea, or making profits, and bringing local and global progress, but this is why we exist. Creating advancements in technology, science, and social organisation have resulted, and by extension will continue to result in improved human conditions.

Adding value throughout the asset’s initial first 24 months lifecycle.

Prior to a potential public listings, Haussmann will appoint a Growth & Innovation team, to support Haussmann’s assets and to achieve superior performance throughout each plant’s establishment and lifecycle by optimising value from the time of the initial concept through to when a plant is contracted to a Plant Management Group.

Working with Haussmann’s product groups and overall site-specific project management groups will ensure that our assets are safe, productive, and profitable throughout their planning, establishment, and life cycles.

Growth & Innovation adds value by:

- Finding: Planning and acquiring new plant locations. We are assessing opportunities on 3 continents, looking at 8 different plant locations.

- Studying: ensuring the right location for the project to proceed with the optimal business case.

- Building: delivering major plant capital projects safely, on time, on budget and ready for a seamless handover to operations and long-term plant management.

- Optimizing: leading a step change in productivity, technical social and environmental excellence, managing technical risk, overseeing our innovation and automation platforms, managing industrial and enterprise IT.

Our Purpose

“As pioneers of the M3 composite, precision and application engineered building systems, produced by new industrial manufacturing processes, when in production, will enable us, to produce materials and building systems, for state of the art affordable and emergency housing / shelter essential to human progress.”

Haussmann has a novel commercial model using innovative “green”, sustainable new materials and industrial processes that make the existing building industry models – wet build materials and handling methods – obsolete.

Haussmann Limited - Board of Directors

The Company was registered on 9th March 2017 with the express purpose of bringing new range, precision-engineered to application, composite materials building systems, “state of the art” residential housing products and associated industrial manufacturing plant processes and designs. Our M3 composite building systems/ panel designs and process technologies have been produced to full size (laboratory and pilot plant established in Germany) and tested under the supervision of several major German engineering firms and independent testing facilities.

Product 1: Our IP processes and methodologies involve converting mixed solid ‘waste’ from commercial and industrial sources in high volumes into precision, application engineered residential homes, built to lock up stage, ready to move in, potentially in 14 days or less, at prices up to 50% less than the same size and quality conventional build home. Haussmann homes will be offered by Haussmann plant product marketing organisations with in-house vendor / first mortgage finance at very favourable, unmatched rates and conditions (minimal deposit, fixed interest rate terms.)

When dry build – installed, “clicked together” on site, our building systems make up a broad range of ” state of the art ” housing and shelter systems which are sustainable, cyclone, vermin and fireproof. Having completed our R & D phase Haussmann Ltd now intends to commercialise its technology, establishing manufacturing plants worldwide.

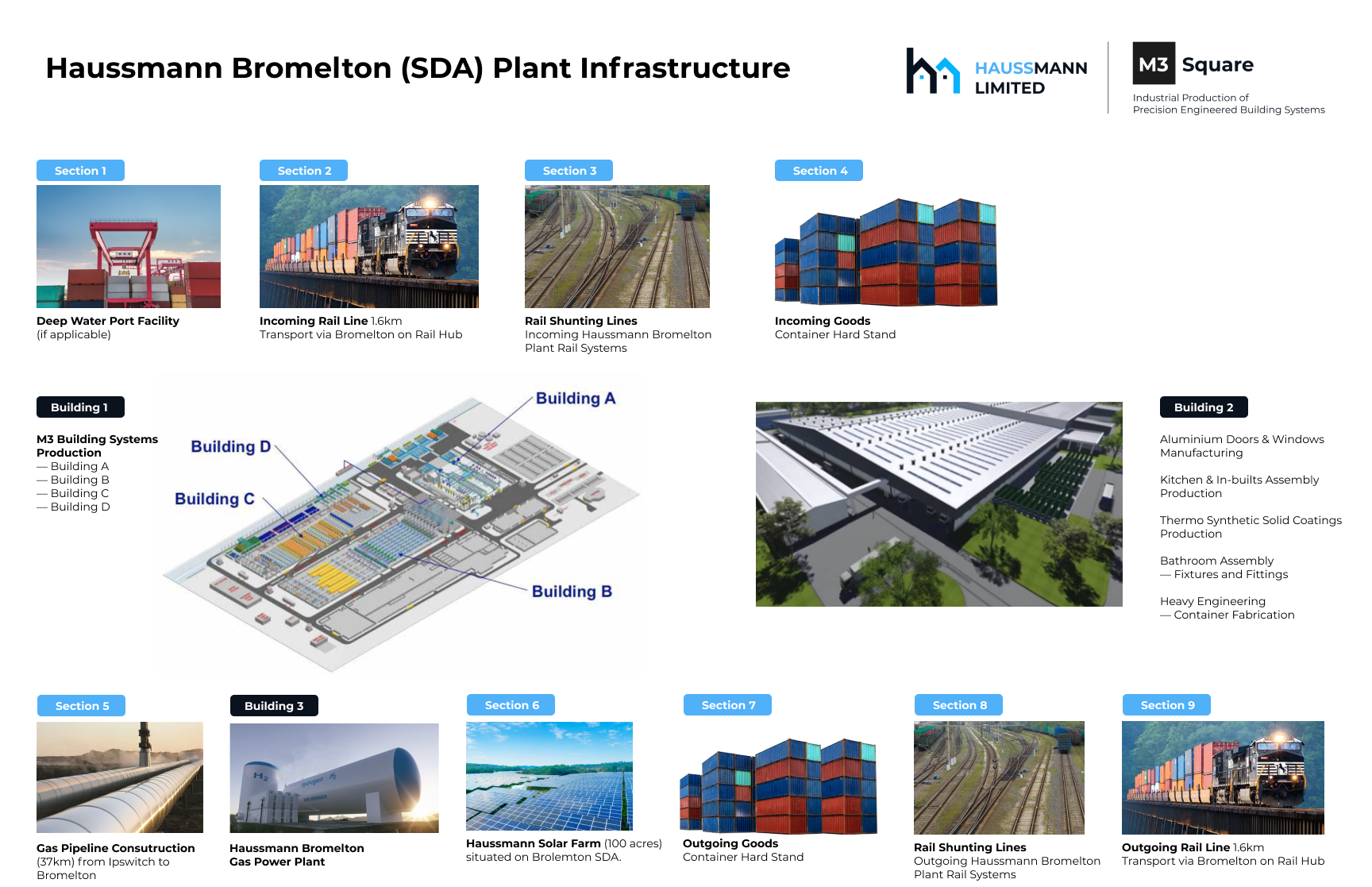

First Plant Location: Haussmann Project Management, contracting consulting organisation, has identified Haussmann’s first commercial scale plant location in Bromelton west of Brisbane, Queensland Australia, as potentially suitable as a showcase site for our production systems. The Haussmann Plant in Bromelton will include a Hydrogen Power plant, producing up to 150 MW per hour. Haussmann Bromelton Hydrogen Plant establishment further supports our goal of environmental sustainability.

Haussmann representatives are in discussions with the Queensland Government about this exciting project, ThyssenKrupp and other Plant Engineering companies and prospective stakeholders. Please find below a brief ‘dot point’ introduction to the project:

- Each Haussmann Plant is a major infrastructure project wherever established.

- Our planning suggests that during the establishment period (12 – 18 months) each Plant may require up to 1200 – 1400 professionals & trades. (Civil Engineering and Construction)

- In addition our modelling suggest that each plant may directly employ up to 2500 people per location and indirectly up to 25,000.

- Each plant is designed to produce up to 70,000 homes per annum (average size of 288 m² per home, at a cost that will be disruptive to traditional home building pricing.

- Each plant is designed to convert 750,000 tonnes of mixed solid waste per annum

- Haussmann homes can be built to lock up stage within weeks, weather permitting

- Each Haussmann home can have its own power supply and power storage system inbuilt, potentially allowing for off grid living

- Each Haussmann home manufactured offers superior performance in sustainability and fire resistance and is cyclone and vermin proof.

- Where possible Haussmann Limited has a Local Supply Policy, whereby all goods and services supplied for the production of every Haussmann plant will be sourced if possible, from local suppliers only

- Each Plant is designed, built, and operated to most stringent environmental requirements.

Each plant will connect to the national rail networks via a major rail hub and easy access to a deep-water port facility to service export markets. Our planning suggests that outgoing container movements could be up to 350,000, – 20 -foot containers and incoming container movements of up to 120,000 per plant annually. All associated production, internal rail systems and associated supply plants will ideally take up an area of up to 100 acres.

Reference: Content 2

Haussmann Limited

Equity Crowd Funding Programs: Australia $ 5 million 2021 Overseas: up to $ 75 million 2021 – ‘22

For Sophisticated Investor or Institutional Investor funding – HML to commission Corporate Adviser / Merchant Banker via HML’s Accountant Firm 2021

HML to commission Securities Dealer/Stockbroking Firm to list HML – NSX – reverse merger – ASX 2021

HML has commissioned Grant Consulting Group to seek grants from Australian and overseas governments. 2020 – 2021 – 2022

HML to commission Securities Dealer/Stockbroking Firm to list HML Bromelton M3 Building Systems Manufacturing Plant entity. 2021

HML to commission Merchant Banker – financial lead manager – to prepare and complete convertible bond issues to the amount of AUD $400 million HML to commission via major accounting group, investment offer – for Sophisticated Investor or Institutional Investor. 2021

HML’s Accounting Firm and Grant Consultant – submission for Government special loan facilities of AUD $ 400 million 2021 – 2022

Funding for:

Corporate Entity 1 2020

Corporate Entity 2 2020 – 2021

Corporate Entity 3 2021

Corporate Entity 4 2020

HML is raising commercialisation and preparation funding:

Selling Equity in the global holding company: HML Shares/Equity of: # AUD $109.65 million

A.) via Equity Crowd Funding Platforms and content digital marketing support

B.) via IM to sophisticated Investors and wholesale investors,

C.) via IPO.

HML is raising commercialisation and preparation funding:

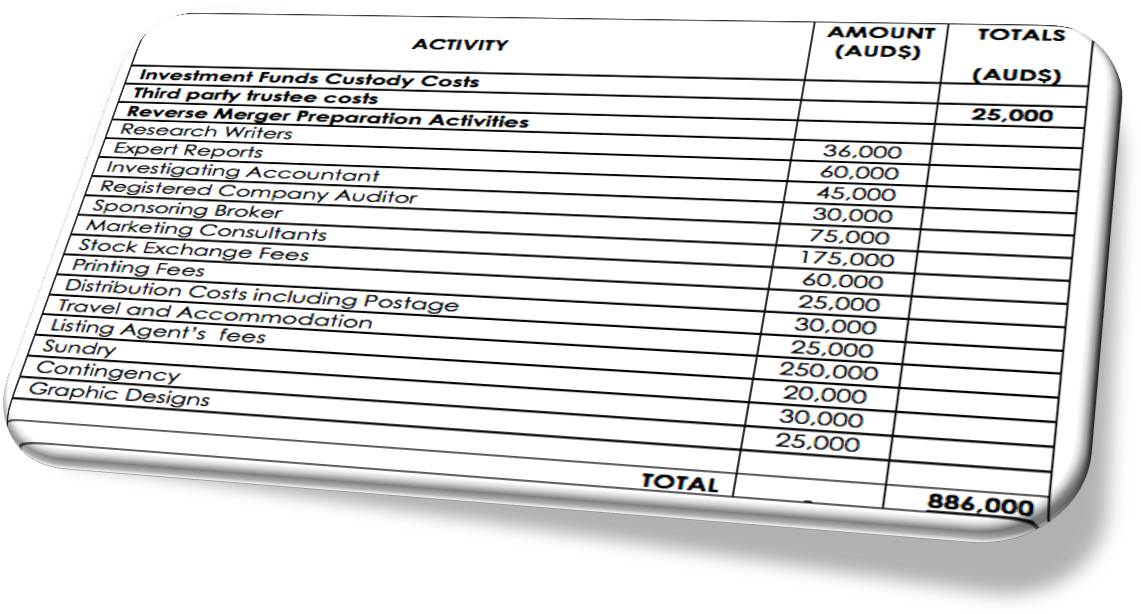

Application of Funds – HML Budget. 2021 – 2022

| Regional Head office establishment including 12 months office Budget | $1.6 million |

| Loan re-payments 5stargreen Building Technology Trust (BTT) | $1.2 million |

| Stockbroking Firm/ Merchant Banking Firm | $680,000 |

| Pilot Plant “one off” production, full size panels for Australian Standard Approvals Taxation advice expenses, patent costs etc. | $3.2 million |

