FAQ

By supporting companies like Haussmann, you are making a meaningful, sustainable, ethical, social, environmental, profitable, and industrial difference.

Each Haussmann Plant will create employment for up to 2500 people and will provide “a ripple effect” of up to 25,000 in indirect employment.

The “short on-site dry build” – click together process – of a Haussmann Home, with low or near no (zero) emissions created, (unlike conventional homes, which are wet built over many months), each Haussmann Home will leave a substantially lower environmental footprint.

Our composite materials core mixes are derived from *intermingled raw material and virgin materials. * Intermingled raw materials disposed by industry and commerce in the form of intermingled mixed solid waste which can be timber, glass, plastics, paper, cardboard, rubber, textiles, all demolished materials, are transformed by industrial processes to new composite, application, precision engineered building materials/building systems.

The “creators” and designers of the Haussmann industrial systems have created precision engineered, mass produced living spaces, manufactured by the latest industrial manufacturing methods, in large, fully emission-controlled manufacturing plant facilities.

Annual new residential dwelling numbers currently being achieved do not exceed 240,000 dwellings per annum. To unlock the affordable housing demand, Haussmann is making dreams reality for new home owners, who, under current circumstances (terms and conditions) are unable to afford to purchase a new home, Haussmann is unlocking a new markets and supplying for such demand as no other provider of new residential dwellings can provide.

Our production systems have been developed very much like Henry Ford’s mass production of precision engineered motor cars. Haussmann’s “tailored” customer designed, precision engineered panel systems, when interlocked, dry build on site, will provide the new homeowner with a state-of-the-art home, second to none. Haussmann is making it possible for new homeowners to purchase an affordable, high quality, sustainable, superbly finished mass-produced house at the “right price” and quality.

To meet market demand, Haussmann intends to build a minimum of two Plants in Australia dedicated to producing up to 70,000 homes (affordable housing) per annum per plant. Australia’s immediate, (“yesterdays”) affordable housing demand is a minimum of 1.2 million homes.

This means it will take 2 Haussmann plants up to 10 years to satisfy this now specific demand. Home shortages based on independent studies show that actual affordable home shortage numbers have now reached critical demand and are in excess of 9 million homes which were required “yesterday”.

Haussmann is the owner of an exclusive global technology license, issued by the building technology trust, formerly known as the 5stargreen Building Technology Trust. Extensive Research and development has been committed over many years and by many individual stakeholders to create the unique Intellectual Property of the Haussmann building systems.

The Building Technology Trust (BTT) has achieved, after many years of frustrating R&D efforts, together with European engineering and special material development groups and suppliers of machinery and equipment, the development and perfection of new building materials systems, to be mass produced by industrial production methods.

BTT created new building material composites which replace existing materials, with advantages which allows industrial mass production to make it possible to provide new building systems, which offer advantages over competitors and traditional wet building methods.

We are currently negotiating with various parties and stakeholders to assist us to roll out our first commercial scale applications of the Haussmann Building Systems in the World. It is important that we get these early stages right. Our planning suggests initial start of production might be possible by 2022 – 2023.

The Website Link: Vision: R&D provides a virtual “slide show” showing all different plant production sections, from acceptance of mixed solid waste, – intermingled raw materials to finished product dispatch.

Haussmann’s website link, “Project”, shows a one-page picture of typical Haussmann plant infrastructure establishment, with plant information combined in a screenshot picture with easy to understand text outlined. This shows plant infrastructure, including a gas fired/Hydrogen plant, incoming and outgoing rail systems and shunting lines, 2 container hardstands for incoming and outgoing container storage, Building 1, ( 800 x 450 meters) producing Haussmann M3 building systems, Building 2, (600 x 450 meters) satellite supply plant producing doors and windows, kitchens and in-builds, Thermo Synthetic solid surface materials production, bathroom section-fabrications assembly and storage, heavy engineering and container fabrication and internal road systems between buildings and container terminals and loading and dispatch areas. Our total Plant infrastructure area is typically 100 Acres minimum.

Fund Raising Programmes:

NSX Listing / IPO (and to be followed by reverse merger on to the ASX) HML will raise $5 million — the issue of Shares pursuant to (proposed Listing and IPO Prospectus).

Fund raising Limited: AUD $ 5 million

Sooner, rather than later, Haussmann Limited and proposed “HML Plant Corporate Vehicle,” need to become public companies. Haussmann Limited is an Australian unlisted public company and has not traded to date. Once our Website is public, we intend to appoint a lead financial Manager – Stockbroker / Stockbroking firm, to take us via an IPO, raising further AUD $ 5 million, on to the NSX and this move is to be followed by a reverse merger on to the ASX. Timing for these undertakings, including start of agreements, negotiations and completions for listings and IPOs with the nominated Stockbroker and Underwriter should have commenced at the latest in early ’2021.

Global Equity Crowd Funding. (Australian and Global Platforms) (small investors.) Initial AUD 5 million Australian Equity Crowd Funding program, total global Equity Crowd Funding Programs:

AUD $ 75 million

To successfully achieve projected funding amounts, we intend to engage global and Australian Equity Crowd Funding Platforms, which are licensed to seek investment from small investors. In previous talks with an Australian Platform it was outlined, that they have affiliated global Equity Crowd Funding platforms, making it possible to raise funds not only in Australia, but also at the same time raise funds globally. Annual funding via such platform in Australia is limited to AUD $5million. We are also considering raising funds in staged programmes, starting with small amounts of $2million or $3 million dollars, seeking up to AUD $75 million.

Equity Crowd Funding will provide us with many small shareholders and also will keep large equity interests out of the HML balance sheet and directed to Plant funding opportunities and Bond issues. Our starting point is determined by our Website being “live,” as our website will provide fully transparent information flow, including our initial draft index of our prospectus, available to all investors. Haussmann will seek ASIC approvals, meeting compliance for issued draft Prospectus via appointed Stockbroker. Prior to listing, the proposed website will have extensive information provisions to enable any prospective investors to search for answers about our project, prior to investing into HML. We expect first funds to be received from those programmes by latest end of 2020.

Convertible Bond Issues. (HML Global Bond issues to fund each Plant

AUD $ 400 million

It is our aim to fund all Plant infrastructure expenditure via convertible Bonds. We intend to restrict large parcels of investment and create smaller parcels and broad-based sophisticated investment opportunities, which, from a strategic point will be most beneficial to HML and the Haussmann balance sheet. Debt funding will provide and form a future equity position for HML and HML shareholders, rather than Bond Holders in each and every Plant. We expect that up to 33 1/3% of Bond Holders will convert to Plant equity holdings. HML can demonstrate that each Plant when in production will have the capacity to pay back debt within less than 4 years. (Estimate Project Debt: AUD $750- 850 million.) We intend to prepare for our Bond issues to be offered globally at the latest by mid of 2021. Bond issue dollar amounts can be influenced and reduced by possible large investor offers, (presently being explored and negotiated), we would discount all such large investor proposals, as HML seeks to reduce larger funding proposals to fit in with our Bond issue programmes.

First Mortgage/Vendor Finance Bonds. (HML Global Bond issues to fund its first mortgage lending programmes.)

AUD $ 250 million plus (ongoing Bond issues to cover up to 70 000 Haussmann Vendor first mortgage finance offers of AUD $ 250 000,00 Each.. (Please note, Australian Banks do hold mortgage loans in excess of AUD $ 17 trillion dollars).