Application of Funds – SPV Budget 2021 – 2022 – 2023

| Payment – Project Management Account – Bromelton Master Plant Study | $450,000 |

| ThyssenKrupp Hydrogen Plant site specific establishment | $100,000 |

| APA Gas Pipeline establishment Study – Ipswich to Bromelton 37 Km – part of Bromelton Master Plan Study | $100,000 |

| HML – Company Accountant and Auditor | $600,000 |

| SPV – Budget (Total) | $75 million |

HML M3 Building Systems Manufacturing Plant Bromelton – Balance Sheet –

Plant Funding – via convertible – Bond issue

First Mortgage – Vendor Finance – via Bond issues

Manufacturing Plant organisation – Working Capital – via Bond issues

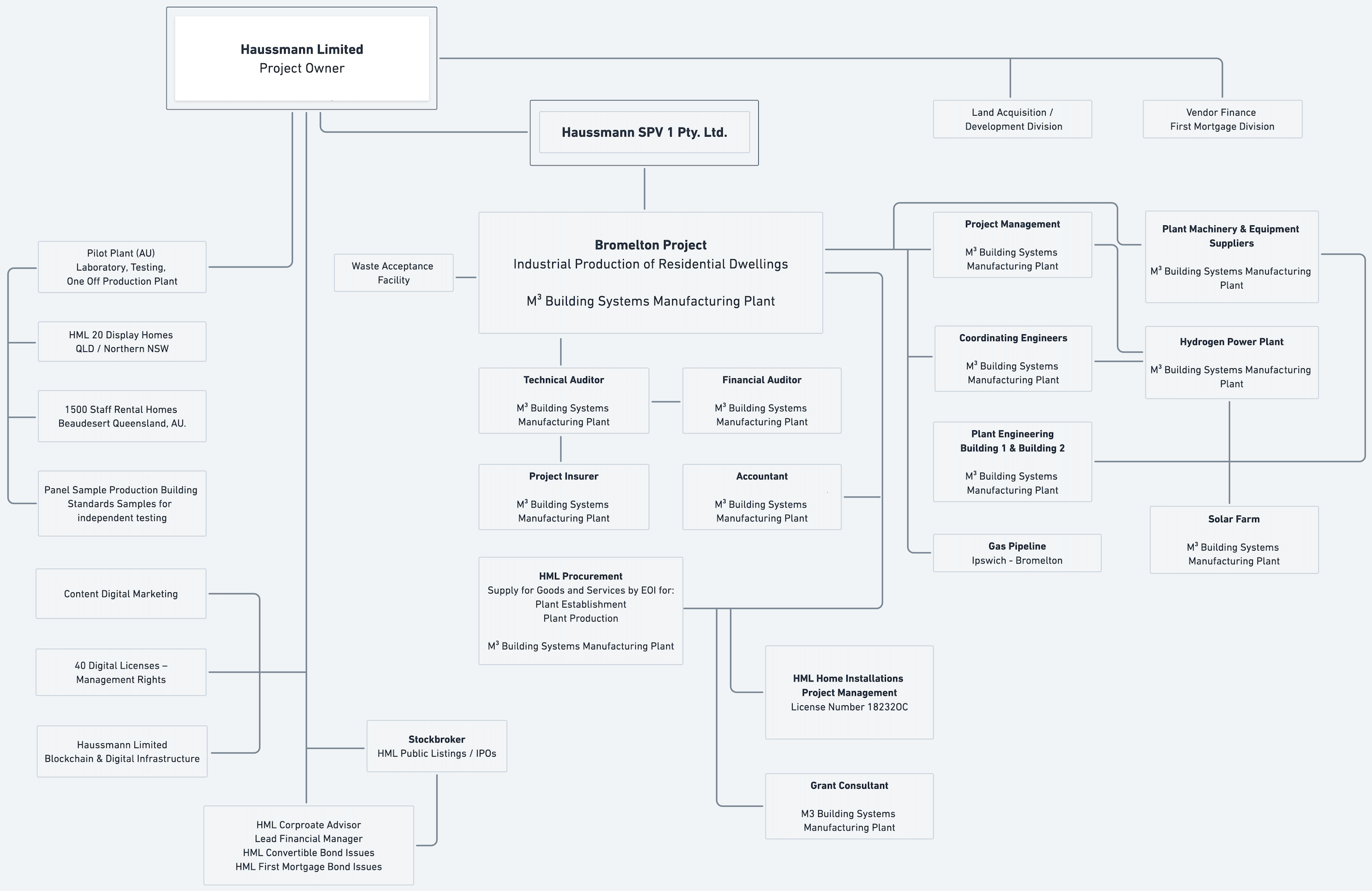

Click image to enlarge

The Business of Haussmann is commissioning with relevant Consultants and Organisations:

- Plant design

- Plant establishments

- Taking plants into full production

- Plant ownership

- Appoint and handover each plant to a nominated plant management company for a term of up to 24 years per plant, to manage each plant on behalf of Haussmann Limited.

Plant Catchment Areas

(Marketing Area for Residential Dwellings)

Haussmann Plants aim to produce residential housing systems – for national markets, in Australia, New Zealand, New Guinea, and the Pacific Islands.

Product 2

Haussmann Plants to be established to produce emergency housing systems for the global market supporting major Aid Agencies in the supply of emergency housing products to aid humanity and provide quality and first-world shelter/homes for an estimated 92 million displaced people around the world. All Haussmann export home products are not sold, but leased only, on a 25-year term through our Haussmann Limited range of housing systems products. Due to advantages of price, quality and quantity availability, a huge commercial opportunity in Australia and other global markets has been created.

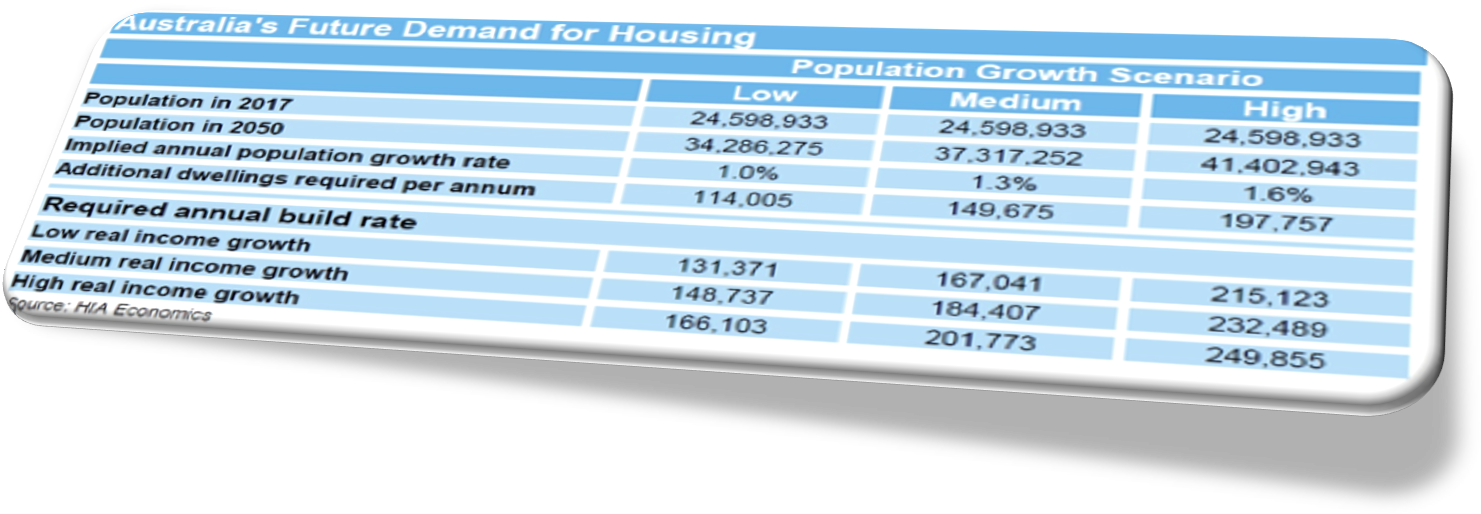

Haussmann industrial residential home production aims to give hope to 9.9 million Australians, who presently can not afford to purchase a home, and practically have given up their hope and dream of owning their own home, (reference: ABC radio announcement 1. Feb. 2018).

Haussmann will ideally make those housing dreams a reality for hundreds of thousands of people per annum, (average 4 People per household) by building at least two residential home/housing manufacturing plants which will provide, in time to come, affordable housing to all Australians at an affordable price.

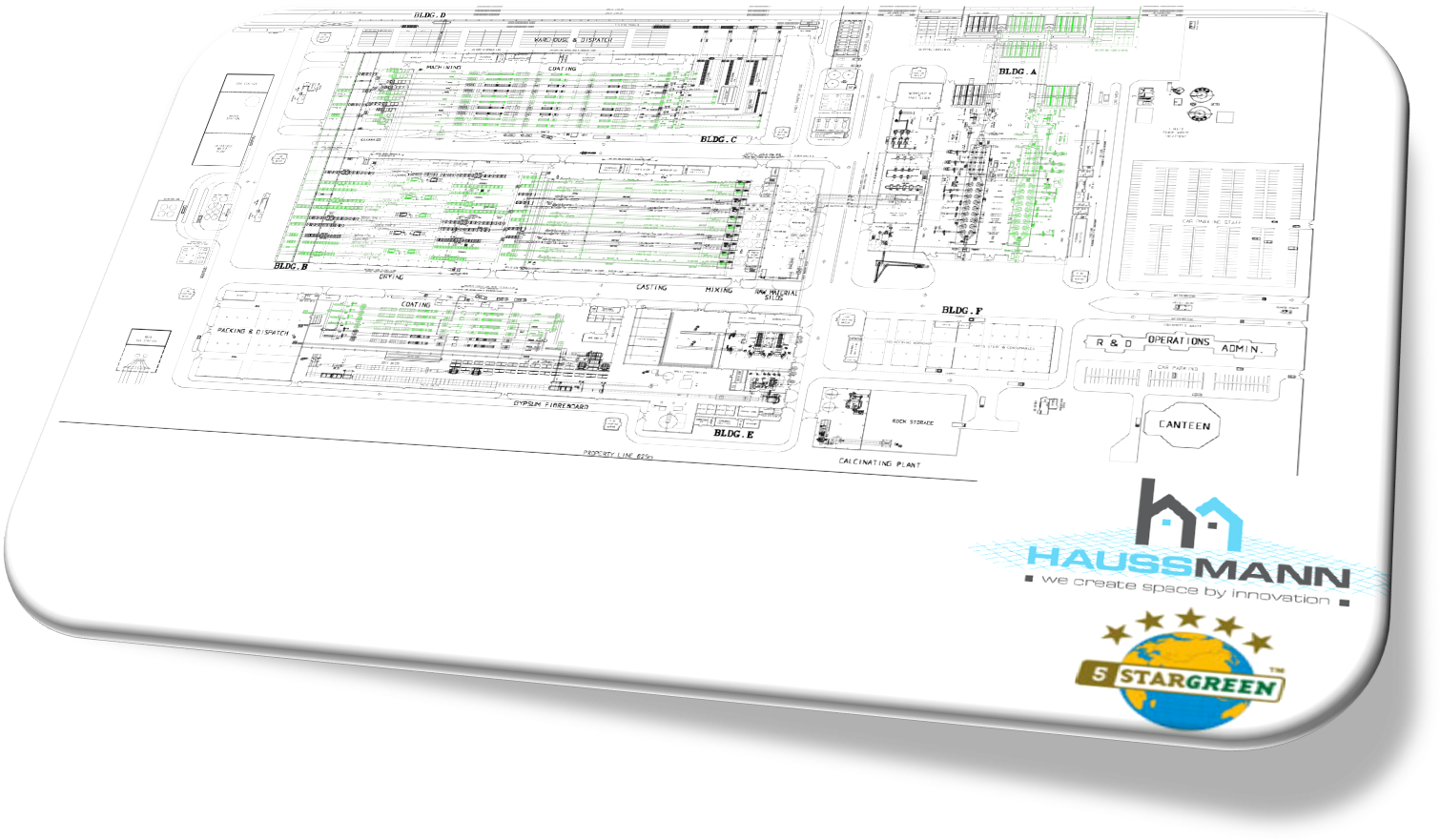

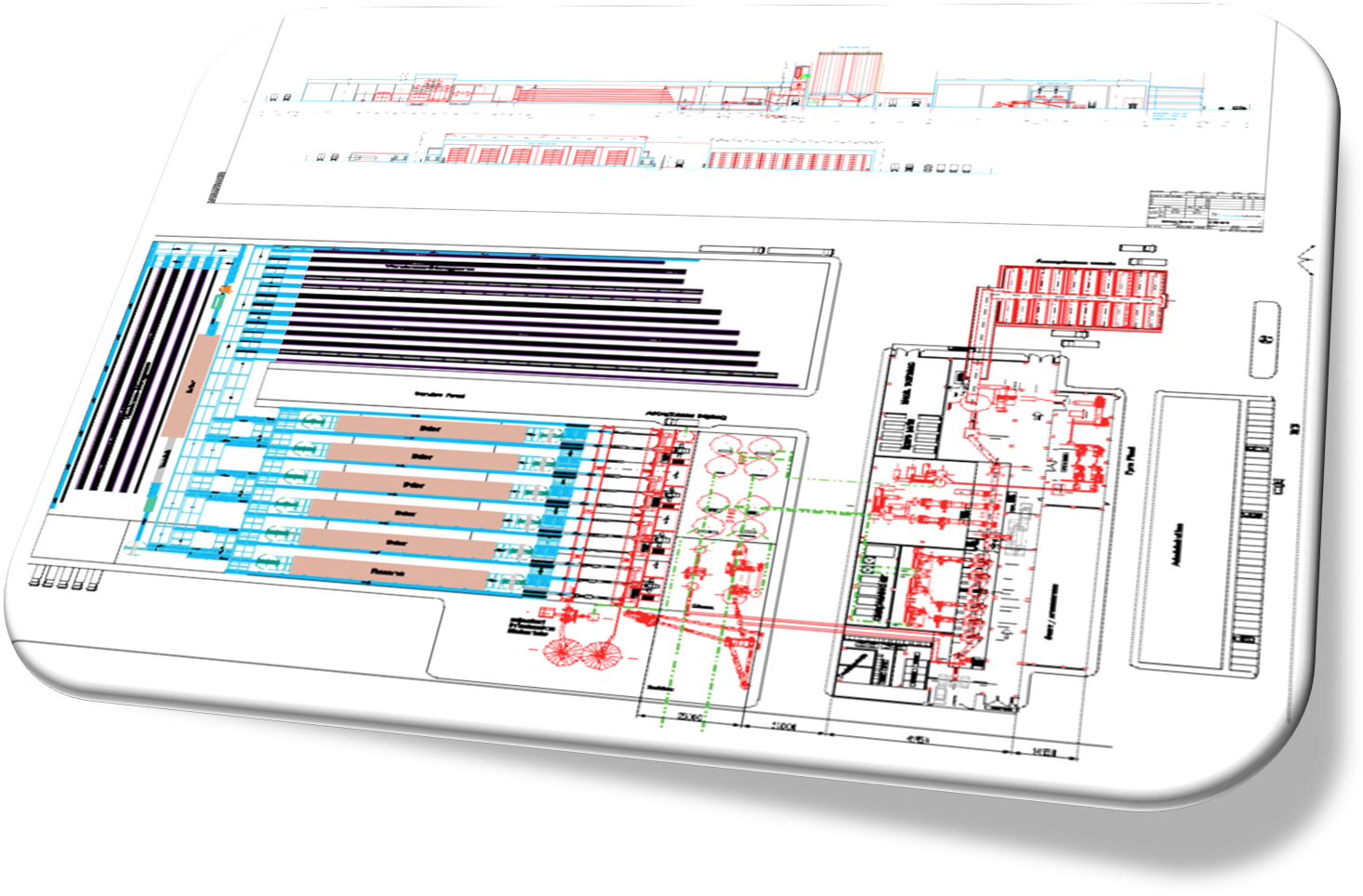

Haussmann M3 Building Systems optimum production Plant

Click image to enlarge

Our planning consultants have identified that it will take two full-size production plants ten years to provide up to 1.2 million Haussmann Homes. The local Australian affordable housing demand alone will warrant the construction of two more Haussmann Housing Systems manufacturing plants in Australia to satisfy local, New Zealand’s, New Guinea’s and the Pacific Islands residential housing demand.

Haussmann Ltd. products are designed to pass stringed environmental standards and are fully sustainable and can be fully deconstructed and reprocessed. Haussmann plants strive to create substantial local and national employment, wealth and social benefits, thereby delivering great positive social change. Meaningful, respectful, dignified employment with generous rewards are an important part of our values as a business (Haussmann Cost and Benefit Study).

Our long R&D history is filled with firsts. We have developed unique composite materials. These innovations make our manufacturing operations viable in most countries across six continents. We intend to lead our new industry in partnerships with customers, our workforce, local communities, and our suppliers. We have pioneered innovations in industrial processing technologies and plant implementation programs. We have paved the way in developing blueprints for premium workplace conditions and in fair trading.

Through research and innovation. We are helping meet the needs of society in a growing and changing world.

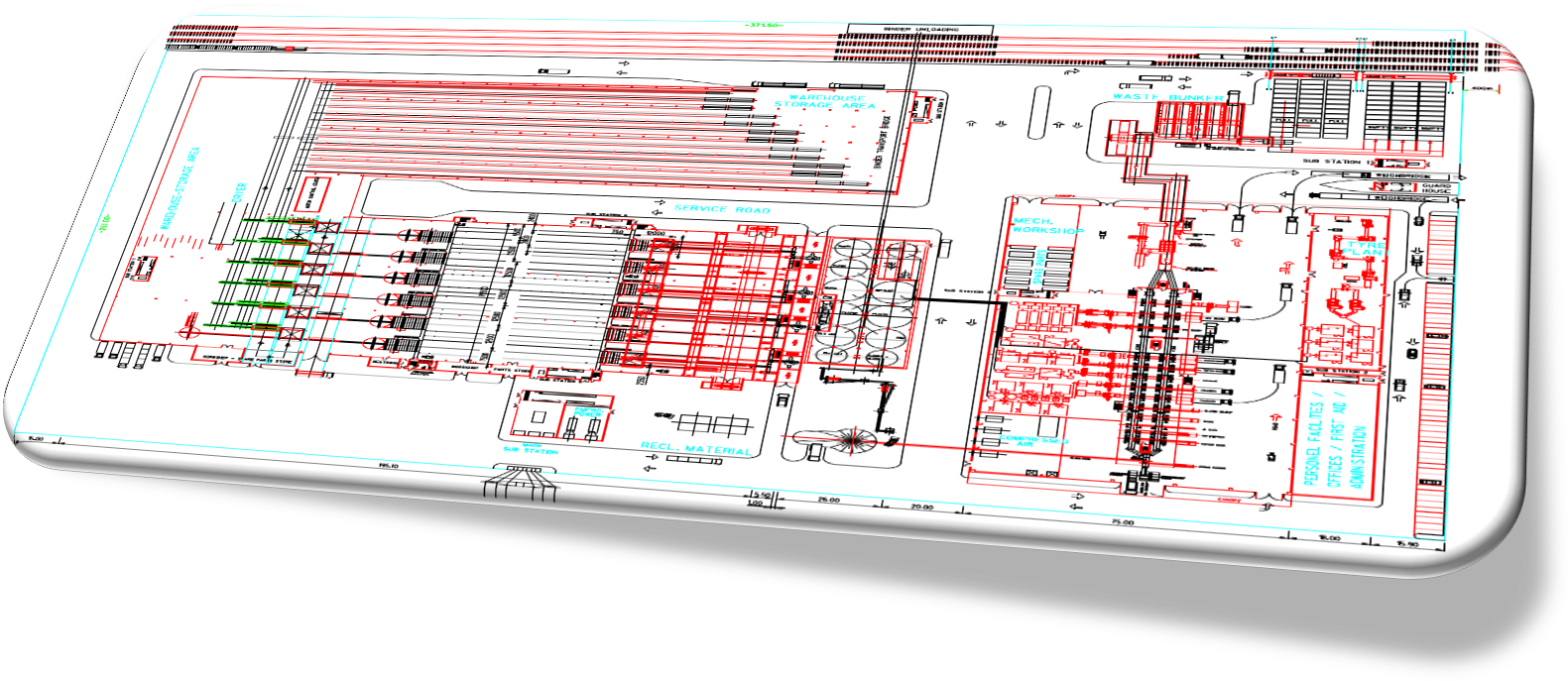

Haussmann Pilot Plant – M3 Building Systems Production minimum automated footprint

Click image to enlarge

Reference: Content 3

The Haussmann Manifesto

Haussmann is setting new standards. Because we can.

- Haussmann is setting new standards in industrial production, marketing, sales and first mortgage funding, for affordable housing.

- Haussmann is setting new standards in industrial production, marketing and global leasing programs for emergency housing.

- Haussmann is setting new standards by globally positioning industrial manufacturing plants, which will be producing sustainable, precision-engineered building systems on an industrial scale, making it possible for Haussmann to offer housing in numbers (quantity), price (affordability) precision engineered (quality) in a way no other manufacturer can offer or has offered. Any Haussmann housing product and design is 50% cheaper, compared to the same size and quality standard dwelling.

- Haussmann is setting new standards, providing in-house client home design services, total home establishment project management services to lock up stage, including applications and management of all DA and BA approvals.

- Haussmann is setting new standards in offering to any customer, a state-of-the-art affordable home, guaranteed to be built to lock up stage (ready to move in) within weeks from the start of site development. (conditions apply/weather permitting/ size of home).

- Haussmann is setting new standards in marketing and funding of affordable homes, offering to any customer, in-house first mortgage finance on a minimal deposit offering a fixed interest rate of 5% and terms of up to 30 years. (interest and principal or interest only payment terms).

- Haussmann is setting new standards, in that all supply of goods and services of Haussmann plant productions must be locally sourced. Haussmann contracted suppliers must pay fair wages and provide good working conditions for their workforce.

- Haussmann is setting new standards providing its workforce with generous employment conditions. Haussmann will contract with each workforce member: A 4-day working week, double superannuation contributions, providing free private health insurance including hospital costs cover, will pay 10% more than the average national minimum set wage conditions, and will contribute to child or children’s university education, when requested and applicable.

- Haussmann is setting new standards, donating all up 2000 homes per plant, per annum for 20 years (conditions apply). Haussmann donated homes to the general public, 1 000 homes will have a rent cap of AUD $50 per week (conditions apply: home donations will commence after year 4 of the start of plant production).

- Haussmann is setting new standards in environmental responsibility and sustainability, as each Haussmann production plant will be processing “intermingled raw materials” of up to 80% of plant raw material input, providing a zero solution for mixed solid waste and processing 750,000 tones of mixed solid waste per annum per plant. (Intermingled raw materials are: timber, glass, paper, plastics, rubber, man-made materials – all demolition materials.)

- Haussmann is setting new standards, has created a new industry, providing up to 2500 jobs per plant established, direct employment, and up to 25,000 jobs created by indirect employment per Haussmann plant. (Additional employment of up to1400 people during construction, during a period of up to 2 years, of each Haussmann plant facility, including supply contract establishments located next to each Haussmann Plant).

- Haussmann is setting new standards in the provision of exceptional quality emergency housing, which can be built on-site by a trained person or persons within weeks, capable of reading and following assembly instructions. All Haussmann emergency housing units come in 2 sizes, 8 x 4 meter & 12 x 4 meters, will include kitchen and shower/toilet facilities and will be leased to selected global aid agencies for terms up to 30 years. Each Haussmann plant designated for such emergency housing production will produce up to 100,000 building systems per annum. (Export products only).

Our Strategy

Haussmann’s strategy focuses on the “four Ps” – plant portfolio, performance, people, and partners – underpinned by disciplined capital allocation. We have recently further developed and improved our composite materials and increased our preparations to start our funding programmes.

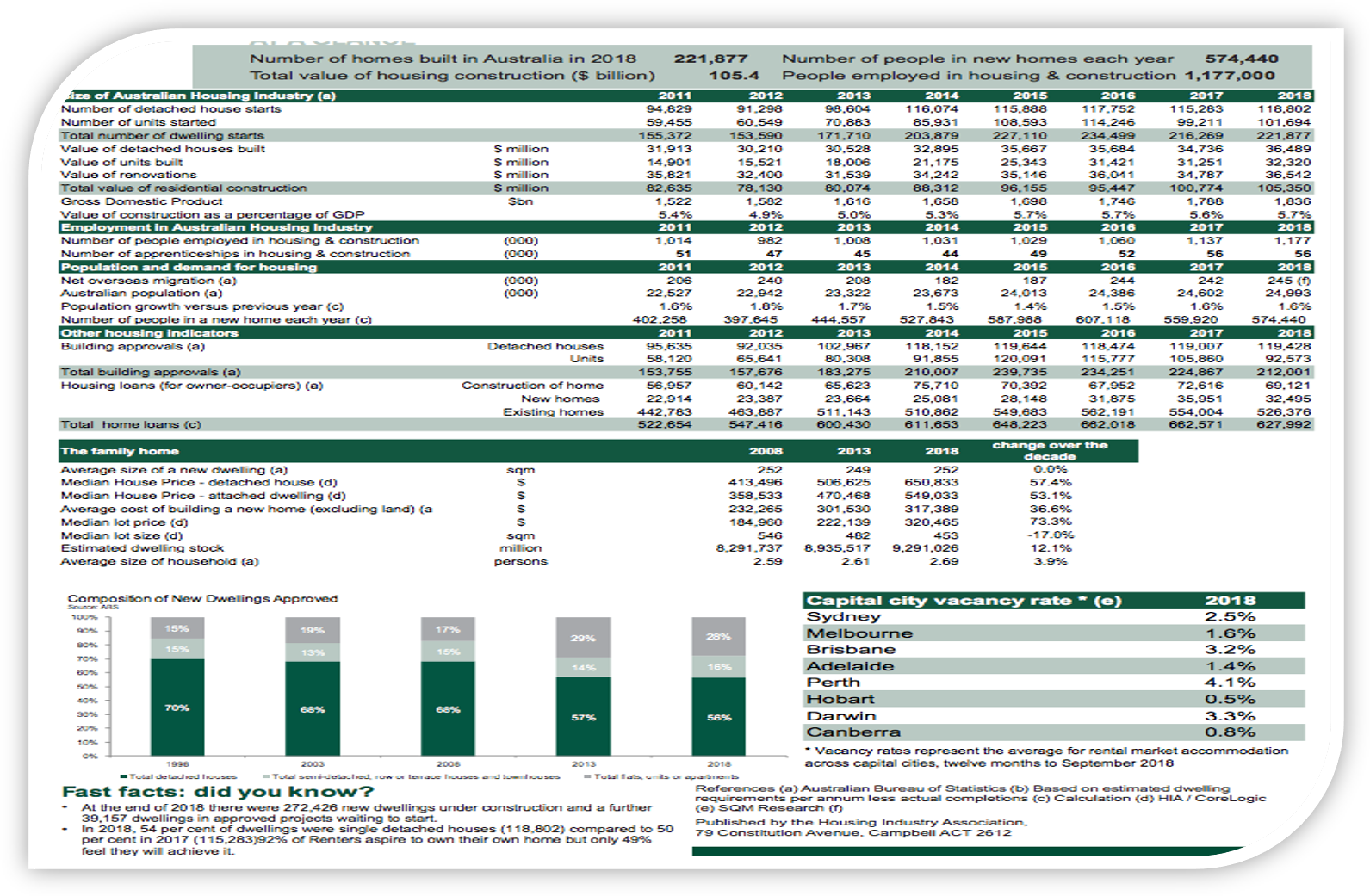

As global and local housing markets strengthen, aided by economic expansion and positive consumer sentiment in advanced economies, demand for affordable housing can and presently will outstrip supply. In Australia there is demand for up to 9 million homes yet only 240,000 homes are being built each year.