First Mortgage Bonds will be issued by Haussmann as vendor first mortgage finance to each home purchaser purchasing a Haussmann home, which also may include House and Land Package mortgage finance. Once the Bromelton Plant infrastructure is approved, it will bring on the preparations and marketing undertakings of pre-production home sales based on model homes having been produced at our one-off Pilot plant built at Coffs Harbour. We are confident that we will be able to accumulate, during the time of the establishment of Haussmann’s Bromelton Plant and prior to production, large forward sales of Residential Dwellings. We expect first mortgage Bonds to be issued for many years of Plant Vendor finance operations to provide Vendor Finance to all prospective clients of Haussmann purchasing a Haussmann Home and/or approved land. Such loan facilities will be available to all Haussmann Home purchasers only, condition to proof of serviceability of such loan facility. Haussmann does not offer mortgage loans to the public. (Loan repayment starts on receipt of Home on site by the purchaser under a take and pay agreement – being part of first mortgage agreement).

Australian Procurement Group – appointed.

A more detailed outline will be part of Haussmann’s business procurement undertakings, (see website link – Procurement), listing all nominated preferred suppliers of goods and services, by specific supply and industry category etc., and all such contractors nominated and/or appointed and/or contracted specifically for a nominated plant location.

All contracts are, in the first instance, identified by preferred calls for expressions of interest by Haussmann from organisations and businesses able and capable to undertake (by special contractual arrangements) provision of goods and services to establish, install all infrastructure, machinery and equipment at each and every Haussmann plant, Waste Management Transfer Station infrastructure, Building 1 and Building 2, Container Hardstands (2) internal Rail infrastructure, Power Plant, Solar Farm, Gas Pipeline, internal Road Systems, (Waste Management Transfer Station located at nominated Brisbane outer Suburb industrial area).

Each Haussmann Plant will have its own marketing, home design services and approvals division, which will manage home sales, each customer’s home approvals, and, if applicable, financial loan facility and home establishment at a nominated location. Haussmann’s Builder’s License and other license arrangements in NZ and NG and the Pacific Islands will permit HML to build residential dwellings for any Home Purchaser.

In the pre-plant establishment period, (after Haussmann receives its first plant establishment approvals, and to achieve pre-plant establishment forward home sales contracts), Haussmann Limited Regional Head office will establish a home marketing organisation, design and approvals division. The Haussmann Limited, Housing Assembly Project Management organisation will seek expressions of interest from individuals to be trained to install Haussmann Homes, talented individuals, “locals” (State by State) in Australia, New Zealand and New Guinea and the Pacific Islands, to form teams capable of being trained to build Haussmann homes, (the M3 building “click together” building systems) on site. Each team will be instructed by Haussmann’s appointed Team Leader and will be trained and supervised on site by HML, a licensed Builder. Haussmann does hold a Builder’s License to build Homes in Australia and will hold such licenses in New Zealand, New Guinea and the Pacific Islands.

Most Businesses are created for what ever reason, but mostly to make profits for its owners and shareholders and very little or no consideration is given to social impact or giving back to employees or the community, as clearly any business provides goods or services to the community within its market catchment area.

Starting a new industry, we not only change the game of providing affordable and sustainable living spaces, homes, we do much more.

As a 21st Century Industry, we not only have obligations to our employees, shareholders and owners, we also have a social and environmental obligation to the community.

The Haussmann Manifesto is the ethical, socially responsible “building stone” and foundation” of our organisation. Haussmann is sharing its profits with its employees and the community in an advanced way, bringing social balance to all concerned, avoiding social injustice and possible future revolutions, caused by the imbalance of equity.

The great social imbalance of affordable shelter and quality homes, is causing worldwide social tensions which are ever increasing, and it is sad to say, that no government and/or private organisation has ever tackled such imbalance in an industrial, sustainable and affordable way.

Haussmann specific products to be produced offer affordable, state-of-the-art housing for local markets and emergency housing, (an export product), which will provide a novel solution of supply for many lucky recipients.

Global emergency housing demand is in the 10’s, possible hundred of millions.

Haussmann commits to donate to its communities /early investors, within the Plants’ catchment areas, 2,000 homes per annum, per plant for 20 years. 1 000 of the donated homes can only be leased out for maximum $ 50 per week (rental). This will provide shelter for the homeless and families now living on the street and/or in cars and other substandard shelters. (In 2020 – 120,000 Australians were homeless and sleep on the street.)

Haussmann, at all its plants, when in full production, including all Haussmann Offices, is offering a 4 day working week, double superannuation payments for each employee, free private health insurance which will includes full hospital care, plus education/ University education scholarships funding for gifted children, which is a further commitment to creating a fairer society and a most dedicated workforce.

Haussmann will provide affordable housing fully funded (first mortgage for each purchaser, on condition of ability to service such a loan facility) on a $2 dollar deposit. Haussmann Homes are 50% reduced in price, plus Haussmann’s near no deposit in house finance will open the “flood gates” of demand for housing and housing orders. This unique offer is now available to millions of people in Australia, New Zealand, New Guinea and inhabitants of the Pacific Islands.

Haussmann will be a great job creator, providing well paid and meaningful permanent employment for over 2500 people per plant. Haussmann intends to build, over a 8 – 10-year program, up to 5 manufacturing plants in Australia.

Haussmann has created a fully sustainable product, with a raw material input of up to 80 % of mixed solid waste, which we call intermingled raw materials, making our project a brilliant project, taking care of societies’ housing demand, providing large employment, affordable housing, respecting the environment and our natural resources, and providing all concerned with a better solution – which makes all concerned – winners !

We are proudly planning and implementing and creating a better and fairer society by implementation of our company’s policies and commercialising our project. Each Haussmann Plant, when in full production, will provide annual donations to the Plant’s catchment areas communities of AUD $ 750 million for a term of up to 22 years.

The best way to provide such information is to provide information independently undertaken and established, based on Haussmann’s financial information provided.

Note: These figures are tentative and based on expected profit forecasts based on expected demand and sales.

Haussmann’s manufacturing model is receiving up to 80% of its raw material supply at no cost. In addition, for accepting such raw materials, Haussmann receives up to AUD $400 per tonne. This provides an acceptance fee total, which, when in full production, of 750,000 tonnes per annum, multiplied by $400 per tonne (accepted and processed) equals $300 million annually net (before tax).

A Haussmann plant, when in full production, is expected to produce up to 70,000 homes per annum, (240 m2 homes) at an average price of AUD $250,000.00

Deducting Plant operational summary costs, (wages and associated costs, materials, power, water, maintenance, marketing and office costs), including working capital costs, Plant establishment loan interest and donations of 2,000 homes (1 000 to the public and 1 000 to early investors, per annum for the term of 22 years.

Tentative projected net profits per plant production and sales, expected to start from month 39 – 51, when in full production:- the Website Link Investment outlines in part, quoting specifics re: projected annual gross profits per plant (pre tax rate of 15%) Projected Net Profit per Plant per annum when in full production: $ 1.95 Billion minus value of donations of 2,000 Homes. 80% dividend payment policy – # paid out annually to shareholders. Please note such net profit quoted during first year and up to 3rd. year of production will be 1/7th of quoted net profit when in full production. Major Loan/Bond repayments, interest only for the first 4 years of production, followed by principal payment reduction of debt will commence during year 4 and year 8 of production.

As outlined above, Haussmann plants will produce 2 types of products for:

A) the local market, which is affordable, state of the art housing – residential dwellings.

B.) an export range of products, emergency housing, being leased to major global aid agencies. (net profits are based on 5-7 % of leasing amount contracted).

Proposed establishment of:

- 2 affordable housing systems manufacturing plants and 3 export emergency housing manufacturing plants in Australia.

- One affordable housing systems manufacturing plant in Sassnitz Germany and one plant in Selma Alabama, in the United States of America.

- Further Plants may be established by plant license transfer to approved partners.

- Demand for affordable housing globally is significant. Globally displaced populations exceed 92 million people. (Emergency Housing)

- Australian and Regional Residential housing shortage numbers are in the millions. (Affordable and new Housing – Residential Dwellings).