When Haussmann plants are fully operational, we can supply up to 70,000 homes per annum per plant. Haussmann proposes to build five plants in Australia over the next eight years. Two plants will be producing affordable housing/residential dwellings for the local markets in Australia, New Zealand, Papua New Guinea and the Pacific Islands, and a further three plants will produce emergency housing and Australian export products for major global aid agencies and governments, providing shelter on a global basis for the displaced.

A Clear Strategy

A clear and effective strategy is critical for us to perform strongly under a range of industry conditions. Our goal is to deliver superior value for our workers, shareholders and the community, throughout the lifecycle, and we believe the best way to do this is to focus on the “four Ps”: portfolio, performance, people and partners.

We couple this with our disciplined approach to capital allocation. This seeks to ensure that every dollar we generate is applied to prepare and build our manufacturing plants and associated infrastructure, providing the highest-return opportunity – whether that be for maintaining our balance sheet strength or investing in compelling expansion growth opportunities of our business and in doing so, delivering superior returns for all stakeholders.

We will continue to shape our plant portfolio plant establishment assets, ensuring that we focus only on the highest-returning, world-class assets in our preferred industry sectors.

Investing in our people and our partnerships with external stakeholders remains a key focus. We are investing ever more in developing the technical and commercial capabilities that will enable us to unlock maximum value from our assets.

In addition, we will continue building and maintaining strong partnerships across all stages of the value chain, which will be founded on trusted relationships and our reputation for doing things the right way.

Strong partnerships will allow us to access and execute new plant establishment opportunities, maximize value from our existing assets and manage license to operate risks.

Reference: Content 4

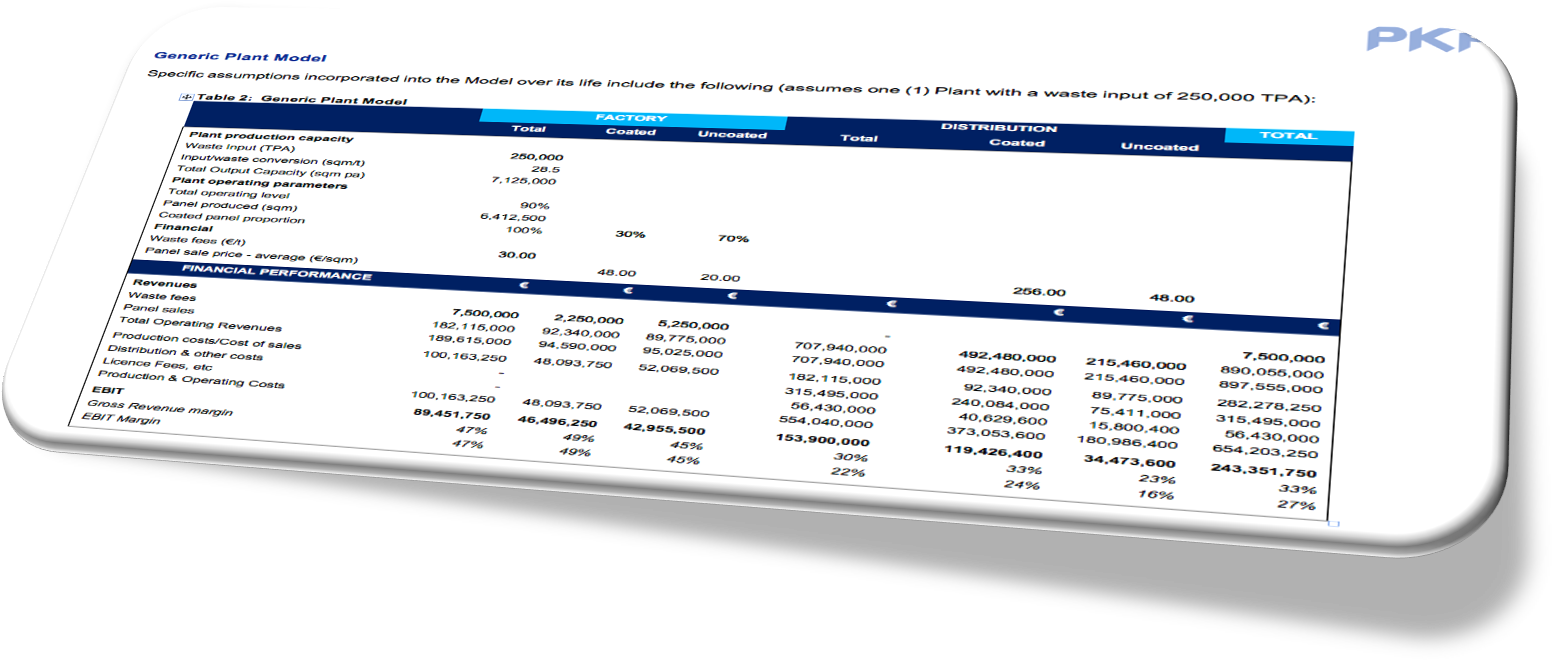

* Our home model size of 288m2 has been chosen as the average size residential dwelling for our calculations.

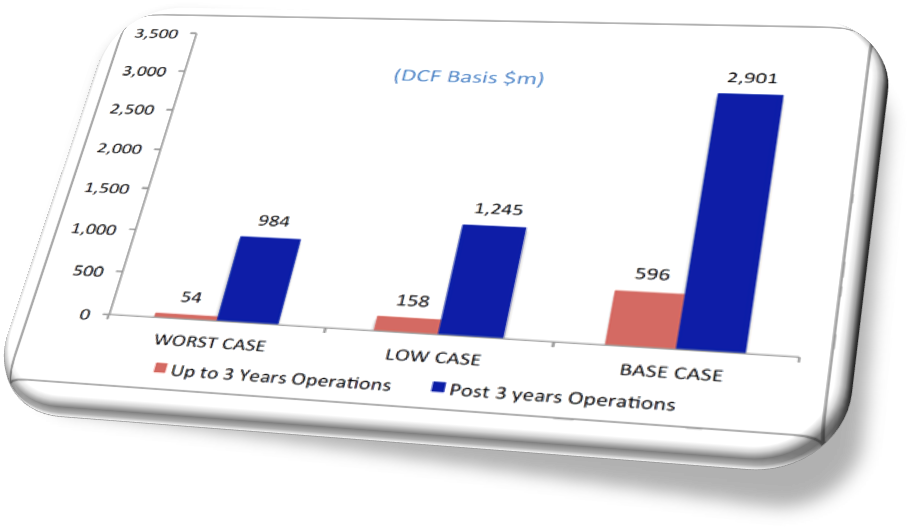

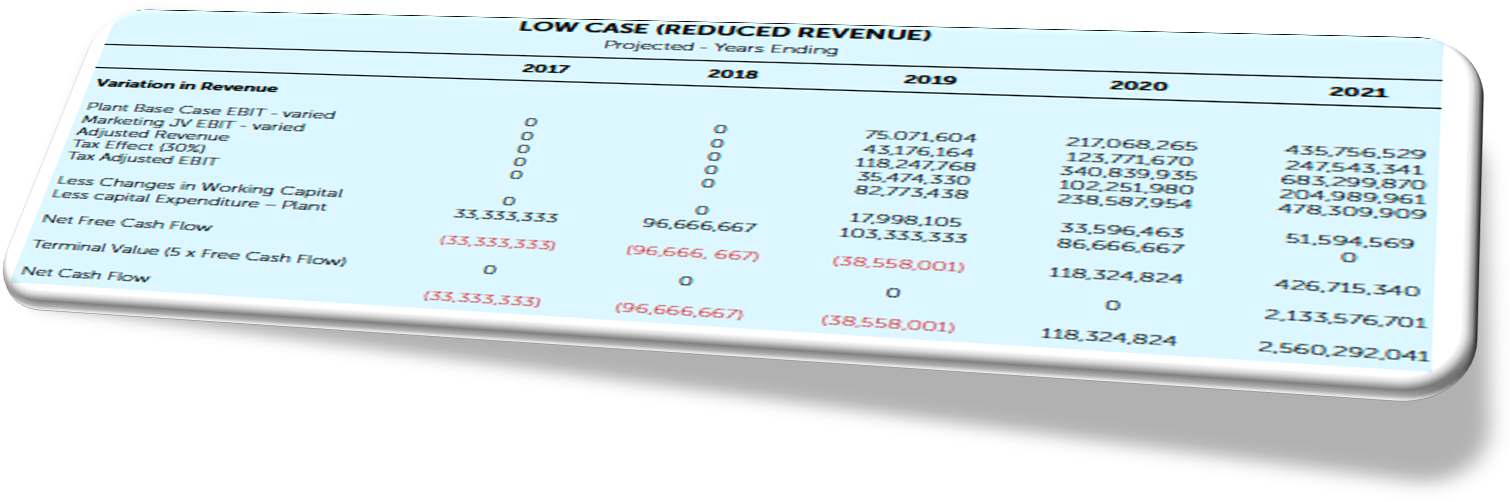

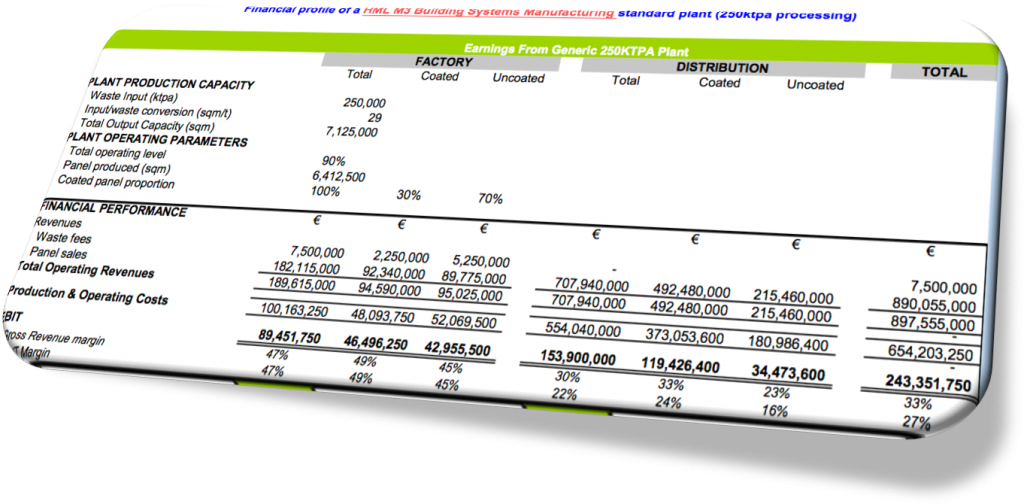

At this stage, we only can estimate the mix of size homes being sold by HML manufacturing plant’s marketing organization. The number of large, medium, and small homes are going to be sold based on a 10,000 or 70,000 home production volume per annum. We are projecting an annual average plant net estimated profit in Euro of $350M per annum, which is a conservative projection of actual net profit attainable. Based on such lower-end net profit projections of minimum $ 276.428,571 our projected return on Investment to investors does also reflect an ultra-conservative figure. (12 – 15% p.a.) (once in production for 12 months)

** excluded cost:

First mortgage / vendor finance of each home and or land by Haussmann. ** = AUD $2 dollar deposit and processing fees estimated $2,000.00 (including legal fees and first mortgage documents.)

*** Projected net profit of AUD $5.267 billion

Does not exclude the cost of deduction of HML 2,000 homes donated per annum to the total value of AUD $ 700 million (the amount of $ 700 million is deducted from nominated net profit of $ 5.967 billion. Minus deduction of $ 250 million Donations – Contributions – donating University Scholarships and Apprenticeships.

**** Quoted employment benefits in the Haussmann Manifesto, will provide “additional profit share”

for all Haussmann employees. Substantial increased benefits to our workforce, of estimated 2500 people, working a 4-day working week, 2 shifts at 10 hours per day, 280 days per annum. Substantial superannuation benefits, double standard amounts will be paid to our workforce, by annual donations, which are tax deductable. Other benefits include free private health insurance and contributions to children’s university education programmes.