Yes, anybody can potentially buy a Haussmann Home anywhere in the world. For any Purchaser residing outside a Plant’s catchment area, additional transport, installation and building approval costs apply.

For every Equity Crowd Funding investment of minimum $10,000.00 or maximum $ 20,000.00 per person/investor, either via IPO and/or global equity crowd funding platforms, the investor will receive a priority/option allocation from the first plant output of the first 10,000 homes produced.

Such priority/option allocation will be effective and such priority order can be exercised by the investor at month 36, from start of establishment of the first Haussmann plant at Bromelton, Qld.

The investor will not only receive the priority/option order benefit, he or she also will receive another deduction on the already discounted home price of a further $10,000.00 as compensation for their $10,000.00 or $ 20,000.00 investment. Maximum bonus deduction of $ 10,000.00 applies.

A 36-month delay on a new Haussmann Home delivery applies from the time of investment. At the time the home is delivered to the investor(s) and built on site, (the nominated home purchaser’s site), HML’s 24-month escrowed shares based on the Plant’s production and annual profit projections, should have increased substantially in value. In addition any early investor will receive an annual entry ticket for a HML Home lottery, providing 1000 lucky winners with 1 000 homes per annum for the term of up to 22 years.

We believe, based on our projections for market orders and net profits, an investment in Haussmann is capable of significant growth.

Conditions of projected growth and T.O., may allow the investor, between month 24 and 36 months to either cash in his or her HML share holdings and this may enable the investor or investors to make payment in full for the purchase of their first home from proceeds derived from the sale of his or her ongoing dividends from the investment in first HML industrial production of residential dwellings.

Haussmann intends, on an ongoing basis, to issue bonds to fund its plant expansions and first mortgage funding programs, which will also be the funding source for its $2 deposit first mortgage (vendor finance, secured over each home funded and made available to each home purchaser). First Mortgage Bonds are secured over the Property as a mitigated risk investment.

Each Haussmann home loan facility is fully insured against default by the vendor. On default, the Vendor will have a time frame of up to 12 months to achieve agreed loan repayment minimum, in the interim until such time, the insurer will make payments for agreed minimum monthly payments for the term of 12 months.

Haussmann will not put any home buyer or family, funded by Haussmann’s first mortgage, in a position of being “unloaded” by the mortgagor on to the street! Haussmann is a responsible, moral and ethical enterprise.

Each Haussmann plant infrastructure project has a combined establishment and operational establishment value of up to AUD $850 million.

To achieve successful bond issue take up/acceptance by global investors, the corporate entity, Haussmann Limited, (the plant owner), needs to be a fully transparent and audited public company/ organisation, and, as such, Haussmann as a publicly listed entity on the NSX provides such corporate entity characteristics, as demanded by global corporate investors, institutional lenders and Governments.

Ease of, and achievable fund raising and liquidity in Haussmann shares is most important to all investors, which will also allow ease of investment exit.

Each Haussmann plant, when established and put into production, will potentially provide permanent employment for up to 2500 people and indirect employment of up to 25,000 jobs and 1200 – 1400 jobs during an 18-month construction period.

Each plant will provide affordable quality homes to Australians and people within a plant’s catchment areas who are now unable to purchase such a quality and size of home. Such inability has created a huge social problem and is the cause of a huge social imbalance being created in Australia and other countries. Governments have indicated their desire to undertake major steps to resolve this significant social problem.

Haussmann Limited, over the last 12 months, has been in meetings with Government representatives and has been asked to lodge submission for funding with Qld State Development.

Haussmann is in talks with the first plant nominated project management company, ready to be commissioned to prepare a site specific Master Plan for the HML Bromelton plant, overall planning and site investigations, assisting grant applications and completion of an initial master plan to assist with Haussmann’s State and Federal Governments Grant submission, which will be prepared and lodged by a nominated major accounting firm for and behalf of Haussmann Limited.

Haussmann’s local goods and services content policy dictates the use of local content for the HML Haussmann has nominated a Brisbane based Procurement Group. Plant establishment and preparations of planning approvals is being contracted with a Brisbane based project management group. Haussmann will appoint by expressions of interest a “local” (Australian) civil engineering and construction group, and the same will apply to all plant engineering and other main contracting arrangements, including a Brisbane based coordinating engineering group.

General and custom designed processing machinery and equipment will be sourced in Europe and North America. Heavy plant engineering, including fabrication of Haussmann containers will be allocated and fabricated by expressions of interest to local companies, possibly through strategic partnerships – to be located at Building 2, at the Bromelton Plant as container fabrication is part of Building 2 Haussmann plant infrastructure.

(See Bromelton Haussmann M3 building systems manufacturing plant infrastructure). (Supply contracts disclosure information – preferred companies and suppliers, based on previous negotiations and supply offers – see Haussmann Prospectus document –Website link: Procurement).

Haussmann intends to apply and hold a number of patents, once patent pending period and patent application have been actioned. Application process, to be lodged by our appointed Patent Attorney, on behalf of Haussmann Limited, authorized by BTT, the Licensor, – Australian patent application lodgment will need to be followed by global regional grouped patent applications.

We are seeking to apply for patents for Haussmann building systems designs and manufacturing plant processes and design. Application engineered, composite materials formulations are not disclosed and or patented. Trademarks will be registered on a global basis once our first plant engineering blueprint is completed.

Haussmann, the majority plant owner of each plant, will go public via the NSX and then by reverse merger on to the ASX, as soon as possible. Dual Listings will apply and once Plant preparations for Sassnitz have been activated, Haussmann will list on the Berlin Exchange.

The same will apply once Plant preparations have commenced at Selma, Alabama, for Haussmann to List on Nasdaq.

To enable Haussmann to qualify as a national company in Europe and the United States, each Haussmann Plant will be owned by a national entity.

Over a period of 8 – 10 years (the 10-year plan), Haussmann intends to establish 5 manufacturing plants in Australia, one plant in Sassnitz Germany and one Plant in Selma, Alabama, in the United States.

Other Plant establishments may be sought and progressed by strategic partnership arrangements in other global locations. Demand for affordable housing and shelter, at cost, quality and quantity supply offers is near unlimited – Haussmann’s offer creates those demands and will meet those demands as created and demanded by prospective home purchasers.

As part of Haussmann’s designed social balance corrections, Haussmann intends to provide projected profits from industrial manufacturing to smaller investors.

By limiting the investment per investor to minimum $10,000.00 or maximum $ 20,000.00 which does lowers the individual investment risk for every investor, together with the benefits of a new industry investment, Hausmann can provide long-term solid dividend returns with expected solid and long-term share value increases.

HML’s social and ethical investment, demonstrating values and morals and substance in the offer to the general public and small shareholders will provide initial seed capital funding up to AUD $75 million.

The sale of minimum equity is designed to take up the greater share of funding by preferred debt funding via convertible Bonds. HML Bonds (convertible Bonds) issued will be offered for the term of 8 years and will offer an annual Yield of 3%, with the option of conversion to equity of 3 1/3 %. (debt to equity). Estimated net debt payment over year 1 – 4 = $12 million per annum. (3 % on AUD $400million).

Haussmann convertible Bonds will be offered with a yield of 3% per annum, and are secured over each nominated HML Plant infrastructure, with a term of 8 years.

Each Haussmann first mortgage Bond is offered at a yield of 3% per annum, secured by first mortgage over a home, sold and built by Haussmann, for and on behalf of a Mortgagee over a term of up to 30 Years. (Each loan is insured in case of default and such premium being paid by the Home purchaser – mortgagee).

Equity Crowd Funding – is simply a smart way to fund our business and raise money faster, with dedicated support from a large global investor community, which may share our values and will provide ongoing financial support.

IPOs combined with new listings are a more complex and time-consuming exercise but will provide our company with a status that befits our company and transparency for all, benefitting and enhancing our industrial undertaking and size of business.

The Benefits of Equity Crowd Funding:

Project Founders – Entrepreneurs retain control

B2B Benefits – free exposure

Crowd funding platforms have extensive membership numbers

Equity crowd funding has its own press clique (Dexster)

Equity crowd funding investors act as an army of brand ambassadors

Telling a Story to Investors with a single link

Crowd funding can benefit investors just as much as entrepreneurs

Thanks to the World Wide Web, crowd funding is possible.

Equity crowd funding helps manage protections for both startups and investors, by making the process more streamlined and affordable.

Reaching Investors far and wide – global investor base.

Seamless Transition From launch to close

Entrepreneurs and investors can act as their very own bankers with all the right tools at our fingertips.

Through equity crowd funding investors have become supporters, evangelists, and customers

A great amount of potential capital can be unlocked by including non-accredited investors

Investors from essentially anywhere can invest capital into companies listed for equity crowd funding

Benefits the entrepreneur who has access to a larger pool of investors

Ease of investment in early-stage companies

It opens up the potential for higher returns for these investors that they previously did not have as part of their portfolio.

Investors also have the benefit of choosing to invest in companies that have meaning or align with something, that they are passionate about.

It provides access to capital. New regulations under the JOBS Act make it easier than ever to raise money for our startup

Equity crowd funding allows finding accredited investors who are interested in our venture and have the funds to back it.

Minimizes risk. Crowd funding relies on a large pool of investors who invest at lower levels, minimizing overall risk.

Raises more than just money for our startup. The investors quickly become a group of people dedicated to making our venture successful.

Entrepreneurs can rely on their crowd of investors for feedback, comments, and ideas, which often helps during the early stages of the venture.

Builds a network of investors for the future. As our venture moves forward, your investors from our crowd funding campaign are still involved and they are more likely to invest in future ventures. Plant funding in part.

Acts as a marketing tool that increases organic visits to our platform.

Crowd funding introduces our venture to the market.

By incorporating social media and digital marketing, crowd funding provides an easy way to direct traffic to your site and globally promotes the business of Haussmann.

Crowd funding campaigns are easy to share, which makes it easier for our investors to spread the word to their connections.

Gains credibility with proof of concept now completed, a successful equity crowd funding campaign can give our venture more credibility when approaching other investors.

A crowd funding campaign’s success shows other investors that our venture has sufficient market validation.

Introduces prospective customers to our venture and pre-sells our concept and housing products.

With an equity crowd funding campaign, our investors become our early-adopters and benefactors and first home buyers – customers.

As we pre-sell our concept, gain insight into user reactions and analyze the market, we will be able to adjust our business plan or plan for further plant establishments and growth, as needed.

It offers simplicity compared to other forms of investing.

In many ways, equity crowd funding is easier than traditional forms of capital investing which usually impose more corporate and management hurdles.

Entrepreneurs simply can choose the right crowd funding platform and then use it to spread their message to potential investors.

Generates in part, free media exposure.

A successful crowd funding campaign is newsworthy, which attracts media attention, feeding and creating a greater investment circle.

Crowd funding is a unique industry and can help pick up widespread media coverage, especially as our campaign gains momentum.

Provides access beyond the bank and traditional funding, simply avoiding early-stage funding impediment

Crowd funding is relatively affordable, making it accessible for most startups and entrepreneurs.

Many crowd funding platforms charge nothing to start our campaign and only take a small percentage of our equity to make the campaign is successful.

Haussmann Equity Crowd Funding Programs are limited to maximum $20K investment per investor. (investment regulated by compliance)

Haussmann Sophisticated Investor Programs are limited to minimum of AUD $250,000 – $300,000 per investor. (investment regulated by compliance)

Haussmann Bond investors, mainly institutional investors, are limited to US $10 million per investment or otherwise as per special investment arrangements. (Which applies to Strategic Partner(s) investments.

Haussmann’s preferred location is within the South-East Queensland corridor, close to Coolangatta Airport. The office will double as liaison office for the establishment of and SPV entity for the management of the establishment of Bromelton Plant infrastructure. A commercial manager to manage HML’s SPV is nominated for appointment.

All initial marketing presales Residential Dwellings activations are to be carried out initially from Haussmann’s regional office and then transferred to a nominated SPV office. In time, Haussmann will establish a European Office in Berlin and its North American Office in New York to assist pre- preparations for its Plant establishments in Germany and the United States, as we need to be a

“local” to achieve and be permitted to lodge grants with state and federal Government entities.

- Fledgling company, shows great promise – “Unicorn” Status

- New Industry, unlimited global markets, no competitors

- Seeks investment – financial backing by the public, preferred small investors to enable the company to create large industrial profit centers – “industrial production of Real Estate.”

- R&D completed and now seeks a type of “Later stage, expansion funding” via IPO, equity crowd funding and grants and special loan facilities from State and Federal Governments.

- Plant investors Exit strategy: Listings (by reverse mergers) Public Company Status.

- Proposed Haussmann Listings by reverse mergers – ASX, New York, and Berlin.

- Projected future profits may substantially outweigh risk of investment.

- Barriers of entry are revolutionary technologies creating a “no competitor status position”.

- Presently our business concept has NO competitors within its market segment worldwide.

- Unique and exclusive formulas and processes/inventions & designs. (IP).

- When implemented globally, will improve life for 100’s of millions of people.

- When implemented and in production, will provide large job creations, affordable and sustainable housing, an ethical and social investment and is simply a new industry.

- Patents, formulations, and industrial processes will monopolise the building industry.

- Competent contracted experienced consulting groups and companies providing Plant implementation planning and management, based on contracted contributions from key Plant engineering advisers and consultants, suppliers of machinery and equipment.

- Creating a Win: Win position, when implemented, new profit centers with benefits for investors and community alike, turning the dream of affordable housing into reality for millions of people.

Quoting the Australian Constitution – the rights of every person:

Article 23

Standard of living

(1) Every person has the right to an adequate standard of living, including:

(a) sufficient food and water; and

(b) clothing and housing; and

(c) access to health care services; and

(d) access to social security, including if they are unable to support themselves and their dependants, appropriate social assistance.

We at Haussmann, and per our company’s policies, believe, shelter, (quality housing) is a global basic human right. To date, in our opinion, nobody seems to care or has made any effective, reasonable attempt to effectively deliver quality shelter in such quantities as demanded on a global basis.

Presently, our studies, and independent studies show, based on global demand for affordable shelter, that the market to provide affordable shelter is near unlimited.

We believe that we must protect our environment and manufacture sustainable products.

We at Haussmann are promoting justifiable economic and social, ethical development for the benefit of present and future generations. (see HML 2,000 homes donation per annum for one dollar each to nominated communities within the catchment area of each Haussmann Plant).

Article 29

Environment

- Every person has the right to an environment that is not harmful to their health or well-being.

- The Commonwealth or State Government will take appropriate steps to protect the environment for the benefit of present and future generations, through reasonable legislative and other measures that:

- prevent pollution and ecological degradation; and

- promote conservation; and

- secure ecologically sustainable development and use of natural resources while promoting justifiable economic and social development.

Haussmann investors will enjoy shared plant ownership, on each established plant and when in production. Annual plant dividends will substantially increase with each plant being brought into production. Haussmann Limited is a global holding company.

Share values and dividends are also expected to increase with each plant production ramp up from 10,000 homes per annum to 70,000 homes per annum, as well as with the establishment of each and every new plant.

Based on our company’s industry, customer and competitive analysis of the global housing market, our expectations for annual housing orders, once in production, and even prior to production, (pre- product pre-sales of residential dwellings as each plant will be marketed and offer pre-production sales), and based on minimum deposit, the cost of site specific vendor requested design, processing and sales documentation and first mortgage facility are the only charges applicable.