****** Tax deductable Items: 1.) all Donations, 2.) Scholarships & Apprenticeships 3.) Superannuation donations, 4.) Health insurance,

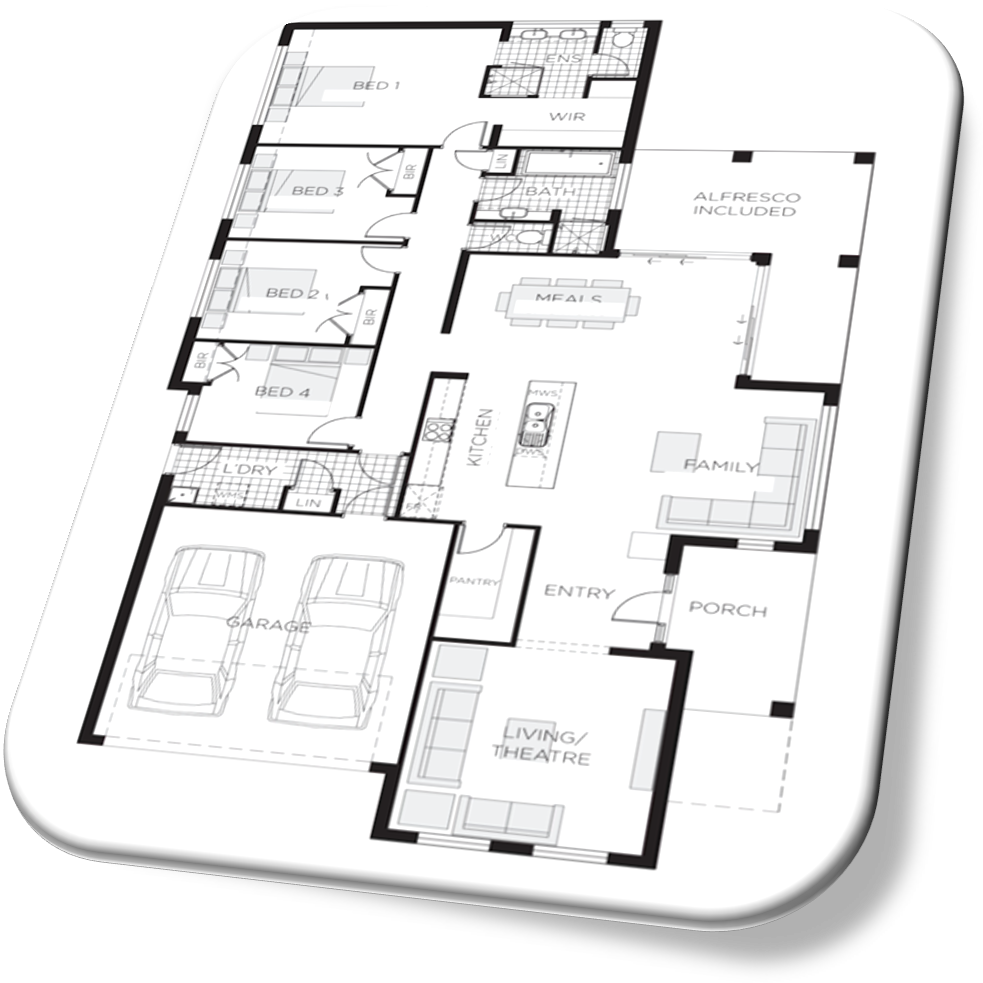

Base Calculation Information – based on HML average, state of the art, Residential Dwelling

As outlined above, a typical size and type of Haussmann Home, 4 Bedrooms, 2 bathrooms, Kitchen – Dinging Room, Living Room, Laundry, 2 Car Garage, plus outside “Alfresco” area, home size: 288 m2 (12 m x 20 m home size internal structure) (Total build out area will include in addition all around, up to 3 meter overhead covered area and 3 meter all-round veranda area). See Haussmann Home M3 building systems video.

Haussmann designed services and finance: Haussmann $2 dollar deposit Home Loan – first mortgage facility/vendor finance.

Building approval and planning management application for single dwelling with relevant council, for and behalf of the homeowner.

Supply and build on site: Total panel numbers – building systems manufactured, including foundations, small, single dwelling sewerage plant, water tanks, solar system including hydrogen power storage (for off-grid independent dwellings), including all in-builds, aluminium doors and windows, kitchen and bathrooms. Transported/shipped to location, build to lock up stage by the Haussmann team, we estimate, (as per 288 m2 home model), the ** total cost to Haussmann is 60%. total cost per home $212,500,00, based on net home sales price of $350,000.00).

** Transport fees – depending on location – distance of transport of 5 x 20-foot containers to home site location – minimum charge: AUD $10,000, maximum fee: AUD $30,000. Transport inside Australia is included and is part of the Purchase Price, and is part of cost of goods and services costs.

HML vendor finance/first mortgage finance is achieved by HML issue and offer of first mortgage bonds, offered to investors at 3% yield per annum, for a term of up to 30 years, secured over each borrower/customer’s Haussmann Home. (Default insurance paid by borrower).

Haussmann residential home offer to lock up stage – Ready to move in

Individual summaries for each section

Stock list, fabrication, manufacturing – goods and services Building 2:

Quantity Estimates for each 288 m2 – Home

Sliding Doors (4 meters and or 6 meters long) $ 1800.00 each Standard Doors (1.80 wide) $ 600.00 each

Standard Windows $800.00 each 4 Bedrooms – 3 x 4 m long sliding doors

Dining Room / Kitchen 1 x 6 m sliding door $3,000.00 1 x Entrance standard Door $1200.00

6 x standard Doors between Rooms $400.00 each 6 x standard Doors (small)

Garage Roller Doors

Choice:

2 Car Garage $2,500.00

(3 Car Garage $3,500.00)

Kitchen (1)

Choice:

3 types of Kitchens

A.) Different Sizes – small, medium, large – small, $8000.00 medium – $12,000.00 large – $18,000.00

B.) Different Quality finishes and appliances – standard, special, premium. standard – $9,000.00 special – $15,000.00

C.) Premium – $21,000.00

Showers (2)

Choice:

Showers only $700.00

Shower and Bath $1,500.00

Shower and Spa Bath $2,200.00

4 wardrobes and Laundry in-builds

Choice:

3 Standard Wardrobes $700.00, $,1000.00, $1,500.00

1 Walk in Wardrobe $2,000.00

Solid Surface Materials Production

(21 million m2 annual production)

Decorative sheets, 2 mm, size: 1.20 x 2.40 @ $60 per square meter –

application: Decorative surface finishes – internal and or floor, and or sealing and or wall, bench tops, tops, applications & in-builds.

Why is the Purchase Price of a Haussmann,

288 m2 average size home,

50% less

compared to the average size and

quality home being build by Builders and or Developers.

- All HML M3 Building Systems are built in a controlled environment, precision engineered, from fully sustainable composite materials

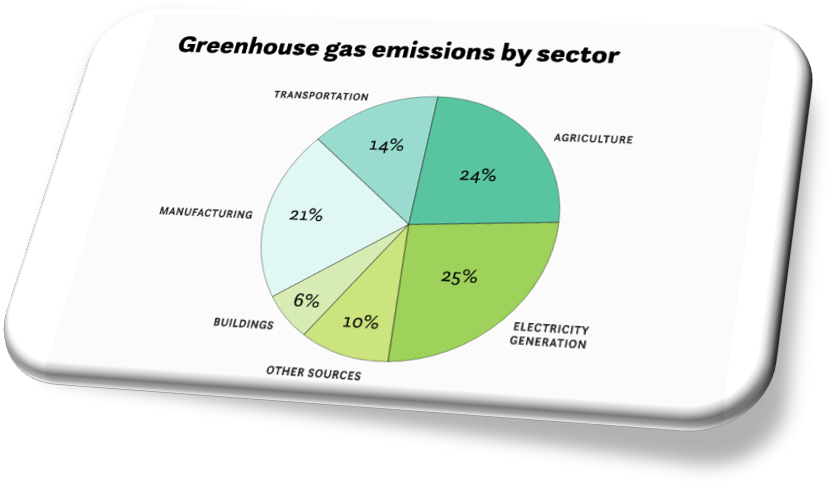

- HML homes are dry build – no CO2 emissions (unlike all other Homes build, which are wet build, create large CO2 emission)

- Substantially Reduced Purchase Price with additional benefits by design and inclusions

- Haussmann Homes come with Life time benefits by design and inclusions

- Haussmann Homes are built within in Weeks on designated location

- Assembled by specialist Haussmann Teams Dry Build Structural joining points – Clicked together – building methods

Nil Fire Insurance Policy for the Building,

Nil insurance Policy for Homes build in cyclone prone areas, part of content insurance policy covered under storms)

Nil cost for Pest Control treatment

Haussmann Homes are vermin proof, cyclone proof and will not combust, fire proof.

During the life time of such home, savings in reference to fire insurance, as there need to be no such insurance needed will be in excess of AUD !00 K. No need to spray on a 6 monthly basis and or annual basis of poison, which may affect your health and associated costs will save the home owner another 50 – 70 K during the lifetime of the dwelling, (50 years). Possibly once or twice in the life time of the building, In some areas of cyclone effected areas, will save the owner insurance and replacement of at least possibly once or twice the replacement of the home, saving possibly another $ 60 K.

Nil Cost for Electricity – Single Residential Dwelling – Hydrogen Power generation and storage- solar system.

Nil CO2 emissions producing and using electricity

Haussmann Homes will be independent of the Grid

and will have their own power supply, which will be produced by HML roof solar panels, solar in build in HML Panels, and Hydrogen power storage within the home, which will save the owner every 3 months the average amount of minimum $ 500 dollars, which is an annual average of $ 26 K and will total during a lifetime of 50 years to an average of $ 1.2 million

Substantial Water Bill reductions – Underground Water Tank storage

Haussmann Homes will have their own under home water tanks,

which can catch rain water, Such holding tanks can be in total 4 tanks with a length of up to 20 meter and a width of 1meter and an height of up to 0.5 meters each holding 10 m3 meters of water when full. Such tanks can be removed for cleaning and easy placed within original position.

In builds are part of the building structure – additional 3m wide – 360 degrees veranda shelter

In builds are part of the building structure – additional 3 m wide – 360 degrees walk way

Haussmann Homes have additional external shelter and external walk ways

Veranda, part of roof area of 3 meters around the building and also walk way area, part of home floor area of 3 meter width around the building. No need for awnings and or walk way path concreting around the home.

Home internal sealing heights 3 m – throughout Each Haussmann Home (clear span).

Haussmann Homes have standard 3 meter Room heights

Higher home internal cubic meter space of 3 meter heights will allow larger in build spaces.

Large Room space areas of a Haussmann Home, will have alum sliding doors between 4 – 5 meters x 2.40 meters.

Haussmann Homes have large Glass Sliding Doors

each major Room has large Sliding Door to the outside

Each Haussmann Home is double insulated throughout, walls, sealing and floor

Haussmann Homes have double insulation

Exceptional protection from Hot and Cold temperatures – substantial savings in Heating and Cooling

Exceptional Acoustic Quality – Noise protected quality living spaces

Each Haussmann Home will have large internal build – ins

Haussmann Homes have more build- ins at no extra cost

Each room, by design choice, at no extra cost, including bedroom, bathroom and kitchens – will have large build in wardrobe/storage spaces including on walk in pantry.

Each Haussmann Home, if not connected to town or city sewage system, will have its own sewerage treatment plant

Each Haussmann home price will include its own sewerage treatment Plant

In addition each Haussmann Sewerage Plant will be providing irrigation for gardens and or grassed areas, around the Home, this are additional, substantial water savings.

Standard connected Town Systems sewerage charges do not apply, which will save the owner of a Haussmann home annually minimum $ 1200,00 and over 50 years $ 60 000,00

Each Haussmann Home is handed over, on key hand over, fully landscaped

Each Haussmann Home established and keys handed over to the owner(s), comes with outside – home areas fully – landscaped. (grassed areas and Plant and Trees areas)

Reference: Content 5

Commercial

Haussmann’s commercial group will be headquartered in a regional centres, preceding the establishment of regional manufacturing plants. Haussmann teams will be focused on delivering market strategies and working hand in hand with the plant project management group, coordinating Engineering Group, the Plant Engineering Group via a nominated SPV, products group, to grow value across customer and supplier chains and will include local, pre-plant home sales, global sales and marketing, assisting procurements, including rail and marine logistics organisations, supported by our commercial and finance team, including market analysis functions via nominated SPV.

SPV – our nominated special-purpose entity (vehicle), is a legal entity created to fulfil narrow, specific, and temporary objectives used by Haussmann to isolate the firm from financial risk. The SPV/entity is a fenced organisation having limited predefined purposes and a legal company which will receive all funding from Haussmann Limited and will transfer such funds and rights under the plant license and royalty agreements to contracted entities for management obligations and rights to use the SPV to finance Haussmann Plant contractors. Haussmann’s large plant manufacturing infrastructure project is thereby achieving a narrow set of goals without putting the entire firm at risk.

The site-specific plant infrastructure nominated SPV will hold a single asset and associated permits and contract rights. Our nominated special-purpose entity will be owned by one entity, Haussmann Limited. Our nominated SPV may be set up as ‘orphan’ company, with their shares settled on charitable trust and with professional directors provided by an administration company to ensure that there is no connection with Haussmann. Such proposed structure set up may, or not may be considered, when Haussmann Insurance policies have been structured and ready to be contracted and implemented.

All Plant infrastructure contracting parties will contract with Haussmann Limited via nominated SPV. Haussmann will procure all such parcels of funding to start, enable, progress and complete contracting entities with obligations to plan, establish, test and commission all relevant industrial processes, fabrications and assembly and all necessary infrastructure for the nominated Haussmann Plant to produce product as contracted to input, output and quality, cost and type of product within agreed contracted timeframes

Business resilience and recovery

The global nature of our company – and our proposed locations which range from capital cities to some of the most remote parts of the world – mean we need to be prepared for a variety of incidents. While some can be anticipated, others – such as an earthquake or a terrorist attack, pandemics, – cannot. But, however they arise, we must be trained and ready to respond quickly and efficiently to situations that threaten our top priorities: our people, plant infrastructure environment and the communities in which we operate, our assets and our reputation.

Our Business Resilience and Recovery Programmed (BRRP) aims to ensure that we have the right skills in place to cope with major or catastrophic events. The BRRP covers how we prepare, how we respond, and how we analyze and improve, in order to minimize business disruption and maintain the continuity of our business. All our plant infrastructure sites will have their own BRRP plan, adapted for local use, and a business resilience team tasked with preparing for and responding to incidents. These teams must rehearse the plan annually, to learn how to work together should a real incident occur. By responding to realistic, simulated incidents, team members gain invaluable hands-on experience – and the confidence to apply it. Ultimately, the aim of our BRRP is to enable us to make better decisions and protect our business priorities.

The way we work

At Haussmann, the way we work, outlines how we deliver both our purpose and strategy. It makes clear how we should behave, in accordance with our values of safety, teamwork, respect, integrity and excellence.

The way we work provides a clear framework for how we should conduct our business, no matter where we work or where we are from. Importantly, it provides clear boundaries that we should hold ourselves and each other accountable for, to help make the right choices.

It applies to each Director, employee as well as to our consultants, agents, contractors, and suppliers. We also want these principles to be respected by our joint venture partners and non-controlled companies.

Sales and Marketing

Haussmann will be selling and marketing high-quality products within a plant’s catchment. Sustainable, precision engineered to application, affordable, state of the art homes, sold to individuals and families, whilst Haussmann emergency housing products will be leased to global aid agencies and governments. Haussmann’s diverse portfolio allows us to respond throughout a countries’ economic development cycle, including infrastructure and transport, machinery and energy and specific consumer goods, making modern life more affordable and work more efficiently.

Haussmann’s marketing teams are a division of the plant operations so as to align resource management with product market needs and to make sure Haussmann plant production improves products and services in a way that at all times maximises value to customers. Initial residential home sales will be started and managed by Haussmann Limited Regional Office, prior to the start of plant production and establishment of each plant’s in-house marketing organisation. Pre-plant product sales marketing will be a Haussmann off balance sheet funded entity.

Rail, Marine and Logistics

Well-developed rail, marine and logistics adds value to all our services, acting as the central repository of all logistic expertise for our organisations, via or managed by the Plant Establishment Project Management Group. Over the next 10 years, Haussmann aims to, and has the potential, by future demand its goods and services, to become one of the largest bulk container and goods shipping businesses in the world.

Procurement

Wherever Haussmann operates, it is strategically important that we have a secure, sustainable, local and internationally competitive supply chain. Haussmann Procurement is set up to leverage the global buying power of one of the world’s leading industrial undertakings. At the same time, we maintain the flexibility and agility necessary to support the needs of individual product groups and business units, and the economic development of communities in which we operate.

Procurement delivers industry leading value as the provider of easy-to-use and quality services that enables product groups to focus on core operational objectives. Procurement provides control and generates greater cash to Haussmann Plants through lower costs, creating new profit centers, in some instances, release of working capital, and better productivity. Procurement is focused on creating commercial advantages for Haussmann Limited Plant operations.

Research & Development

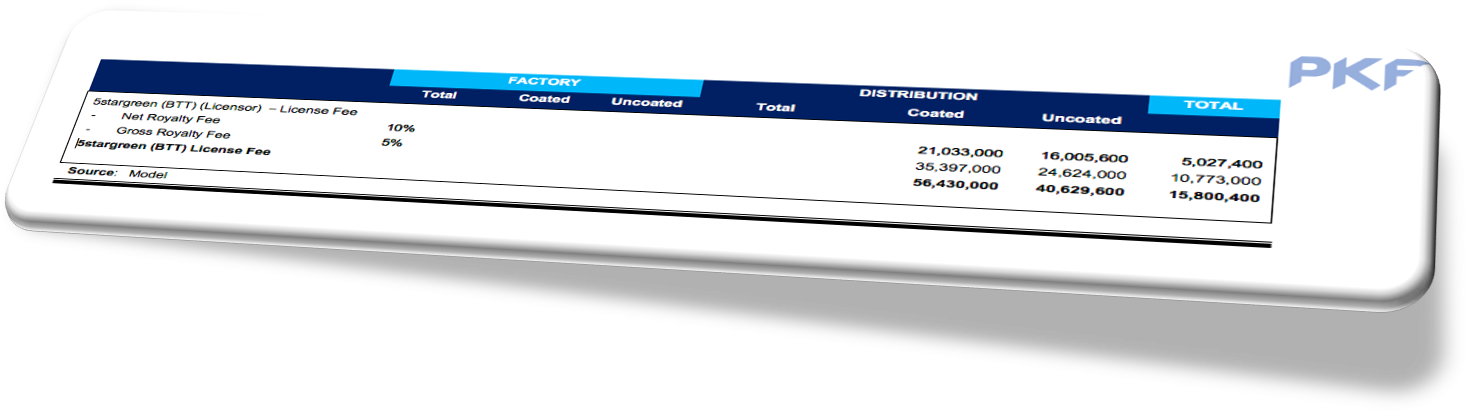

Haussmann Building System Technology (Products) Haussmann Limited was established in 2017 to acquire exclusive global rights to establish and commercialize M3 building systems manufacturing plants, created by the “5stargreen” building technology Trust(BTT) R&D programmed. The exclusive global rights acquired by Haussmann are based upon BTT IP, that have been under development for many years (the “Haussmann System”). M3 building systems are a game changer, taking the building and home establishment process from wet build to dry build, providing millions of people who previously had no chance to even dream of home ownership, to become home owners and leading the effort to address the global problems of waste disposal and affordable housing supply.

Reference: Content 6

R&D Pilot Production – Full Size Panel Production

Plant Engineering Gates and Processes

- Feedstock, other than virgin raw materials. Containerised Delivery, (acceptance) of mixed solid waste from commercial & industrial sources (200 000 kilotons – 750 000 kilotons p.a.) Plant separation of solid waste into intermingled raw materials categories.

- Processing of mixed solid waste (intermingled raw materials) and blending, to form specific base ‘core fillers’ for applications – engineered building materials mixing and blending of processed waste materials with virgin raw materials to produce a range of precision engineered and factory quality finished applications, precision engineered cores and surface finishes for the full range of building systems.

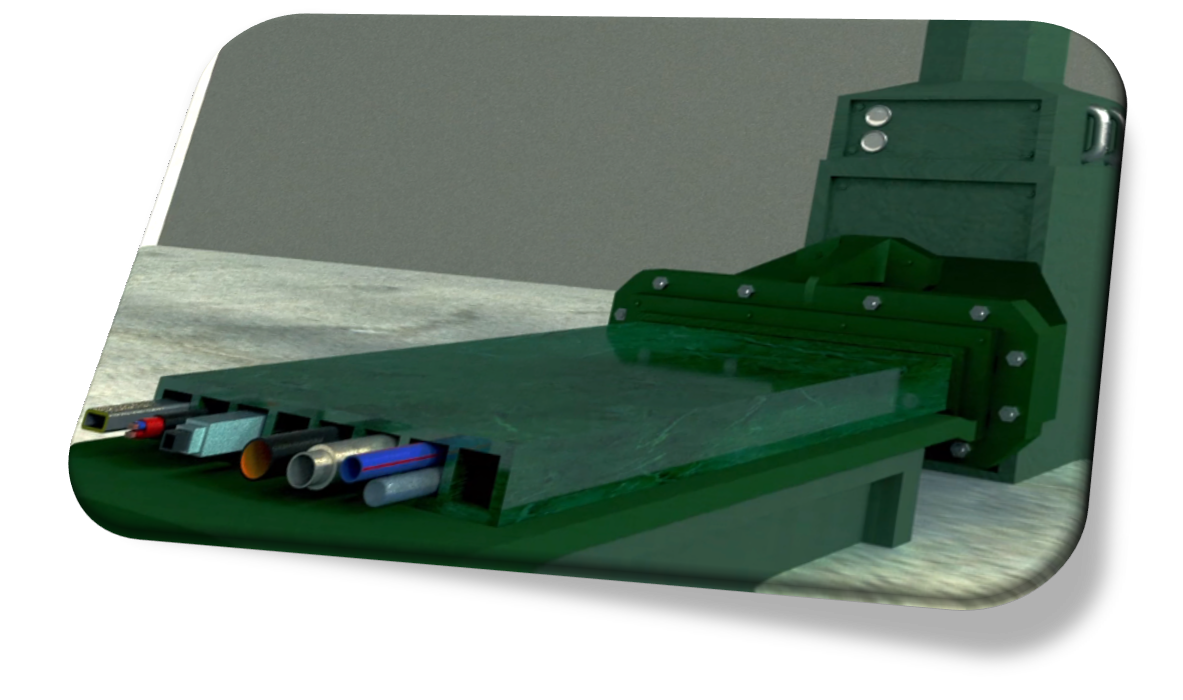

- Drying and postproduction panel core shaping and panel surface treatments and finishes will produce an industrial superior building systems product. In addition to panel production, Building 2 will house stock supply, container fabrication, warehousing, production and assembly of kitchens, showers, toilets, fixtures, and fittings in-builds, aluminium doors and windows and solid surface materials. Outgoing M3 Building Systems are transported in containers, containerisation of all housing parts, and all precision engineered housing systems ready to be shipped to the client’s nominated location, building site.

- Our precision engineered panel systems are engineered composite panels, assembled on site, section by section, which, when completed, are a summary of interlocking building systems, engineered to specific application. Applications are floor, wall, sealing, divisional and roof panel systems. Each panel core is designed and engineered using specific composite mix and is by composite maximised to application.

- When interconnected, “clipped together “, any size M3configuration living space and interconnection between the living spaces can be created to be totally “free – span” or sectionalised by room/space division panels.

- All panel applications can be interconnected to size and or configuration as per client design choice.

- All panels are produced, built, and configured and surface finished to client design. (Freedom of design)

- Relevant panel application systems include enclosed services and structural components: water, grey water, waste water, air conditioning ducting, electrical/intelligent wiring and specific structural configured steel tube arrangements.

- Haussmann guarantees any dwelling design, standard size home, 288 m2 to lock up stage to be dry build on site and finished, ready to move in within weeks. Haussmann agreed / contracted building completion date. (Weather permitting).

Click image to enlarge

Reference: Content 7

Disclosure Request

The term ‘disclose’ is not defined on the Privacy Act. Our entity ‘discloses’ personal information where it makes it accessible to others outside the entity and releases the subsequent handling of the information from its effective control. (Act by the disclosing party). The state of mind or intentions of the recipient does not affect the act of disclosure. Further, there will be a disclosure restriction, and for such restriction to be lifted, the prospective recipient must fully disclose his or her identity and provide a written request to Haussmann Limited requesting a Haussmann NDA (Non Disclosure Agreement), by sending such request to Haussmann Limited – (a restriction lifting request) – request directed to: info@haussmannlimited.com.

Your Disclosure Request (Privacy Act)

Thank you for your enquiry.

Please send your email address together with your request to: info@hmlglobal.co.

Once received, we will provide you with Haussmann’s NDA ( a non disclosure agreement ).

On receipt of your executed NDA copy, you will disclose requested information, re BTT Stakeholders and Cash Contributors.

Your Haussmann Support Team

0409 888880

We are contracting the expertise of established technology and engineering firms to deliver an innovative end-to-end solution for high volume and low-cost housing needs via the manufacturing process (the Haussmann System). By advantage, the Haussmann System supersedes all other building systems in quality, price, and quantity availability. Haussmann products: Building System offers affordable, state of the art housing and emergency housing.

Composite materials systems formulations

As an international research and production consortium, BTT has developed world leading technology to meet the challenge of providing sufficient affordable housing along with the adoption of more sustainable living practices – affordable housing with the development of a production system that uses waste as a raw material and will produce modular M3 building systems, providing environmental and social sustainability.

The underlying driver for Haussmann’s operations is to use innovative and proven technology to deliver large volumes of affordable low-cost, modern, quality housing to the world’s poorest along with an environmentally sustainable solution to the growing global waste problem in a manner that is reliable, cost-effective and provides long-term social benefits through the provision of affordable housing in areas previously lacking accommodation. Haussmann hopes to build social cohesion through improved living standards, and also help develop the local economy through local job generation.