Estimated sales processing charges per each home sale will be:

- Legal Fees for preparation of Sales Contract and first mortgage agreement,

- Individual Housing Design fees, and

- AUD $1,500 Deposit, which will be fully refundable if the *contract is canceled by the Purchaser and or Haussmann has not complied with contracted terms, times of delivery and installations and general conditions of sale.

* The Home purchaser – cancellation of its contractual arrangements with Haussmann, a cooling off period of 3 months, from signing of Agreement, but will not receive the refund of cost of his or her housing design, estimated cost for 3 D design as per Purchasers instructions: AUD $1000,00 (Walk through…. 3D design…fully rendered) when canceled.

Haussmann housing sales from each plant will be restricted to individual purchasers (1 home per person, no large corporate orders from developers and builders will be accepted). Pre-production sales will commence when Haussmann has established its display/show homes at its show home village (20 homes) at Coffs Harbor, NSW.

The Board of directors have set out the Plant net profit dividend distribution policy:

Once plant cash reserves equivalent to the total of two years of overheads are held in Haussmann Plant reserves accounts, all annual net earnings will be distributed to shareholders by way of payment of special annual dividends.

Maximum and minimum annual net profit distributions are set at being the amount of 80% of net profit achieved per annum per plant applicable after year 4 of operations.

In all cases, the same revenue assumptions are made, including that the Haussmann plant revenues are partly “indirectly shared” with the community, shareholders and future partners:

- selling houses 50% cheaper than any other competitor and

- donating a total of 2,000 homes per annum at $1 dollar each, for the term of 23 years per plant

- donating to early investor – shareholders annual lottery 1 000 homes for 1000 lucky winners per annum for 20 years.

- staff special bonus remunerations and annual allocations applied, substantially enhancing superannuation employer payments, providing 4 day working condition per week, full and free private health insurance (in – house insurance in partnership with a mayor insurer) and extended family benefits for each employee in reference to higher education contributions by Haussmann to nominated, approved employee family member.

There will be no shareholders dividend returns for the period of 24 possibly up to 36 months from the time of the first investment being made by the first and all investors. With contractual arrangements being placed for the establishment of the first plant, funding achieved and establishment of the first plant, we do expect share values to increase. We expect and believe investor profits can be achieved by selling equity within 12 months of purchase of equity.

Conditional on listing and stock being able to be free traded, without any escrow restrictions being in place.

The first investment period being the period of Haussmann investment promotions, from August 2020 to August 2022-23. This applies to investments made by investors via equity crowd funding programs and other sophisticated investors investments including the IPO, the initial public offering, and listing of Haussmann as a public company on the NSX and ASX. Haussmann Public company shares may be escrowed for up to 12 months.

Expected first shareholders’ dividend payments to be paid out in full after the first plant has traded for a period of minimum 36 – 48 months. (calculated on % of net profits disbursed to shareholders, possibly as early as between month 24 – 36, but not later then month 48 of Plant trading period.

*Being in escrow is a contractual arrangement in which a third party (the shareholder or escrow agent) receives and disburses money for the primary transacting parties, most generally, used with plentiful terms that conduct the rightful actions that follow. The disbursement is dependent on conditions agreed to by the transacting parties. Examples include an account established by a broker for holding stock (shares) on behalf of the broker’s principal.

Based on net earnings received from at least 2 plants, second plant dividend payments will be active within 60 months of payment of first dividend from the first Haussmann Plant. Expected share values within 7 years or less should experience impressive increases, conditional on plant production and timeframe of projected plant production and profits to be derived from such production(s). Conditional also on Haussmann being successful in establishing, as per projections, at least 4 plants within a period of 8 – 10 years, with a projected minimum net per plant per annum of AUD $1.9 billion.(prior to deductions of donated homes).

Plant operations cost structures, primary processing, secondary processing, tertiary processing, based on established plant financial planning model – accounting and technical design data calculations, closely following international accounting conventions – have been originally examined and re-calculated by major European engineering firms and a major Australian accounting firm. (Calculations and financial models have been adjusted to compensate for time and delays based on previous model-based projections, which were originally issued/projected during the project’s R&D period).

The project plant income statement (in Euro dollars) shows an annual plant net income, after year 5 of operations, net profit before tax of Euro $346,560,677 (Sales revenue, less cost of goods sold, gross profit, less overheads, total expenses = operating profit (EBITD), less financial and non-cash flow, less royalties/license fees = net taxable income ** Euro $ 346,560,677.)

Above calculations have been based and calculated on goods being sold as building materials, not completed homes, therefore building materials manufacturing profits applied and have been used for such calculations. (Minimum net income model).

The Australian Plant at Bromelton, when in full production, will show projected annual net returns of minimum AUD $1.9 billion, plus. Bromelton plant establishment cost is estimated to be between $ 750 million – $ 850 million.

Above net profit projections are based on the sales of 70,000 Residential Dwellings/Homes per annum. (Developer type profits apply).

*Advance working capital requirement provisions are expected to be substantially lower, as pre-residential home pre-sales are expected to exceed minimum 5 years full production capacity, being sold ahead and prior to start of production. Further detailed information is provided and noted on the website link Vision and sub links.

Haussmann homes are produced and sold factory direct, (there is no involvement of “middlemen” builders or contractors or developers), and calculated and sold as/in (cubic meter) m3 sections, which form the guide and basis for client designed, individual dwellings.

HML M3 housing systems technologies and designs provides its clients with a choice of 3 standard “space” (home) sizes: Small, medium or large m3 (cubic meter) sections, which can be arranged, interconnected and interchanged as per client’s designs.

All components are modular so almost any arrangement of panels/housing systems and spaces, doors and windows and service pods are possible. Haussmann has mastered the challenge of industrialisation of buildings, single dwellings, both from architectural and technological and mass production quality points, standardising its new building components to ensure maximum design freedom with considering the final building product.

New production techniques and computer aided production, designs and robotics, permits considerable diversification of output without affecting construction feasibility and providing minimal time for on-site connections of parts. See Website animation videos about the Haussmann M3 building systems. (Dry build Residential dwellings – clipped together building systems by Haussmann home assembly team).

The Haussmann system has dispensed with conventional on-site construction activities. Home Infrastructure, foundations, erection, in build and finishes are carried out off-site at Haussmann’s centralised industrial manufacturing plant facilities, providing substantial product core and finishing benefits achieved by robotics, precision machining and coating processes and special production equipment and overall production organisation (“Dry build“ homes).

The conventional building site work environment and physical hardship of construction work in rugged ambient conditions has been eliminated by the Haussmann building systems. All parts of construction work are now performed in a Haussmann plant, a hospitable and most effective workplace (Haussmann precision, application engineered homes).

Benefits and merits of Haussmann automated realisation housing systems, which employs automation in the production of building elements in the manufacture and prefabrication plant, performing minimal time for remaining works of erecting on-site. Industrialisation, mechanisation and automation of the building industry will save manual labor, eliminate strenuous, dirty and dangerous work, and will result in flexibility and improvement of quality overall Haussmann computer software analysis of the performance of its various buildings systems and composites of elements, structural, mechanical and environmental, checking that they conform to accepted codes and standards.

A conventional construction process involves 20 – 30 different skilled trades. This complexity is caused by the multitude of functions., carried out on site, under the sky.

A typical building must provide safe and secure shelter, must have adaptable thermal and acoustic conditions, locomotion between different areas and levels, water and power supplies, disposal of wastes, illumination, and communications with the outside world and specific functions within particular spaces for cooking, recreation, storage, sports activities and other various processes.