Preceding the pilot plant manual production facility, BTT established a product sample testing and production sample laboratory. The facility, which was periodically in use, enabled production of large quantities of laboratory samples, application engineered, full size composite panel core samples.

On – and – off trial use at the facility, equipped with laboratory size machinery and equipment, mixer, extruder, a number of specially designed, one off milling machines, surface coating equipment, the facility produced large numbers of small and full size samples, produced manually in a number of trial productions, in preparation for the establishment of display buildings and for panel designed product composites and shapes, independent testing programs and the establishment and creation of “successful product core formulations”. Records show, laboratory and pilot plant production trial costs have exceeded Euro $ 4.1 million.

The Building Technology Trust advises and Haussmann Limited recognises the need for a second pilot/R&D facility to be established as part of its commitment to ongoing refinement process improvements and new product development with full size building systems being produced to build the proposed 20 display homes.

The commercial plant will be scaled initially from a pilot size plant with a minimum automated footprint, into a full-scale plant, that will eventually be delivering 70,000 affordable modular-style homes per year to customers and local communities. Design of the original housing systems was the responsibility of the Building Technology Trust, which will, in conjunction with its local plant marketing team and the product design team, start selling homes prior to the start of plant production.

Designs and processes developed for each plant will vest in the “client”, (Haussmann owned plant corporate entity) the owner of each Haussmann manufacturing plant will be a publicly listed entity. The Project is expected to commence in late 2020 and involves the design and construction of a pilot plant/R&D facility, production of building systems for 20 display homes and plant blue prints in advance of approvals and building a minimum automated foot print plant, followed by a ramp up period to a commercial full size plant.

While it is pre-mature to assess the completed value of the project, the Building Technology Trust is presently allowing for € 400 million. The plant will initially be constructed to a minimum automated footprint, in order to undertake minimum automated and profitable production after commissioning.

Haussmann Limited is proceeding with finalising its funding facilities, including providing details, when contracted, of planned and preferred contractors for the project.

Haussmann proprietary, application engineered, composite materials formulations have been created by mixing and blending intermingled raw materials and virgin material blends, sourced and processed by separation, milling, blending and raw materials processing.

Formed panels are dried by continuous processes, within minutes of being extruded to produce a core lightweight building module, which is then further surface finished, 3D printed and or engraved and or routed/shaped by robotic process to customer required surface finish design and configurations for walls, floor, divisional, sealing, roof and decorative panel applications.

Once dried, panels can be cut and “shaped” and combined to produce the desired building design and size .The panel is passed through a number of coating processes to produce the end range of products – a lightweight but structurally strong (2.5 times tensile strength of Portland Cement) building material with a decorative polymer coating, 3D printed surfaces and or robotically engraved surfaces are suitable for exterior and interior building purposes .The coating and profiling processes will be combined with a range of treatments to protect against common construction problems like moisture, termites and severe environmental conditions. All processes combined are creating a great range of variations of new building materials.

All Haussmann designed and built homes have an excellent fire rating, and are cyclone and vermin proof, regardless of location. A maximum standard is applied to all housing systems designs, regardless to location requirements and standards.

HML product guarantees warrant that the HM home/building is built and sold as a guaranteed to non-ignition, non-combustion, flame retardant structure, and will not combust or burn (this guarantee does not extend to home content, furniture, additional fixtures and some fittings, etc.).

As a result, the HM living space system will drastically reduce deaths, caused by home fires and accidental home combustions. Present building standards and materials used, as a result of “sandwiching” building materials for an average dwelling, combining a highly flammable range of building products which make every dwelling a potential fire trap for its inhabitants.

Insulation, impact strength and acoustic quality properties of the HM system is maximised within its composite blends, as different applications for walls, floors, sealing, divisional and roof panels, and their composites are different from each other by application, uniquely engineered and maximised in its composite “structure mix” to application.

HML composite materials systems totally eliminate regular vermin home protection treatment requirements of potentially dangerous pest control treatments.

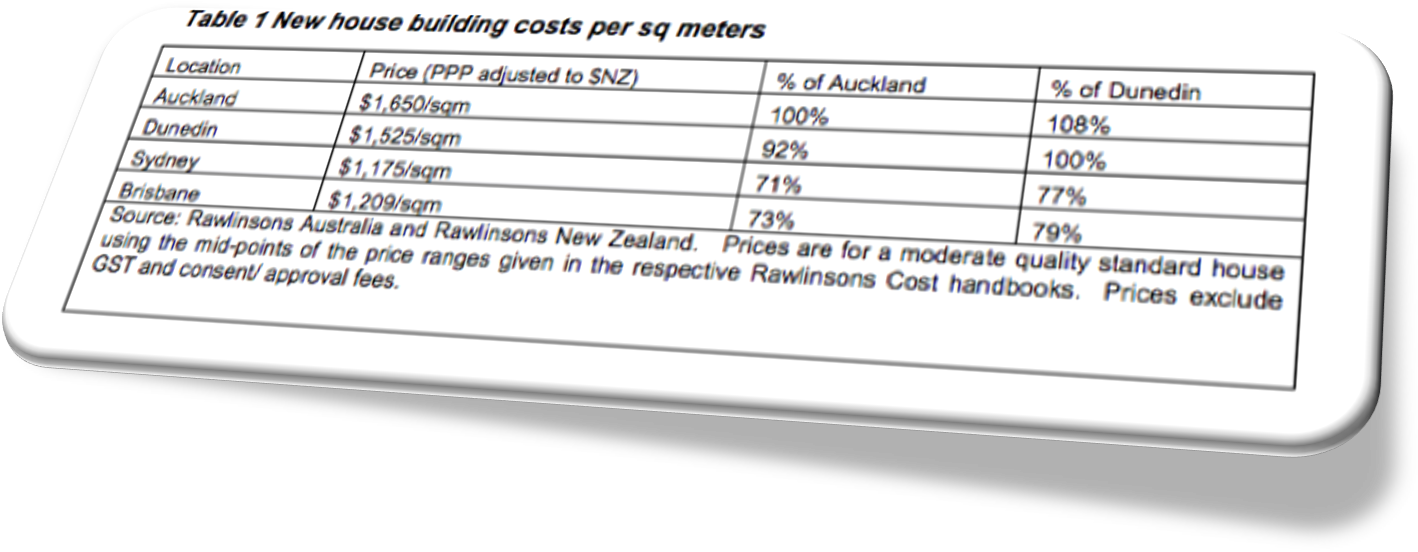

Subject to the regional variations in cost, Haussmann will sell standard m3 panel /housing systems coated and finished to customer designs, for between AUD $700 – $800 m2., including all Distribution and costs of installation for panel systems are budgeted at approximately 85% of the sales price. Total estimated lock up stage dwelling production cost # AUD (225 K) sales price of $ 350 K estimated to be 50% less than any other present single dwelling quoted to lock up total cost and delivering a building completed and ready to move in and considering all extras as outlined.

The company’s novel ways of engineering dry build living spaces designs, innovations and creations, enable the company to produce modern, customer designed housing, by industrial and fully automated and robotic high quality finished, mass production. Composite formulation varieties and some processing and finishing technologies are proprietary and are kept secret. Purposely, no design or plant patents have been lodged, as patents require full disclosure which only plant blueprints can provide. Once Plant blueprints are completed, Haussmann will lodge plant patents. Design Patents will be lodged in early 2021.

All formulation composite mixes for each application will be delivered sealed and blended, fixed by quantity, to exactly produce “x” number of Australian designed products suited to local conditions – M3 housing building systems. Such powder composites are provided as 2 separate blends, as the 2 final blends have to be mixed by special mixing procedures and entered into vacuum processes, to accelerate product mix particle processes, prior to the start of mixing of materials for core panel production.

Haussmann intends to maintain its cutting-edge market position through ongoing research and development in all key aspects including focus on design, product range and materials composition, improvements in delivery of modular building systems, innovation in engineering processes and construction technique. HML will license and will acquire licensing rights to enhance its range of products and advantage enhancements for its range of products. HML plant annual profits have an allocation being a % of net profits, designated for Research and Development.

List of cash, goods and service providers

In acknowledgment of contributors to R&D, including BTT 1642 cash and value contributors, Stakeholders, participants, and supporters, BTT acknowledges that without such diverse contributions, BTT could have not achieved its new materials technologies and formulation results and plant design and programs completion. (See attached List of contributors, showing their summarized total $ benefit entitlements and Stakeholders Cash value contributions which are well in excess of AUD $ 25 million.

The major Stakeholder a Family Trust contributions provided services and cash contributions in excess of $ value over a 20-year period,1.) entity S. Pty. Ltd # $ 19.3 million (value certificate – Tax Losses), 2.) F.F. Trust – M. Pty. Ltd. # $ 12.9 million Losses. F and M Pty. Ltd) 3. F B Services accumulated losses: # $ 712K

Haussmann Limited is an Australian unlisted public Company, with the objective of establishing technologically advanced manufacturing plants and the marketing of such range of plants and products under its own trademark. Initial Business revenues are derived from the establishment and sales of equity in each of its plants and marketing licenses as well as from its equity interests in each plant, building systems sales and product marketing and distribution business.

The business platform was secured by acquiring exclusive global rights from BTT to establish plants and to market products. The exclusive global rights acquired by Haussmann Limited are based upon proven and commercially viable technologies, developed by the consortium of the BTT. This system addresses the global problems of waste disposal, affordable and emergency housing. This propriety technology offers Haussmann commercial advantages over competitors.

Haussmann corporate governance

Haussmann directors are committed to corporate governance, which is primarily about the relationship between its shareholders, who are the sole owners of the company, and the company’s managers and directors. Haussmann directors clearly understand, whose interests they are serving, the affect they have on wealth creation and risk taking, and the forms of accountability they embody, which are vital to the functioning of the company. The company has appointed independent consultants to assist directors to improve and maintain high standards of governance of the company.

Scale of Building Materials Production

The optimum scale of building material production (the generic plant) was determined on the basis of the volume of incoming residual materials, resulting in definition of the most cost-effective minimum size and dimensioning of the processing plant. The cost-effectiveness of small units decreases proportionately, and as such they are more difficult to finance.

Transfer of Technology (POC – Plant owner company)

The Building Technology Trust was established by its consortium, with the intention of creating a new building materials manufacturing process and plant which can produce a new range of revolutionary products and systems, that can deliver affordable and modern housing, in half the time and at half the cost, without the involvement of trades and professional builders.

Some of these profits will be shared with the main contractor, who are effectively the bankers to the project during the construction and early production testing and commissioning phase. Haussmann will aim at all times to retain plant ownership by debt (minimum 70%) being the preferred position. (Convertible Bond issues)

Plant operations cost structures, primary processing, secondary processing, tertiary processing, based on established plant financial planning model accounting calculations, closely follow international accounting conventions which have been examined by a major accounting firm. (independent Auditors appointments – financial and technical Auditors).

Haussmann production major raw materials sources by volume

In industrialised areas and urban conurbations, (conurbation is a region comprising a number of cities, large towns, and other urban areas that, through population growth and physical expansion, have merged), there are large volumes of potentially reusable waste materials which are not reused and end up in landfill. Only some of the total amount of reusable material is actually recycled (less than 95%). Haussmann technology has unlocked intermingled raw materials, called mixed solid waste, to be used as “raw materials” for its processes.

In order to be able to process 80 % of the available residual materials, intermingled raw materials, in a single range of product, as described in this project, a highly developed and coordinated technology and process is required. In order to meet the needs in a targeted way, additional materials need to be defined, procured, and incorporated into the products in line with usability, availability, and cost criteria. (Range of virgin materials and additives).

Haussmann building system addresses the dual problem of waste disposal and affordable housing with the development of a production system that uses waste as a raw material and produces modular, application engineered building panel systems ideally designed and priced to meet the demand of low cost housing systems. This innovative building process will not only help the construction industry to reduce its costs by to 50 % but will also pass on this financial benefit and advantage to each and every home purchaser customer of Haussmann. The Haussmann environmentally sustainable process to produce application, precision engineered composite materials for building/housing systems has created a new generation of building materials and products.

There are also a number of ancillary materials and resources necessary for delivery, production, and distribution of the finished product. This group of goods and materials is subject to local conditions and availability and is also a substantial factor in determining the scope of the product and process (Plant waste acceptance fees charged etc.).

Pilot Plant Productions

Successful pilot plant production was conducted in Germany, from which demonstration buildings (e.g. schools, medical clinic, homes) have been constructed in South Africa. In relation to this technology, DBE office in Mainz, Germany, have been involved in supervising the production of panels at the test pilot operation undertaken in Germany. Such tests also involved personnel from EK Stuttgart. These tests successfully produced building panels which were used as test case, in the construction of various dwellings and structures.

Plant locations identification such as Bremerton (SDA), Queensland Australia – sites for the plants are located and secured by preference of transport options, and must be located close to or at large rail infrastructure, but preferably, near wharf/port locations, or close to Highway transport ports, connecting to large national and international road networks.

Plant Production – supply of goods and services to a Haussmann manufacturing plant is achieved by either mergers, acquisitions or strategic partnerships or procurement total Haussmann Plant entity ownership. (Haussmann Local Product and Goods Manufacturers and Suppliers of Services Policy).