Those proliferations of functions and the many types of work coordinated and adapted to each on site have been eliminated by the Haussmann manufacturing process, through combined comprehensive assembly adapted to the various comprehensive multipurpose functions and applications intended.

Haussmann integrated systems have done away with this distinctive nature of every building project and most effectively, superbly enhancing user needs and creating new market conditions by advantages and as such, providing entrepreneurial alternatives to create an unlimited market for its products globally.

Haussmann building systems are guaranteed for 50 years, but the actual services’ lifespan may be much longer. The key to building in life cycle implications with regards to several aspects of building performance is quality, which is of paramount importance and is insured by design and control during in-plant production.

Haussmann’s flexible building cube structures are designed to be adapted to the dynamics of family growth, change of lifestyle and living standards, for use as a home or commercial premise, without modification of components, or changing of user requirements or special maintenance needs.

Haussmann building systems can be defined as a set of interrelated elements that act together to enable the designated performance of a building. It also includes various procedures and technologies, processes and designs and new materials, technologies and composites, for the production and assembling of these elements for this purpose.

Haussmann housing designs, productions and erection on-site are strongly interrelated and are parts of an integrated process, which reduces human involvement and provides improved quality of design, production and construction on-site.

The benefits of industrialised Haussmann building systems include savings on labor on-site, no skilled trades required, a substantially faster construction process and earlier completion and substantially higher quality of components due to better production “tools ” and quality control.

The Haussmann benefits are realised and provide large economic gains to its clients, due to substantially lower costs of new materials (use and processing of intermingled raw materials).

Any Haussmann home completed to lock up stage, at hand-over to the new home owner, will immediately increase by 50% in value, as the home was purchased by the home owner from Haussmann at a 50% discount of the market price.

In short, Haussmann has passed on substantial savings to the home purchaser to create an affordable home, and as such, financial benefits will become real for the new Home owners, doubling the value of his or her new home when moving in.

Pressure is rising on infrastructure investors to focus on both value and morals in business, including the choice of social, ethical, sustainable and environmental value of their investments. Over the past year, we have seen increasing pressure on government – and through governments – to prioritise infrastructure investments that deliver greater social and environmental benefits; simply put, to become more responsible industrial leaders.

Governments are now being asked to account for the social and environmental value of their investments and public opinion has drawn the spotlight onto social inequality (as evidenced by recent election and referendum results).

Institutional investors are recognising that their returns are also under pressure from social and environmental concerns (witness the debates about pipelines in the US or coal fired power plants in India). The beneficiaries of the bigger public pension plans are starting to ask searching questions about the social and environmental benefits of their investments. Some, like CalPERS and CalSTRS have begun to create policies to help their dealmakers measure social and environmental impacts alongside financial return.

To be clear, this is not about ‘impact investing’ where financial returns might be sacrificed in the pursuit of social benefit. This is about measuring and assessing the wider basket of benefits that an investment delivers beyond purely financial returns.

Over the coming year, we expect investors (public and private) to make serious efforts to measure and communicate the real impact of their investments. In some cases, this will lead to difficult choices as plan managers and their beneficiaries gain greater awareness of their social and environmental footprint. It will also likely lead to growing competition for projects that are able to demonstrate stronger social and environmental benefit.

In the short-term, however, the challenge for investors and governments will be in formulating a consistent and appropriate approach to measuring and reporting on social and environmental impacts, a discipline that is currently at a relatively early stage of development.

In viewing the long to medium term, we expect some confusion as different players and markets test different approaches to creating a clear, comprehensive and workable set of measures. However, once institutional investors and governments start reporting on social and environmental benefits using a generally accepted set of measures, the pressure to deliver even greater benefits will start to rise.

As measurement and reporting becomes more sophisticated, we expect investors to move towards achieving a true ‘triple bottom line’. However, further recessions and bear markets may complicate matters as governments are forced to focus on investment for economic growth, and for institutional investors the fiduciary imperative to provide for the beneficiaries’ retirements comes under pressure. In short, an investment into the Haussmann project is an impact investment creating all the right value and moral changes and at the same time bringing all the right benefits for the employees, investors and customers alike.

Each Haussmann plant will have supply contractual arrangements with local suppliers and HML policy dictates to acquire by merger and or full acquisition, all such suppliers. Standard % acquisition policy is a 50% equity position or strategic partnership or outright Management Contract with profit share for a term of up to 25 years.

For Haussmann plant production and business to be successful, Haussmann Limited must control all supplies, as this is crucial for the success of its business.

Profit projections from acquisitions and mergers, have not been quoted, as at present, Haussmann has not placed specific acquisition contracts, and accordingly can only quote estimated annual profit summaries in those areas. The expression of interest process will apply to acquisitions and/or supply of goods and services. Should supply locally not be available, it will be sourced from Japanese, European, Canadian and US suppliers, (from regions and countries labour is properly and fairly remunerated).

We truly believe that investing in Haussmann is a value, moral and social investment. Your investment will be changing the world, and will make it a better place, protecting the environment through your actions, creating jobs for your children, producing affordable housing for mankind, encouraging sustainability and providing hope for shelter for generations to come, while at the same time creating national wealth and personal wealth and dignity, making a huge social difference. You are, as an investor in Haussmann assisting and contributing to the foundations of a fairer, better society.

You often hear stories about professional investors closing obscene percentage gains on early-stage venture capital investments. Investors like Reid Hoffman, whose $40,000 investment in Facebook, when they were just a tiny startup, is worth more than $1 billion today.

The problem is, all you do is hear these stories. Because you’re not one of the insiders and have no access to private companies like Facebook when Mr. Hoffman made his investment, you’ll never get to live out the dream yourself.

Right now, as you read this, there are companies out there, start ups like Haussmann Limited, on the markets, with their stock available to you, which may have the same kind of growth potential as Facebook, or Google, or Twitter, simply based on market demand and product pricing, or any of the big household names which made other people very rich in the last few years. Now consider the huge global market demand for products to be produced by Haussmann.

Right now, the high-tech sector has never been more active, or more fertile with new ideas, processes and technologies that have shaped and will be shaping our world for decades to come.

And, as history has shown, there is no faster way to build a small investment into a true nest egg than by nailing the right tech play at the just the right moment. Everyone knows Son, the CEO of SoftBank, is the richest man in Japan. He had the “vision” to invest $20 million early on in Alibaba and that stake is now worth $138B, with total returns of 690,000% (this is the result of new technology investment).

A Haussmann Plant funded and put into production, most likely be in a profit position within year 3 or even as early as month 24, expected to be the start of plant production. Please note, It took Amazon close to10 years to make a profit, we at Haussmann project our first profits within 24 months.

Going public is a powerful tool if used properly. As a public company one gains a great deal of prestige and credibility that one does not have as a private company. This prestige and credibility can also make it easier to raise capital.

The long-term benefits of being publicly traded are numerous and can include: improved liquidity, higher company valuation, the ability to make acquisitions, attract and retain employees with the company’s stock and greater access to capital at a lower cost and transparency. In addition, being a publicly traded enterprise allows a company to make acquisitions with its stock, since public company stock can be used and is viewed sometimes as currency for mergers and acquisitions.

Many people contact us asking what a *reverse merger is. Here is an explanation of what a reverse merger is. Simply taking our company public directly without the need for a public shell. A common way that small companies go public is through a reverse merger with an existing public company. In a reverse merger, an operating private company merges with a public shell company which has no assets or known liabilities (the “shell” corporation). The public shell corporation is called a “shell” since all that exists is its corporate shell structure and shareholders.

The private company obtains the majority of the shell’s stock (usually 96 percent or more). The private company normally will change the name of the public company (to its own name) and will elect its Board of Directors which will appoint the officers. Public companies typically get huge valuations; so, when you’re raising capital as a public company, not only is it easier because of the credibility, but you can give away a much smaller percentage of the company for the amount of capital you raise because of the increased valuation a public company usually receives when compared to the same exact private company.