Our manufacturing plant mass production is designed by preference for maximum job creation. In the modern-day world of mass production, virtually any process step can be automated – that is, executed precisely and at a constant speed by machinery and robots – in such a way, that personnel is required merely to monitor and maintain the production resources. However, when designing and planning such facilities the public, political concerns with regard to job creation need to be considered. Haussmann plants have been specifically designed to make available many multi discipline jobs.

Plant supply contracts, secured for goods and services, are at fixed prices for the term of up to 25 years (CPI adjustments). Job creations by in-house supply contract creations will ensure that overall employment by Haussmann has priority to automation.

Plant establishment contracts awarded by expression of interest, managed by the Haussmann appointed Project Management Group to a main contractor, machinery and equipment and services must be placed “locally”, in the first instance, if possible, to facilitate the technology transfer embodied in the Haussmann system to any of the 5 Australian Haussmann plants in question.

Main Contractor and coordinating independent engineering group – Project Manager is appointed, including plant civil engineering and construction infrastructure establishment contracts to be placed at each plant location with a “local” contractor, if possible.

Plant capital construction – establishment cost estimate is AUD $750 million, (12- 14 panel processing lines). Additional capital will be sought within 18 months after operation commences in order to expand the first plant beyond the first lines (minimum automated footprint to full production plant).

Subsequent plants are expected to be funded by internally generated cash flows and debt. Project finance approach on Haussmann plants will result initially in a higher level of debt, although debt coverage ratio is expected to be in excess of 5 to 8 times. (Estimated Return on investment – x 8.24 see Cost and Benefit Study.)

Haussmann will arrange all turnkey agreements with a main contractor/engineering group through a design, build and finance package. The Project manager and main contractor appoints the civil and construction engineering contractor and is in charge and is responsible to Haussmann for rebuilding and completing the plant’s processes with guaranteed reproduction of input, quality of product and output of product.

Haussmann warrants payments to all vendors and contractors during the establishment period of a plant, (contracted to design, build, and operate, testing, commissioning and ramp up), up to 6 months, after commissioning.

Plant take-out contracts, end take out finance, in part, is proposed to be by contracted convertible and possibly green and impact bonds, to be placed in the global market place, by a Haussmann appointed corporate adviser, together with an underwriting commitment from a reputable financial institution, and will include specific reinsurance programs, underpinned by grant allocation arrangements arranged by Haussmann.

The POC and relevant government entities, prior to execution of a plant establishment contract with the Head Contractor, will have in placed a Haussmann contracted take out position to ensure uninterrupted funding for each plant establishment project, if so decided by HML.

The grant conversion to equity in favour of Haussmann, forms part of Haussmann’s equity in each and every plant and forms part of the company’s earning stream. End take out finance is activated, which will be optional, and can be exercised in part, depending on circumstances applicable at the time.

Plant establishment Licenses and Site specific and operational approvals

All plant related local approvals, licenses, permits including EIS compliance are to be in place and made effective during the blueprint stages. In order to position Haussmann as a true global “local” entity, it will list on the NSX / ASX, Berlin and New York Stock Exchange, from early 2021 to mid 2022.

Our manufacturing facilities and business is being established within the lucrative global market sectors of construction (housing, building materials) and waste processing, both of which are experiencing significant and sustained growth. The global construction market by 2020 will have a total market capitalisation of USD $10.3 Trillion, according to McGraw-Hill. Global waste industry revenues exceed $500 billion per annum. Haussmann can capture a main share of this market globally, depending on funding and number of plant establishments in Australia and globally. Haussmann plant annual T.O.(when in full production) = 70,000 homes (minus 2,000 homes donation).

Projected annual minimum net per plant, per annum, before tax is estimated to be 12- 15 % plus of T.O. Our conservative profit declaration is Euro $350 million per annum, which is minimum, pre-tax, plant profit per annum, when in full production.

Emergency Housing Production

Plant Production input and output information. A fully operational plant is expected to have an optimal processing capacity of between 200,000 tonnes and 750,000 of waste per annum, corresponding to an output of between 5.7 million to 21.4 million square metres of panel per annum. A medium size plant with an average processing capacity of 750,000 tonnes (mixed solid waste) is able to provide panel systems for 100,000 emergency houses per annum and will employ 1200 people directly and an estimated further 2500 indirectly within in the plant’s catchment area/region.

Plant operations revenue – Waste acceptance fees 8%, -Plant Production profits average 12 -15 %, -total plant operations profits 20%, Haussmann will build tremendous brand value through its Intangible Assets that on current valuation are valued at AUD $400 million. We believe underestimating profit projections per plant per annum will provide pleasant surprises when profits may substantially exceed very conservative projections.

Benefits of industrialisation and dry building processes of buildings

The benefits in industrialisation in building are the elimination of skilled labour onsite, a substantially faster erection on site process, a superior quality of product and will provide substantial Co2 emission reductions.

Industrial automation is a natural and essential extension of the industrialisation process and provides and makes feasible provisions of individual solutions to each customer. The company intends to implement an integrated business platform, with a diversified earnings base drawn from operations in Australia, North America, Europe and Asia. The Haussmann Manufacturing System employs a technology that is both novel and innovative.

New Materials and Materials Technologies are the Key to industrialisation of Production for Buildings (Product Comparison).

Total changes and radical improvements of productivity, quality and price in building construction can only be attained through new materials and intensive industrialisation and full automation of the total building/housing process. Building materials are generally viewed as a high-weight, low-value product. Haussmann panels are a low weight, high volume, and therefore low-price building material. Haussmann and the BTT will continue to maintain its cutting-edge market position by spending fixed allocations of funds on research and development. It will continue to identify new technologies that add synergy to the existing business and help add shareholder value. There are currently no other building comparable products on the market in terms of cost, quality and quantity.

Our focus on implementing new materials and technology processes will instigate deep social changes. The most important task of the technology progress undertaken by Haussmann in building, is therefore to increase the extend of industrialisation, with a view of total automation, wherever feasible (Cubic meter (M3) building systems by Haussmann).

Using economics of scale, our mass production, capital investment into manufacturing facilities, management and auxiliary services are to be located in central locations, which will make shipping and or other means of transport to various consumer areas most cost effective.

Competition for Haussmann Housing Systems is simply non-existent. Currently, there are no competitive equivalents, in terms of affordability, volume generation and quality on the market.

While there may be, by self appointment, several competitors, but when comparing with the Haussmann high quality products, there is no real competition. The Haussmann Manufacturing System provides application engineered products which are fully integrated and flexible products that outperform all other building materials and panel systems currently on the market, taking present “wet building” boutique processes to new Haussmann dry build assembly methods.

No other products can be delivered in a similar or same manner as our Products.

Our application engineered panels are far ahead of competitor panels and traditional construction methods and materials. The revolutionary nature of the Haussmann Panels means that traditional building materials will potentially be seen as obsolete. Haussmann “construction contract”- on site dwelling establishment/build any average size home to lock up stage within weeks, ready for the customer to move in (agreed date of completed building handover to customer).

Centralised Industrial Volume Production

Our high-volume production and work teams are centralised into a sophisticated industrial organisation, capable of high quality of planning, coordination and control functions with respect to production and distributions of its range of products.

To ensure optimal organisational results of production, an extremely high degree of coordination exists between design production and marketing of our range of products. Our integrated systems ensure in a most effective way, that all functions are performed under a unified central management authority and this applies to the establishment of any Haussmann plant and the operations of any Haussmann plant globally.

Our industrial, automated, robotic features in both design and the production of products, makes the overall proficiency of workers in the execution of individual tasks less important (trained labour). Haussmann’s sophisticated production tools and in part, robotic production controls, shifts the emphasis from worker specialisation in individual activities to their understanding of the total process and its underlying technologies, this applies to controlled factory areas of production and housing systems installations on site (executed techniques and procedures).

Our housing systems technologies and designs provide clients with a choice of 3 standard sizes, small, medium, or large M3 (cubic meter) sections, which can be arranged, inter-connected and interchanged as per the client’s design. All components are modular so almost any size arrangement of M3 panels / housing systems and spaces, doors and windows and service pods are possible. All individual housing designs, as per the customer’s order, instructions, finishes, and configurations are designed by each and every Haussmann customer.

Haussmann has mastered the challenge of industrialisation in providing mass produced dry build buildings, both from architectural, technological and industrial mass production (21 million M3 panel production, per plant p.a.) quality points, and how to standardise its new building components and ensure maximum design freedom with respect to the final building product (A Haussmann home). Present methods of building, carried out by builders, are basic and simple, archaic and clunky methods of building, compared to Haussmann buildings, which are precision engineered, engineered in and under controlled conditions, factory finished and exceptional quality.

New production techniques employing computer-aided, digital design and manufacturing permits considerable diversification of output without affecting construction feasibility. The system is dispersed with most construction activities completed on-site. Infrastructure, part foundations, erection and finishing components are carried out off-site at Haussmann’s centralised manufacturing plant facilities, providing substantial product core and high-quality finishing benefits achieved by better machinery and production equipment and overall organisation.

Conventional building site work environment and physical hardship of construction work under rugged conditions have been eliminated by the Haussmann building systems. All parts of construction work are performed in a Haussmann plant, which is a hospitable industrial and effective workplace (Dry dwelling, building methods).

The benefits and merits of Haussmann automated housing systems realisation, which employs automation in the production of building elements in the manufacturing and prefabrication plant require minimal time for on-site erection works.

Industrialisation, mechanisation and automation of the building industry will save manual labour and eliminate strenuous, dirty and dangerous work, resulting in flexibility and improvement of quality overall. Haussmann uses computer software for analysis of the performance of its various buildings systems and composites of the elements, structural, mechanical, and environmental, checking that they conform to accepted codes and standards. Independent tests of composite materials mix variations have been carried out by independent testing institutions in Europe.

Conventional construction methods versus the Haussmann industrial mass production – Systems and Superior Range of housing Products.

A conventional construction process involves 20 to 30 different skilled trades. This complexity is caused by the multitude of functions. A typical building must provide shelter, adaptable thermal and acoustic conditions, movement between different areas and levels, water and power supplies, disposal of wastes, illumination, communications with the outside world and specific functions, within particular spaces such as cooking, recreation, storage, sports activities and other various processes.

Those proliferations of functions and large number of works coordinated and adapted to each other have been eliminated by the Haussmann manufacturing process, by combining comprehensive assembly adapted to their comprehensive multipurpose functions. Haussmann’s far-reaching solutions under the principal of producing all parts for the assembly of a whole building, and its sizable parts, with all its necessary finishes and works completed in a Haussmann plant, makes the transportation and erection process a simple and time effective undertaking (Haussmann home finished to lock up stage within weeks).

Our building systems products are guaranteed for 50 years, but the actual service life may be much longer. Building life cycle implications in regard to several aspects of building performance is quality, which is of paramount importance and which is insured by design and control during in-plant production.

Our flexible building cube M3 structures are designed to be adapted to the dynamics of family growth, change of lifestyle and living standards; without modification of components, or changing of user requirements or special maintenance needs or making living spaces smaller.

The distinctive nature of every building project, for its procurement process and individual inputs, presently act independently from each other e.g. sponsor, designer, contractor etc. and this divided authority reduces overall efficiency. Haussmann integrated systems have done away with this distinctive nature of “one off”, wet build boutique building. Every building project and in a most effective manner, superbly enhancing user needs and creating new market conditions, and as such, providing superb entrepreneurial attractive alternatives to create an unlimited market for its products globally.

Trade increases will be stimulated by stricter environmental and land use regulations, continuing improvements in mining, processing and material handling technologies (making production and shipping operations more efficient), while further expansion of coastal and offshore sources of supply,(lower water based transportation costs, allowing product to be shipped greater distances) and the response to development of spot shortages will lead to high-growth markets.

The building systems can be defined as a set of interrelated elements that act together to enable the designated performance of a building. It also includes various procedures and technologies, processes and designs and new materials technologies and composites, for the production and assembly of these elements for this purpose.

Our housing designs, products, and erection on-site, are strongly interrelated and are parts of integrated process, which reduces human involvement, improves quality of design, production, and on-site installations.

Benefits of industrialised Haussmann building systems include saving of on-site labour, elimination of skilled labour, a substantially faster construction process and earlier completion and substantially higher quality of components due to better production “tools” and quality control.

Our benefits are realised and provide large economic gains to our clients, due to substantially lower costs of new materials (use and processing of intermingled raw materials – mixed solid waste). Every Haussmann home, when established, for and on behalf of its customer, on occupation, will increase in value by 50%, to match existing housing market values as applied and dictated by market forces.

The automated design and production procedures allow for the use of custom-made components for each individual project without additional costs, and at the same time providing an abundance and variety of shapes and finishes.

We developed a building system, consisting of unique connections and joining methods and panel systems sizes and designs.

Our building system has done away with one of the greatest impediments to constructing a building: the professional builder and his or her crew, the architect, the quantity surveyor, complex DA and BA approval methods.

Industrial construction methods are compliant and will perform to physical performance, stability, strength, thermal and acoustic requirements, maintainability and insulation, aesthetics, functionality, versatility, and flexibility. This all is made possible by Haussmann new materials, production methods, connecting, jointing, click together finishing techniques.