As a public company, if one follows certain guidelines, including registering stock with the Securities and Exchange Commission, you can even advertise to the general public for investors to buy stock. This is prohibited for private companies. This levels the playing field and makes it easier to raise capital. Haussmann’s consulting advisors will build a new public shell company for us, once we identify the private company, the public shell or blank check company merger can be accomplished within a week or two. (The SEC Securities Exchange Commission registered shell company is ideal for consultants, CPA’s and attorneys, who may have clients that want to go public).

When merging a company in the United States, appointed advisers/consultants/Listing Agents will need to file a Form 8-K with the SEC. Most public shells ready for sale are not listed on a national securities exchange, but are instead traded in a less glamorous setting, such as the OTC Bulletin Board. Of course, they can be renamed and moved, but that may negate the cost and time advantages originally sought. Yet reverse mergers are not all bad.

Even the New York Stock Exchange did one with the acquisition of Archipelago Holdings via a “double-dummy” merger in 2006 in a $10 billion deal to create the NYSE Group. Some people believe that reverse shell mergers may soon become the preferred IPO approach for emerging high-growth companies. In fact, the quality of companies taking the back door into a public exchange seems to be getting stronger and has become the avenue of choice for Asian companies seeking to go public in the American market.

Being public makes the company more visible to shareholders and potential acquirers and provides a presumption of future liquidity. Other than raising money, the reverse merger may be the quickest way to get you other benefits of a public company. These include the ability to offer meaningful stock options to employees, the use of liquid shares to purchase other companies, and the credibility and public access to information you need to attract key customers and suppliers.

In summary, a reverse merger, or going public through the “normal” IPO process should never be seen as just a way to fund our start-up. It is a strategic decision that may indeed attract more funding, but also will likely change the culture and focus of a company, and our role as an entrepreneur to corporate executives. Small capital, Berlin reverse mergers are less complicated, prepared and managed by German specialist corporate advisers and market makers.

*A reverse takeover or reverse merger takeover (reverse IPO) is the acquisition of a public company by a private company so that the private company can bypass the lengthy and complex process of going public. The transaction typically requires reorganisation of capital of the acquiring company. Sometimes, conversely, the private company is bought by the publicly listed company through an asset swap and share issue.

Haussmann needs to become a “local” in Germany. The Berlin exchange is the third largest exchange in the world and growing bigger every day. The Germans recently just bought the NYSE. OTCBB companies can still dually list on the Berlin Exchange.

There is some debate whether this is a good idea, however, in some cases it is and, in all cases, it can be used as a stepping stone to a subsidiary’s full and exclusive listing on Frankfurt. (Not for small caps).

In addition, German regulators and tax laws encourage and support developmental stage companies. You can get listed from scratch in as little as 30 days on the Berlin Stock Exchange without audited financials. If you are in a big hurry you can buy a German shell and cut the time down to 7 days.

If you are an exchange company (NYSE, AMEX, NASDAQ, etc.) you can get a dual listing in as little as 7 days.

Money raises can be completed on the Berlin Stock Exchange in as little as 30 days. But you must be connected to the right people.

Fair trading — Naked short selling is banned in Germany and brokers are not allowed to short on a down tick.

Less regulation — no restricted shares for anyone even officers, directors and insiders. No Sabanes-Oxley and ongoing costs are much less than the OTCBB, TSX, and Hong Kong exchanges. Public offerings can be conducted without underwriters in the Berlin Stock Exchange.

Fast listings, and fast money raises and fair trading is what Berlin Exchange is all about.

For Haussmann to become a “local” in the US – Our deal, which has an enterprise value of estimated $400 million, should be able to ease the way for a backdoor public market listing.

NASDAQ has three different U.S. markets, the NASDAQ Global Select Market, the NASDAQ Global Market, and the NASDAQ Capital Market. Each of the three markets is designed to accommodate companies of a different size, from largest to smallest in the order presented.

Each market has its own distinct set of initial listing requirements, and its own set of continued listing requirements. The initial listing requirements are more stringent than the continued listing requirements; I suspect this reflects NASDAQ’s desire to vet out companies with a marginal track record, while being more lenient once the company receives the NASDAQ listing.

Many times, a reverse merger company does not use an underwriter when it goes public, and because it is likely still developing its business, like Haussmann, the NASDAQ Capital Market is probably the best fit.

Our listing agents advise for Haussmann Limited to undertake the reverse merger on Nasdaq as a “2 step exercise” (OTC Bulletin) to enable us to meet Listing Rules re – equity standard, net income standard and equity standard, corporate governance requirement. (Section 5110 (c) of the market rules covers reverse merger companies, applying for initial listing).

A company that goes public via a reverse merger is subject to a higher set of listing standards than issuers that go public through other methods. In particular, it is possible that the issuer, and its shareholders, may have to wait longer than anticipated, in some cases nearly two years, before listing on Nasdaq.

Upon identifying an investment, usually the prospective investor starts inquiring about the business. He or she will want to evaluate the company. By this, he or she will want to know, what the company’s pre-money valuation is and what the projected post-money valuation will be. (At all times a qualified financial adviser should provide advise prior to commitment to purchase an equity /shares).

Pre-Money Valuation. What is pre-money valuation? Pre-money valuation is what a company is worth before the investor invests in a company. This needs to be calculated, and many investors will have their experts who will calculate how much a company is worth before the investment. Pre-money valuation may also determine how much capital a prospective investor might actually want to invest in our company.

How is pre-money valuation determined? Well, to tell the truth, there are several factors in determining the pre-money valuation of a company. Several things that determine a company’s pre-money valuation are listed as follows: Intellectual Property – Intellectual property can add quite a bit of value to a company, depending on what kind of intellectual property the entrepreneur brings to the company.

Likewise, new technology that can simplify every-day tasks can be considered intellectual property. Intellectual property can refer to unique formulas or inventions that can improve life or industry.

Depending on methods of valuation, the amount can be more or less. At present Haussmann valuation has been determined as being the value of the company, as quoted by the company, before receipt of funding from new investors.

Quoting a simple example, say a company has a pre-money valuation of $10 million. Post-money valuation determines the value of our company after the investment is closed.

The post-money valuation will be the value of a company before the investment plus the money given to the company has been received (after the investment).

So, if the pre-money valuation is $10 million and investors have agreed to invest $5 million in the company, the post-money valuation would be $15 million = Post-Money Valuation.

Haussmann Limited will engage a major Accounting Firm, managing introduction and arrangements with stock broking firm ( and underwriter) as listing agent, for each listing, as Corporate Advisers in Australia, Berlin and New York to activate its NSX IPO, its reverse merger listings program, S-1 IPO registration, in future, as proposed, on all 3 exchanges. Proprietary “international” solutions will allow us to:

- Go public in as little as 90 days on a foreign exchange and get funded in as little as another 60 days;

- Be listed in several countries at once – including the US, without US and SEC rules having jurisdiction over the entire structure. This allows us to take advantage of rules on other exchanges like the German exchanges which allow for immediate free trading stock (no holding period) and no bar on affiliate sales (affiliates can sell immediately and as much as they want);

- Prevent and eliminate the bad effects that “shorting” by market makers, as is usually the practiced on the US OTC, creates;

- Hold an attractive price for your stock rather than the penny and sub-penny prices that US OTC stocks often fall to;

- Keep control of our company. Get funded without dilution beyond a set acceptable amount no matter how much money we raise;

- Undertake mergers and acquisitions of other companies without losing control of our company or going beyond a set dilution upon merger or acquisition;

- Attract private “investors” by creating investment grade securities that are projected via our financial projections and forecasts, expected to make a profit, but as they say, we can not forecast our future, we can only make calculated forecasts and at best, will have satisfactory outcomes.

- Solve problems we may be having with note holders, existing investors, and other factors.

Initial funding tends to be through draw down funding and other market related funding. We know several broker dealers – US and International – that do firm draw down funding commitments from $1 million on up. We know of other firms that will buy blocks of stock and/or notes from shareholders of listed and trading companies.

We also know and are aware of several banks that will do loans against stock shortly after you get listed and before you start trading for select companies. After an initial funding the same banks may arrange funding via stand by letters of credit or bonds for larger transactions ($20 to $100 million). We are aware, and have been in talks with broker dealers who will undertake a firm commitment S1 and/or a 1001 or Reg A Exemption funding in the US.

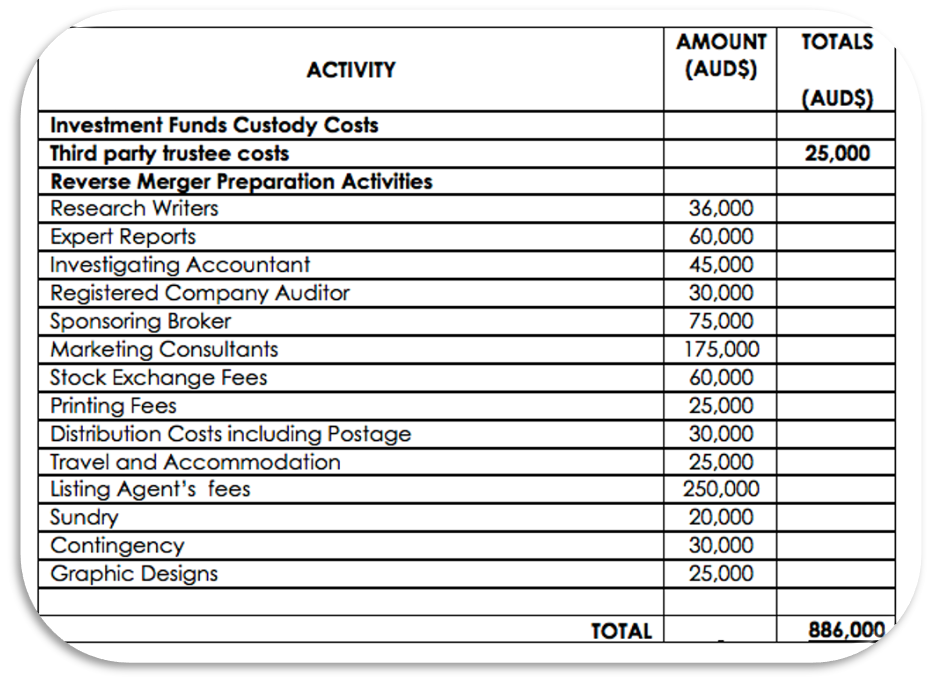

In future, we may have many prospective sources for PIPES and PRIVATE PLACEMENTS. Once we are public, we can arrange road tours in Europe, the US and Asia with investment firms and “Billionaire” investors for medium to large size Bond investments. Estimated Reverse merger costs per listing: $1 million. Detailed estimated costs per each reverse merger:

Please Note: Average Listing Cost, which may differ with each Listing

Consolidation

When a company undergoes consolidation, it can have a variety of different meanings. A classic definition of consolidation is a company that is looking to be merged with another company. Some investment firms, however, define consolidation as an amalgamation

Recapitalisation

Recapitalisation is the restructuring of a company’s debt and equity to make it more stable. Restructuring is a step a company takes when it encounters problems.

The primary reason for restructuring is when a company is in debt and needs to reorganise its finances, management and other key operations.

Seed Funding

Seed funding is the funding a company receives when it is just starting out. The seed funding round is the funding a company seeks to develop its product or service and purchase the necessary equipment and real estate to begin operations.

Equity Crowd Funding is a mechanism that enables broad groups of investors to fund start up companies and small businesses in return for equity. Investors give money to a business and receive ownership of a small piece of that business.

Later Stage – also referred to by some investment firms as either expansion or growth stage is the stage when a company seeks capital to expand its operations into new markets. During this stage, a company primarily requires bridge funding. The company is already in a mature stage.

Series A Funding

Series A funding is the first round of early stage funding. Companies seek series A funding to provide them with enough capital to operate from six months to two years.

Series B Funding

Series B funding is the second stage of early stage funding and is usually given to companies who are preparing for mezzanine funding.

Leveraged Buyout or LBO

A leveraged buyout, also known as an LBO, occurs when a company is looking for funding to acquire a smaller company and the licensing of the acquired company’s products or services.

Convertible Bonds – In finance, a convertible bond or convertible note or convertible debt (or a convertible debenture if it has a maturity of greater than 5 years) is a type of bond that the holder can convert into a specified number of shares of common stock in the issuing company or cash of equal value.

First Mortgage Bonds – A first mortgage is the primary loan that pays for the property and it has priority over all other liens or claims on a property in the event of default. … It is also called as First Lien. A mortgage bond is a bond secured by a mortgage or pool of mortgages.

What is a Unicorn ? – A unicorn is a term in the business world to indicate a privately held start up, a company valued at over 1 billion – the term was coined, choosing a mystical animal representing the statistical rarity of such successful ventures. There are now over 450 Unicorns as of October 2020.

Haussmann is an Australian unlisted Public Company.

Capital structure refers to our company’s outstanding debt and equity. This allows us to understand what kind of funding our company uses to finance its overall activities and growth. As a rule of thumb, the higher the proportion of debt financing a company has, the higher its exposure to risk, but the higher its convertible holdings/shares. At this stage of commercialisation, Haussmann has no debt.

Determining our corporation’s capital structure – we calculated the percentage of the total funding that each component represents. By analysing our corporation’s financial statements, we are able to compile a list of all the capital components on the books.

We aim to create an optimal capital structure, which we believe, is the best mix of debt and equity financing that maximises a company’s market value while minimising its cost of capital. Minimising the weighted average cost of capital (WACC) is one way to optimise the possible lowest cost mix of financing.

Capital Structure Ratio – external-internal Equity Ratio measures the relationship between our external debts/equity/outsiders fund and internal equities/shareholders fund. We believe this is a measure of long-term solvency.

The Report has been prepared, as an in-house report, in a manner that is substantially consistent with the guidance provided In the Professional Standard APES 225 “Valuation Services” issued by the Accounting Professional & Ethical Standards Board.

There are a number of key assumptions underpinning the determination of the valuation of Haussmann Limited set out in the Report. The Valuation was prepared and provided 20. July 2017, Director Valuation by Francis W. Filler, AdvDipFinPlan, BBus(IntBus), BCom(Econ). The full valuation report is available by request.

The major shareholder is G. Z. S. Pty. Ltd., the Trustee for the XIXI Trust and 5stargreen Building Technology Trust (BTT). The 5stargreen Building Technology Trust is the holding trust entity holding in Trust:

- (to be allocated) shareholdings in Haussmann Limited. Such proxy Stake holdings have been allocated to all previous cash and service contributors to the 5stargreen Building Technology Trust – which undertook the previous IP – R&D development programs and to:

- The F. F. Holdings.

Prior to listing on the NSX and followed up by reverse merger on to the ASX, all shares presently held in both trusts and issued shares held by directors will be issued in the nominated publicly listed entity. Present stake holdings are spread amongst global 1648 investors. These are mainly private investors.

All Haussmann Projects are financed off balance sheet, and to a smaller part on balance sheet. In other words, Haussmann may not propose to approach finance markets (debt or equity) in its own right to arrange funding for each project separately. On that basis, in order to finance each Project (Plant) the following project structure will be put in place: